“Not to be absolutely certain is, I think, one of the essential things in rationality.”

~ Bertrand Russell”

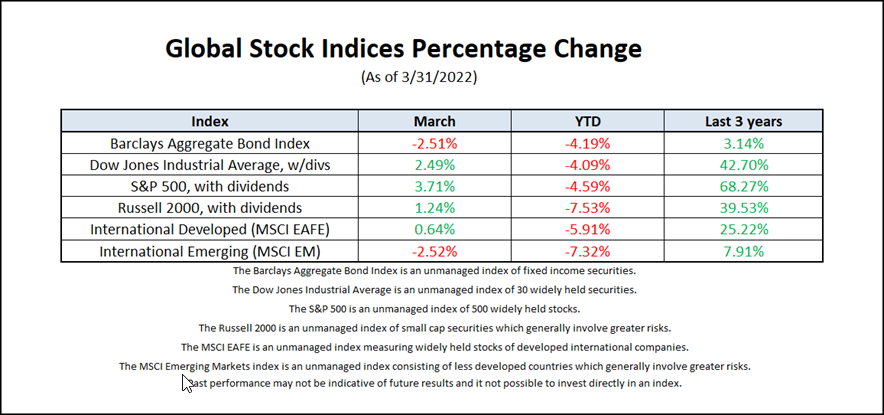

The first quarter of 2022 proved to be a challenging one for capital markets. Stock and bond markets both priced down relatively sharply amidst a backdrop of rapidly increasing interest rates, further inflationary pressures, declining consumer sentiment, and the sad conflict in Eastern Europe.

The Russia-Ukraine conflict is a humanitarian crisis above all else – something I don’t take lightly when putting economic comments out. Millions have fled their homes and thousands have lost their lives. Those thoughts may help us keep things in perspective when we see statement declines.

As an investor predicting what will happen next is short sighted and a fool’s errand. What we do know is that the market dislikes uncertainty, and at this time, we have plenty of it. As such I expect continued and potentially significant volatility in stock and bond markets in the short term.

As for recession fears, the general economic backdrop remains favorable as US consumers, flush with cash, continue to spend despite rising prices; manufacturing and business spending remain healthy, and the labor market remains robust. However, I do believe the chances of recession are growing with every passing day of conflict in Europe. Even if there was a ceasefire tomorrow, the economic chain reaction has already begun and it will be very difficult to “put the toothpaste back in the tube”. The repercussions will be long lasting and widespread.

The Federal Reserve will continue to raise interest rates to combat inflation, higher energy prices will not reverse overnight, supply chains are still distressed, and the decline in sentiment may eventually slowdown consumer spending. If those headwinds unfold too quickly and we actually re-enter a recession on the heels of the pandemic, the stock market is likely to decline much further than what we have seen year to date. Recessions don’t tend to be associated with corrections (10% declines), they tend to be associated with Bear Markets (20%+ declines).

I don’t pretend to know what happens next in Ukraine or the markets but I remain steadfast in my beliefs that market timing is impossible and successful investing requires long term time horizons and strategic allocations.

Call me with questions.-Paul

Noteworthy links:

Raymond James: Investment Strategy Quarterly VanEck: Still Early Innings for Inflation

RBA: The start of a new investment paradigm

WSJ: Homes Earned More for Owners Than Their Jobs Last Year

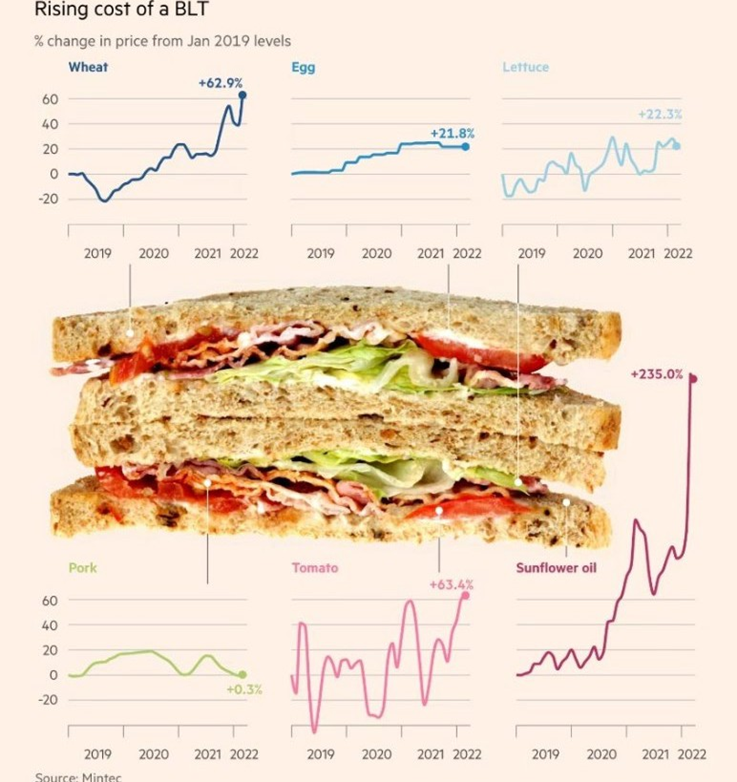

Sandwich barometer, inflation is starting to bite!

The opportunity in inflation

Published in The Sunday Times (UK) on March 20th 2022

There’s so much chatter about inflation, that writing about it makes me feel like I’m forcing kids to eat their vegetables. The cost-of- living crisis adds to the long list of calamities our media outlets are feasting upon. So at the risk of prompting narcolepsy, I’d urge you to read on as there may be a few things in here you haven’t thought about.

The consensus opinion is moving towards the expectation that inflation will settle back later this year, but at a higher level than what we’ve become used to in the last generation. The psychological tinder of confidence in quiescent inflation is drying. Do we need to prepare for a fire?

Financial markets as yet are not fretting – as futures markets seem to indicate a willingness on the part of investors to believe that Central banks have the situation under control (as judged by the 5year, 5year Forward Inflation Expectation rate curve which currently is forecasting average inflation below 3% for the five years from 2027-2031).

Too early to be definitive

In truth, it’s too early to say definitively whether we are in a new inflationary regime where inflation remains much higher than Central Banks target, or one where the overshoot is temporary. Sifting through the data and asking the right questions are necessary but not nearly sufficient for predicting the future course of inflation.

Our base case is that inflation will moderate later this year and will settle back possibly at higher than pre-pandemic levels. But we don’t expect inflation to spiral out of control. The calculus behind that last statement is changing daily as the war in Ukraine unfolds. We hope for a benign scenario where inflation returns to modest levels but should plan with humility, recognizing that the future is inherently unknowable.

Money is purchasing power

At its most basic level, inflation is like a tax. It depletes our spending power. Unlike a tax, its impact is not as explicit. We don’t get reports from the bank quoting our balance in real (after inflation) value terms i.e. what it is worth today versus a year ago. Everything is quoted in nominal price terms.

This is not a helpful way to conceive of money. In the long run, the only rational definition of money is purchasing power. Money is a means to an end, and that end is its ability to fund our spending habits. If our money is being eroded by 5% inflation a year, we will lose roughly 40% of our spending power every decade. We should therefore make investment decisions in consideration of this risk. Many investors have never experienced inflation like we have seen in the last few months, so it may be a good time to revisit what that means for investing.

Equities over the long term have provided strong real returns (after inflation). If your metric for how much risk you take on is maintaining purchasing power, then the stock market (alongside property and other real assets) has proven to be an important generator (and protector of) real wealth.

How do stock markets provide a hedge against inflation?

The data suggest that stocks, in general, do well when inflation is between 1% and 4% (based on US equity style/cap indexes). Many companies have pricing power, i.e. can pass along costs to buyers in the form of higher prices and thereby protect their margins. Not all companies do, however. So inflationary regimes may favor some market segments more than others. But in aggregate, stock markets have historically provided strong after-inflation returns, at least part of which stems from company earnings being linked to inflation through pricing power.

Aversion to risk is innate, so inflation should be a concern

The impulse to protect what we have is instinctive to us all. Aversion to risk is innate, passed down from our hunter-gatherer forbears. Our ancestor that assumed that all rustling bushes concealed lions, lived long enough to pass that trait on. His more blasé counterpart exited the gene pool. Hence we are predisposed to over-weight the negative. Even when presented with a favorable proposition, we will generally avoid it if there is the potential for significant downside.

So what’s this got to do with inflation? If my living costs double and my capital and interest thereon remain the same, I have effectively lost half my money. This should trigger alarm bells for the risk-averse, but we tend not to think about inflation risk in the same way as we do about the risk of capital loss associated with stock market volatility.

My thesis on this is that we are concerned about the risks of doing something (making an investment decision), but not concerned about the risks of doing nothing (decisions we don’t make i.e. defaulting to leaving money in cash). This decision-making flaw has the potential for greater wealth destruction than the stock market does.

There’s a cost to investing and there’s a cost if you don’t. Take control and make a decision and you’ll have a better chance of minimizing it.

Here is a link to the full article: The opportunity in inflation

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Insights & Discovery