The resources necessary to be an informed investor

Working closely with you in pursuit of your financial goals is our number one priority. In addition to offering sound advice and a high level of service, we believe it's important to educate those with whom we work – because when clients understand the reasoning behind their plans, we feel they're more likely to succeed. On this page, we provide a number of resources we hope you'll find useful and informative.

Bond Market Commentary

Odds and ends

April 15, 2024

Fed Funds Rate According to Bloomberg calculations based on where Fed Funds futures are currently trading, there is a 20% chance that the FOMC cuts the overnight rate in June and a ~50% chance that they cut in July. Looking ahead to year-end, these calculations are pricing in 25-50 basis points of total cuts by the end of 2024 with one 25 basis point cut in September or November and roughly a 50% chance of a second 25 basis point cut in December. On January 1st of this year, markets were pricing in between 125 and 150 basis points of total cuts in 2024.

Inverted Curve The Treasury curve is approaching two years of being inverted (short-term yields higher than long-term yields). The 10-year/2-year spread has been negative (inverted) since July 5, 2022 and is currently at -37 basis points. An inverted Treasury curve has historically been a predictor of a coming recession although the timing of when recessions have started with relation to the yield curve inverting has varied.

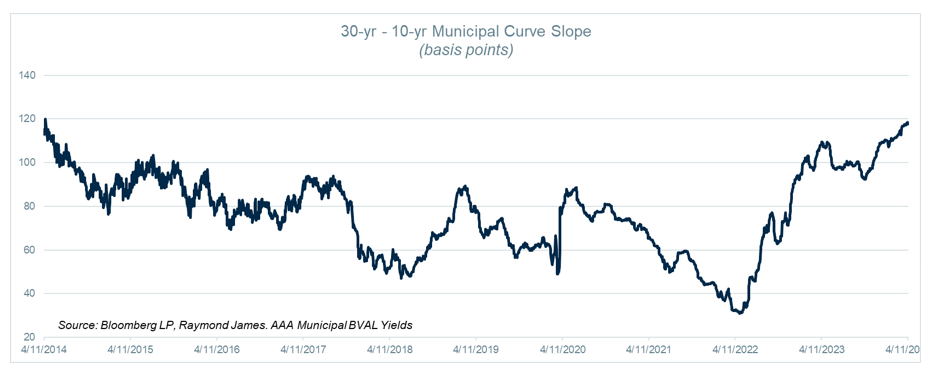

Long Municipals Municipal bonds on the longer part of the curve offer attractive yields relative to intermediate maturity bonds. The yield pickup of a 30-year maturity over a 10-year maturity is currently 118 basis points. The higher this spread is, the more investors are “rewarded” with more yield by extending out into longer maturity bonds. Out of the ~2,500 trading days over the past 10 years, the 30-year/10-year yield pickup has only been higher on 4 days (from 4/11/14 to 4/11/24). Taxable equivalent yields on the long end of the curve for high tax bracket investors can reach into the 6 to 7% range, an attractive proposition for A to AAA rated municipal bonds.

Yields Yields across the fixed income landscape remain at some of their highest levels of the past ~15 years. The 10-year Treasury is currently ~4.59% which is over 200 basis points higher than its average since 2010 of 2.41%. Year-to-date, the 2-year, 10-year, and 30-year Treasuries are all higher by over 60 basis points. Despite spread tightening, the increase in benchmark yields has pushed corporate yields higher as they continue to offer some of the best income opportunities in ~17 years.

Corporate Spreads Demand for high-quality corporate bonds has pushed spreads tighter. Fund flows into taxable funds and ETFs have been positive every week of the year so far, with an average of $10.8 billion of inflows per week. Spreads for investment-grade corporates are near their tightest levels of the past year across all sectors. Investment-grade spreads overall are at ~120 basis points with a 52 week range of 116 to 175.

Higher for Longer The rise of interest rates so far in 2024 has prolonged the opportunity for investors to lock in historically attractive yields (as noted above) for long periods of time which could provide stability in the face of a coming recession regardless of whether it comes next month or next year. Locking into high-quality, long-term fixed income can provide consistent cash flow and desirable income levels for year to come, regardless of what lies around the corner.

All statistics and yields sourced from Bloomberg LP

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

”

To give real service you must add something which cannot be bought or measured with money, and that is sincerity and integrity.

boston capital wealth management of raymond james

Raymond James financial advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact our office for information and availability.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

© Raymond James & Associates, Inc., member New York Stock Exchange / SIPC | Privacy Policy | Legal Disclosures

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

© Raymond James & Associates, Inc., member New York Stock Exchange / SIPC | Privacy Policy | Legal Disclosures