Choose your financial tool wisely

- 11.14.22

- Markets & Investing

- Commentary

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Different tools allow you to perform an undertaking easier than others. You may be able to dig a hole in the garden with a screwdriver, but it is a whole lot easier, more effective and result-driven with a hand shovel. Using the right investment tools is equally important to reaching long term financial security. Recent economic and market activity has made this clear. Let’s toss the cheesy metaphor aside and talk reality. Conceptually it is easy to understand - yet fear and greed often impede implementation. Perhaps we can appeal to those natural impediments and use them to your advantage.

Over the previous few years when interest rates were low, we emphasized the importance of staying true to appropriate asset allocation. Growth assets and protective assets are not exchangeable no matter how much we try to convince ourselves otherwise. When interest rates were low, the desire for more return pushed some investors to substitute growth assets (such as stocks) to replace fixed income which lacked attractive yields. What was sacrificed was the primary goal of fixed income assets: protection of principal. This natural tendency to seek better return eventually failed to protect principal as the stock market has dropped over 16% year-to-date. This risk and swing may be an accepted risk for growth assets but not typically acceptable for protective assets.

The tendency is to point out that fixed income asset prices have also fallen and created losses. This is where having or using the right tool comes to play. Funds comprised of bonds are very different products simply because they do not have stated maturities. Individual bonds have stated maturities so the holder has the choice to retain them until they mature. This is a key feature that provides an opportunity to disregard interim holding period price movements. By holding a bond to maturity, an investor is locked into its cash flow, income and point in time (maturity) when the face value is returned. Only two things can alter this for an individual bond: 1) an outright default (which is a minimized risk when buying high quality investment grade bonds) or selling the bond prior to maturity which would activate the market price at the time of sale (could be higher or lower but will affect return).

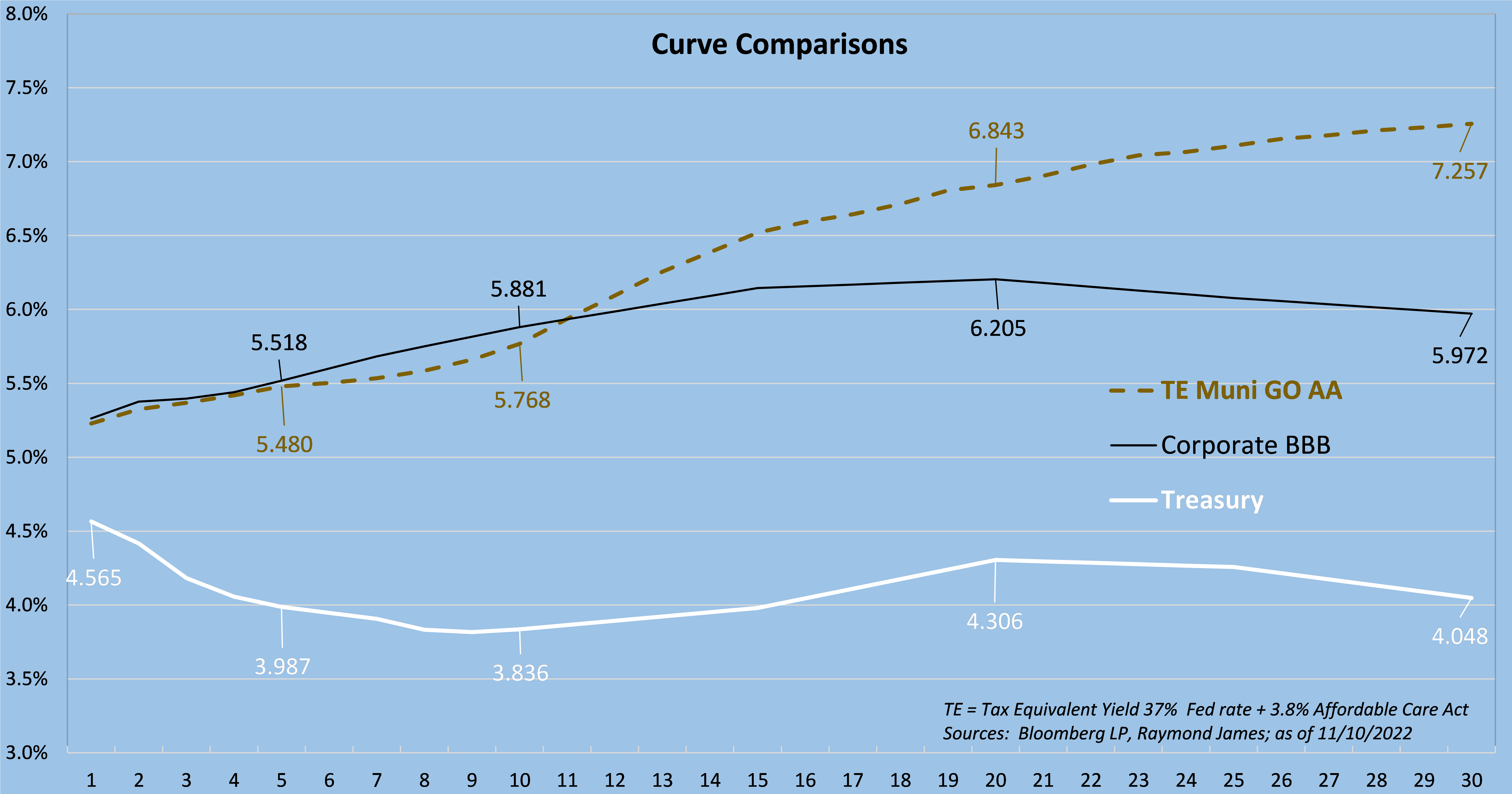

Today, yields are much higher than they have been in years. Resist the temptation to substitute asset allocation in reverse. In other words, growth assets over time should outperform and provide necessary growth of principal. Individual bonds will still provide the primary purpose of protecting principal; however, they now can provide very attractive income benefits. The following graph provides a clear picture of how individual bonds can provide: 1) principal protection; and 2) productive yields for periods investors can define by maturity and product choice. Treasury yields (white line) are attractive. Corporate (black line) and municipal (dashed line) yields are providing even higher rates. Locking into yield and maturity (extending out on the curve) may benefit investors inclined to expand today’s advantage into the future. Choosing individual bonds may provide multiple plusses.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.