Align your values with specialized investment and philanthropic vehicles.

$111 million and counting. That’s how much tennis superstar Serena Williams’ venture capital fund raised to invest specifically in founders with diverse points of view. Serena Ventures actively invests in a growing portfolio of more than 60 companies that align with the angel investor’s broader goals, including elevating women-owned businesses. Williams has been interested in investing and tech, in particular, for a while but was blown away when she learned that less than 2% of venture capital went to women.

Of course, you do not have to be a mega-celebrity to effect change on a broader scale. Specialized strategies, many firmly rooted in what’s known as sustainable investing, can elevate any portfolio. Ultimately, investing and philanthropy are calculated exercises of hope that tomorrow will be brighter than today. Sustainable investing takes that idea even further, using vehicles designed to purposefully and intentionally make a positive impact in the world.

Often referred to as ESG investing for the criteria on which companies are evaluated – environmental, social and governance – sustainable investing considers that progress toward solving global challenges such as climate change, social inequality and unethical business practices can be made by investing in companies and enterprises that promote sustainability. It’s a conscious approach to align your personal values with your portfolio. In short, it’s putting your money where your mouth is.

Each sustainable investing approach aligns with different motivators and comes with its own set of options on how to implement it in your portfolio. The exclusionary approach, for example, helps you avoid investments that don’t align with your values or standards. Options include funds and ETFs available that seek to adhere to religious values, or avoid tobacco producers and weapons manufacturers, or classify their holdings as “fossil fuel free.”

Other approaches to sustainable investing focus on achieving a net-positive global impact alongside a financial return. To achieve change, many foundations and family offices are establishing funds that support local economic development and social impact missions across the globe, like a 2016 impact investment in Civic Builders that built a new school to serve a city in financial ruin with a 29% poverty rate. Or an investment in funds that build affordable housing for people with disabilities. Impact investing ranges from grant support to private equity, with liquidity risk and return potential varying dramatically.

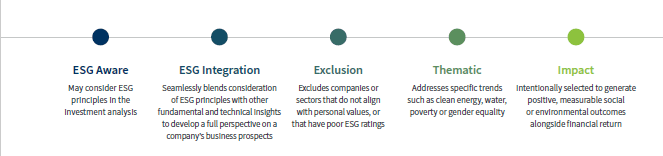

From exclusionary screening to impact investing, and many other strategies, sustainable investing can take on a form that fits your financial and sustainability goals. Some look at integrating ESG factor analysis into the investment selection process as an additional layer of due diligence to vet how sustainable the company will be in the future, and therefore how well it will perform in a changing world.

As you move to the right on the spectrum below, the approaches become increasingly focused on the social and environmental outcomes.

As the sustainable investing space evolves, investors of just about any net worth have more opportunities to create positive social or environmental impact and achieve long-term financial goals. Some of these opportunities have arisen in the alternative investment space, where debt and equity investments can be used to create positive impact. Many alternative investments, including venture capital, private equity, real estate and lesser-known assets such as farmland, were formerly out of reach for many individual investors, due to high minimum investments. However, technology has made alternative investments more accessible. Of course, you’ll want to weigh the risk/reward tradeoffs with your advisor before diving in.

Sustainable investing allows you to invest in companies and initiatives making a positive impact in the world. It’s an approach that considers not only a firm’s bottom line, but the way the company gets there, achieving global goals beyond growth. There is no “one size” approach, but your advisor can help you find a particular strategy that aligns with your goals and the impact you seek to make, whether you’re concerned about diversity and inclusion in the workplace, desire to level the playing field when it comes to social inequality, want to contribute to the transition to clean energy, or seek to promote data privacy. It’s about aligning your investments with the causes you’re most passionate about. Working closely with your advisor, you can tailor a sustainable investing portfolio of any size to promote the kind of world you’d like to see. Here and now.

Sources: Morningstar, “2019 Morningstar Sustainable Funds U.S. Landscape Report.” 2019; Eccles, Robert G. and Ioannou, Ioannis and Serafeim, George, “The Impact of Corporate Sustainability on Organizational Processes and Performance.” (November 23, 2011). Management Science, Forthcoming; Global Sustainable Investment Alliance, “2018 Global Sustainable Investment Review.” 2018; nytimes.com; pbs.org; U.S. SIF Foundation, Report on U.S. Sustainable, Responsible and Impact Investing Trends, 2018 Biennial Report; 2018 Global Sustainable Investment Review; CNBC; MSCI; Global Impact Investing Network; worth.com; nerdwallet.com