Will the economy's resilience continue or fade?

- 03.10.23

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The vast majority of the Fed’s work is already done

- Labor market slowdown has yet to arrive

- Slower glide path to lower inflation likely

According to the Farmer’s Almanac, when March ‘comes in like a lion, it goes out like a lamb.’ While this old proverb has typically been used to describe weather patterns, it got us wondering if the same could hold true for the economy in March. After all, the economy headed into March like a lion after a steady string of hotter than expected economic and inflation prints last month. The market’s reaction to the upside surprises has been predictable – ratcheting up of Fed rate hike expectations, soaring bond yields, and struggling equity markets. However, the economy’s resilience has been remarkable, particularly given the Fed is in the midst of its most aggressive tightening cycle in over 40 years. The next few weeks will likely be pivotal for the markets, confirming whether the economy’s momentum is gaining traction or if its strength fades and March goes out like a lamb (our base case) as the old adage suggests. Here are the key factors that we are watching:

- Powell’s testimony and the dot plots | Powell used his semi-annual testimony to Congress this week to reset expectations that the Fed’s job is still not done. Powell delivered the same hawkish messaging we’ve heard for months – inflation remains elevated, the labor market is too tight, and the Fed has more work to do – laying the groundwork for a higher terminal rate when policymakers meet on March 21-22. Powell also stated that the Fed is prepared to speed up its pace of tightening if economic strength continues (aka ‘data dependent’). Powell's testimony confirmed that an upward revision to the Fed’s dot plots is coming. The question is how high do policymakers think interest rates need to go to sufficiently slow the economy and restrain inflation? Market expectations for the peak fed funds rate climbed to another cycle high of ~5.6%, nearly 50 basis points above the FOMC’s December estimates. The probability of a 50 basis point increase at the March meeting sharply increased after Powell spoke. However, with policy rates heading meaningfully above neutral, we believe the vast majority of the Fed’s work is already done.

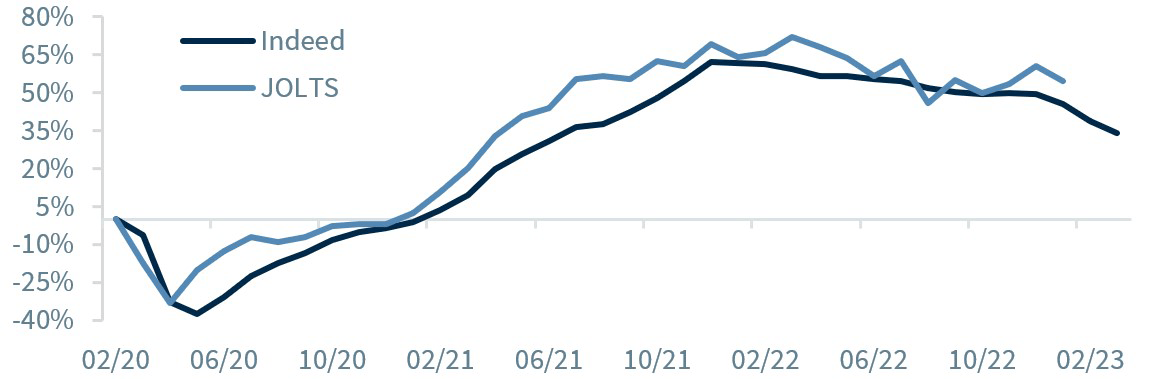

- Labor market trends | The labor market has been remarkably resilient and seemingly immune to the Fed’s sharp tightening in monetary policy over the last year. Its continued strength has been a big reason why our consumption-driven economy has managed to avoid a recession thus far. While the pace of job gains has slowed, it remains well above levels typically seen leading into a recession. For now, the unexpected surge in January’s jobs report has diminished the risks of a recession. We are cautious about reading too much into one number, particularly as seasonal adjustments and warm weather likely contributed to the stronger than expected print. This week’s employment numbers should confirm whether January’s strength was due to these statistical quirks. The JOLTS job openings declined to 10.8 million in February – a step in the right direction. Initial claims rose to their highest level since December – suggesting some cooling in the labor market. While the job gains in February came in above expectations (+311k), the higher unemployment rate (3.6%) and easing wage gains were encouraging signs.

- Inflation’s glide path | Powell couldn’t have asked for worse timing – at January’s FOMC press conference – to utter the words “the disinflationary process has begun.” Just when the market was getting comfortable with the Fed winning the battle on inflation, several key inflation measures last month indicated that inflation was proving more persistent than expected. The BLS’ recent CPI benchmark revisions also contributed to the slowing pace of disinflation. Adjustments to the component weightings (i.e., the shelter weight increased from 32.9% to 34.4%) and new seasonal adjustment factors led to higher monthly inflation gains than what was originally reported. This is not great news for the Fed or the markets. However, a significant portion of the increase was due to surging shelter prices, which reflect last year’s gains. With house/rent prices now falling, downward pressure on inflation should pick up steam in the months ahead. Next week’s inflation reports (PPI and CPI) will hopefully confirm this trend.

- Surging retail sales | Retail sales came roaring back in January after two consecutive months of declines. The 3.0% monthly increase was the strongest gain in nearly two years. What fueled the rise? Strong job growth, solid wage gains and mild weather. In addition, nearly 70 million Americans saw a bump in social security benefits with an 8.7% cost-of-living-adjustment in January. That’s the largest increase in benefits in over 40 years. And it's not a one-time boost, it’s a recurring monthly payment. While the upside surprise is explainable, we doubt this surge is sustainable in the long term. Consumers should start to pull back their spending as job growth cools and excess savings continue to dwindle in the months ahead.

Bottom line: With growth holding up better than expected, the odds of a sudden drop off in economic activity have diminished. However, the recent revival in economic activity is unlikely to be the start of a new robust uptrend. The Fed’s ongoing policy restraint, which impacts the economy with a lag, should put downward pressure on consumer demand and the labor market. Ultimately, we believe the March economic data will show the economy is cooling and less strong than the January data suggested.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.