This all-important retirement income source is tricky, especially around times of transition.

Social Security is complicated. There are many factors that have to be accounted for, including your age, income, marital status, health and life expectancy. According to SSA.gov, the average American retiree’s Social Security payments account for 40% of their retirement income – meaning it’s that much more important to file thoughtfully. Specialized software can help illustrate the likelihood and potential impact of various choices, but you’ll want to start the planning process well before you file a claim.

You must have worked and contributed to the system for at least 40 quarters to be entitled to what’s known as your Primary Insurance Amount (PIA) at “full retirement age” (FRA), somewhere between 66 and 67, depending on the year you were born. You can file as early as 62, but be warned, you’ll be locking in 25% lower payments for life if you do. File after FRA and you start racking up delayed retirement credits. What does that mean? For every year you wait to file after you reach FRA, you’ll get an 8% raise in benefits. Even better, adjustments for cost of living (think inflation-fighting protection) also get factored in and will compound over time.

Spousal benefits offer your spouse steady income based on your work record – a boon, especially for spouses who didn’t work or were the secondary breadwinner. Your spouse can start collecting at age 62, but you must have filed for benefits first. Spousal benefits, unlike the worker benefit, do not earn delayed retirement credits after FRA, but could incur reductions if you take spousal benefits before your own FRA.

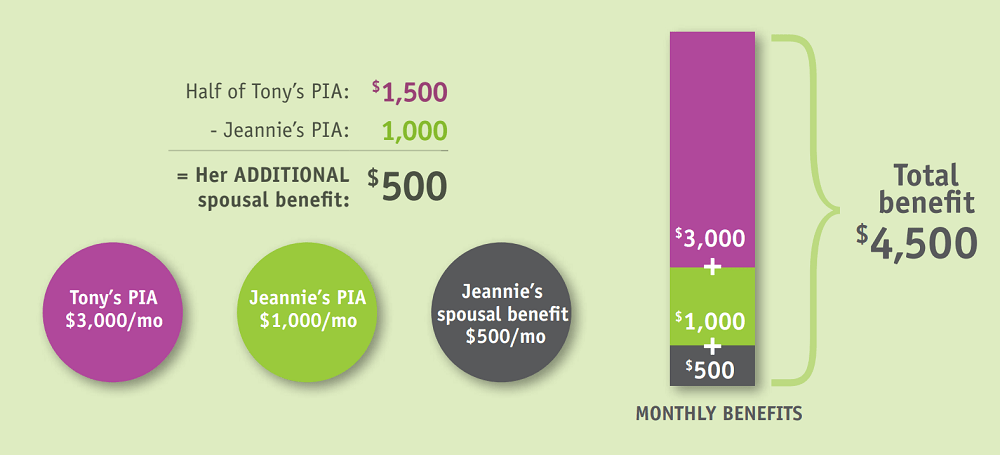

Let’s illustrate some of these benefits with an example. Jeannie is married to Tony, who made significantly more during his career. Both are 62 and eligible for benefits. Jeannie may be able to claim on Tony’s record, but first we need to figure out what her own PIA would be at her FRA of 66. If Jeannie’s PIA is less than half of Tony’s, then she qualifies for spousal benefits, but only if Tony files for benefits first. Then she would receive a spousal benefit that equals half of Tony’s PIA minus her own. In reality, she’ll receive two benefits – her own worker benefit plus the spousal benefit. Tony’s PIA is $3,000 a month at 66, his FRA. Jeannie’s PIA is $1,000 a month. When they both file at age 66, Tony will receive $3,000 and Jeannie will receive $1,500 comprised of her own record plus the additional spousal benefit, so their household monthly benefit would be $4,500.

If the higher earner files early:

This gets a bit more complicated. If Tony files before FRA at 66, he permanently reduces his monthly benefit. But Jeannie could wait until her 66th birthday to start benefits and would still receive the full $1,500. Spousal benefits don’t get reduced if the higher earner files early, nor do they grow if the higher earner delays filing past FRA.

But there’s a twist. Once Tony files, Jeannie can’t pick and choose one benefit over the other. Those born before Jan. 1, 1954, do get the choice, however, using a strategy commonly known as a restricted application, if they wait until full retirement age to file. Jeannie was born a little later, so she’ll have to claim both her worker and her spousal benefits.

If the lower earner files early:

Remember, spouses cannot start spousal benefits until the higher earner files first. So if Jeannie wants the reliability of Social Security income before Tony does, she can file for only her own worker benefits, and those will be subject to a reduction if she files before FRA. Once Tony files at age 66, she’ll get her spousal benefit, too.

Couples who want to ensure the surviving spouse gets the largest benefit possible after a loss should pay careful attention to the rules that govern survivor benefits. In this case, delaying Social Security increases your own benefit as well as the lifetime benefit for your widow or widower. It can kick in as early as age 60, so this can be particularly beneficial for couples with a substantial age difference between them.

Your loved one will receive whichever is higher: their current benefit or your current benefit (both would be adjusted for inflation). Since the lower benefit will drop off in favor of the higher one, it may not always make as much sense for a lower earner to delay taking Social Security.

So if Jeannie loses Tony at age 82, her benefit will switch from $1,000 a month (her PIA) to $3,000 a month based on his PIA, plus any cost of living adjustments (COLAs) that occurred between when he filed at age 66 and when he passed away 16 years later. If Tony had delayed taking benefits even longer, Jeannie would be able to collect on his now-much-higher record for the rest of her life. That higher lifelong income provides an additional cushion as longer lifespans may result in greater healthcare and living expenses, as well as higher inflation.

If you’re single, timing is everything when it comes to filing for Social Security. Delaying earns you an extra 8% for every year you wait past your FRA until age 70, plus whatever the COLA adjustments were for the ensuing years.

Married couples need to do a little more math in order to maximize their total Social Security benefits. Let’s take a look at a few of the more common strategies. Your advisor can run hypothetical scenarios with your specific numbers to help you determine which filing strategy puts you ahead of the game.

If the higher earner delays filing, not only will that person get an increased benefit for every year they wait, their spouse will, too, should they outlive the main breadwinner. Too many people focus on their individual benefit without considering the added twist of survivor benefits. But if you take that into account in your calculations, you may find that it makes more sense for the lower earner to start benefits as soon as you need income, while the higher earner racks up delayed retirement credits. When the higher earner passes away, the lower earning spouse will step up to the higher survivor benefits, which will add a level of income protection for life.

This strategy’s approach is to delay the higher earner’s benefit. Since spousal payouts don’t benefit from delayed credits, Tony may wish to start his benefit at FRA (66 in his case), allowing Jeannie to start her spousal benefit. If Tony were older than Jeannie, he’d want to delay his own benefits until she reaches her FRA, thus benefiting from delayed retirement credits and maximizing her spousal benefit.

But remember the restricted application twist mentioned earlier. Those born before Jan. 1, 1954, get a choice between filing for their own benefits or spousal benefits when they reach FRA. Everyone else will be deemed to be applying for both and will automatically receive the higher of the two benefits.

For those who still qualify, here’s how a restricted application for spousal benefits works. Like with regular spousal benefits, the other spouse files for worker’s benefits first. The second spouse can apply for just spousal benefits at FRA, collect for several years until age 70, and then switch over to their own worker benefit, which will grow by 8% plus any cost-of-living adjustments every year they wait.

Should you find yourself in changing circumstances – dealing with a loss of a loved one or ending a marriage – there are strategies that can help you avoid short-term financial hardship and solidify your long-term retirement income through these times of transition.

Yes, you can do this. It’s almost the same process as filing for spousal benefits, except you must have been married for at least 10 years and remain unmarried while you collect on your ex’s record. If you’ve been divorced for two years, your ex doesn’t even have to file for benefits for you to qualify. He or she merely has to be eligible for benefits (e.g., at least age 62). Plus, your (ex-)spousal benefits in no way affect your ex’s benefits or any benefits that would be owed to a future spouse. You can even collect if your ex remarries.

Here’s another twist: You can even file a restricted application for spousal benefits based upon your ex-spouse’s record if you were 62 by the end of 2015. Survivor benefits may also apply.

For widows and widowers under age 60 who have worked for at least 10 years, you have choices to make between your survivor and worker benefits. Typically, you’d claim the higher of the two when you initially file, but in some cases, you can integrate both.

Widows and widowers are among the few who can claim benefits before age 62, so you have the option to start your survivor benefit at the earliest age possible – age 60 – and switch to your own worker benefit when you turn 70, when it’ll reach its maximum thanks to delayed retirement credits and COLAs. You can deploy this strategy at any point between age 60 and 70.

Or you can reverse the order, but you’ll have to wait two years before you can start. If you made less than your spouse, you have the option to claim your own worker benefit as early as age 62, then switch to your higher survivor benefit at FRA. Again, there’s no reason to wait longer than that because survivor benefits don’t earn delayed retirement credits.

You have options to help you and/or your spouse maximize your benefits. Remember, there’s no one “best” strategy for anyone. The right strategy for you depends on your PIA and that of your spouse, as well as your health and financial status.

You can find out your expected Primary Insurance Amount (PIA) by signing up for a Social Security account and monitoring your estimated benefits. You can run what-if scenarios with your advisor to map out just what will happen if you file at 62, 66 or 70; what could happen if one or both of you fall ill or any combination of key factors. Remember: the best answer may not be what you first thought.

Sources: Prudential; ssa.gov

This case study is for illustrative purposes only. Individual cases will vary. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making any investment decision, you should consult with your financial advisor about your individual situation.