INVESTORS "MAKE MONEY THE OLD FASHIONED WAY, THEY EARN IT!"

The investment firm Smith Barney had a TV commercial in the 80s with the actor John Houseman that said “They make money the old fashioned way, they earn it.”

Well, the higher returns that long term stock market performance offers is definitely earned by investors. They earn it by withstanding days, months and sometimes years when all the media and financial reports make them feel plain old stupid for holding onto stocks.

It appears that we are in one of those periods now. The long term effects of the coronavirus are unknowable. But a slowdown in many areas of the world’s economy is expected.

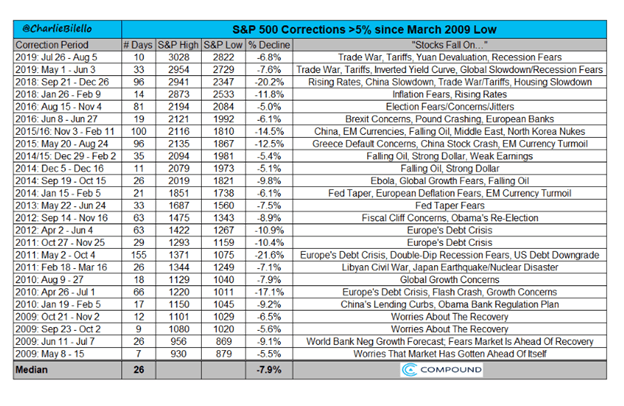

The market has moved quickly to reflect the reduced economic growth expectations. But while each scary scenario is different, I thought a look back at some of the headlines and market reactions of the last ten years would be helpful. Trade wars, inverted yields, Greek bankruptcy, Ebola, the fiscal cliff, European debt crisis, impeachments- the list goes on.

Below is a table that shows something that happens with a great degree of regularity- which is periodic stock market declines. This table shows every 5% or greater drop since 2008 and the news to which the drops were attributed. Market drops are more like “dog bites man”- i.e. not news.

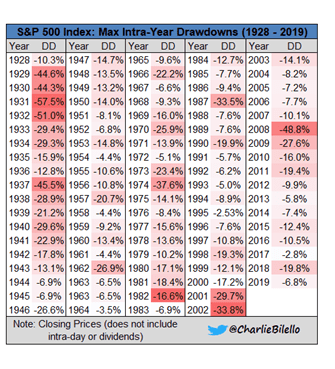

The next chart shows every calendar year since 1928 and what sort of drop an investor had to endure during that calendar year. Five of the last ten years had double digit pullbacks, and that was a decade of above average performance.

The table below is interesting in that it allows you to see how the entire calendar year turned out. Obviously, these returns had to be earned by hanging in there during the intra-year drops highlighted in the chart above.

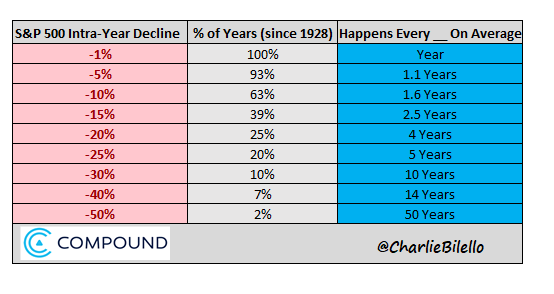

This last table is just the historical probabilities of different drawdowns since 1928. So based on history, we should expect pullbacks of 10% every 1.6 years, 20% every 4 years etc.

And avoiding these pullbacks was not the key to long term success. The key was enduring them.

So like the old ad says, investors “ do make money the old fashioned way, they earn it”.

Thanks as always and don’t hesitate to call with any questions or thoughts.

Beach

Disclosure: Opinions expressed are those of the author but not necessarily those of Raymond James, and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we not guarantee that the forgoing material is accurate or complete. Charts in this article are for illustration purposes only.