How Can the Price of Everything Go Up at the Same Time?

We are all aware of the increase in prices for virtually everything right now. Homes, cars, furniture, services, food- you name it, are experiencing significant price increases.

How can the prices for virtually everything go up at the same time?

Suppose the supply of money in our economy was rather constant. In that case, if the majority of our fellow citizens decided to pay more for a car, they would have less money to spend on a house. Should that happen, prices for cars would go up, but prices for houses would have to come down to complete a transaction- simply because buyers would have less money to spend on houses.

If the majority of citizens decided to pay more for a house, naturally they would have less to spend on cars. Thus, the price of houses would go up, but the price of cars would have to come down for a transaction to occur. Simply because there would be less money to buy a car.

So if the supply of money was rather constant (expanding at roughly the rate of economic growth around 2%-3%), then widespread inflation would be impossible. Areas where more money was spent would reduce funds for other areas, so overall inflation levels would remain in check.

It would be normal to see various prices of goods or services go up and down in a large, complex economy. But not widespread inflation, if the supply of money was rather constant.

But, if the supply of money was expanding, then there would not be the natural balancing of checkbooks that would keep the OVERALL level of prices steady. When prices of virtually all goods and services are inflating it can only be from an increase in the amount of dollars in our economy.

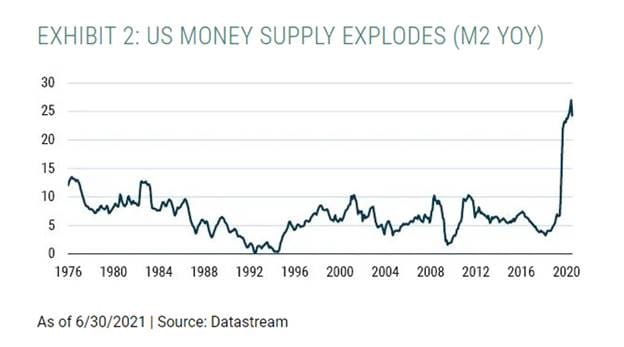

Below is a chart of M2- a measure of the amount of currency in circulation in the U.S.

The other source of inflation is the labor market. In developed countries like the U.S., labor costs are roughly 2/3’s of the economy’s cost structure. Below is a chart from the NFIB Small Business Association showing job openings which they are finding difficult to fulfill.

Between the stimulus programs from Congress, the continuing pumping of money into the banking system by the Federal Reserve’s $120 billion purchase of Treasury Bonds and mortgages every month, you can see how the money supply has increased more than it has in many decades.

So is this current inflation transitory or not?

The Federal Reserve keeps calling it transitory. The high inflation of the 1970s was transitory. The high interest rates in the 1980s were transitory. I guess virtually everything is transitory, eventually.

Current financial market indicators imply that this is a short-lived bout of inflation.

Because we don’t know the future and are firm believers in the quote that “Predictions are hard, especially about the future”, we know better than to make predictions.

But we do want to provide our clients with as “all weather” a portfolio as we can.

If there is long term inflation, then companies can charge more for their goods, and as shareholders (but not as consumers) we can benefit from their pricing power.

Should inflation fall back to lower ranges, cash and bonds which are there to primarily reduce downside risk can be reasonable investments.

So, with very poor visibility as to what the future holds, we believe having a disciplined investment strategy provides you a better path to success versus positioning your portfolios on predictions of an unknown future.

We serve you best when we focus on what we can control. Understanding your goals, incurring no more risk than is necessary to reach them, implementing your plan with tax and cost-efficient investments, reviewing your progress and making adjustments when prudent.

This provides you the best probability of financial success.

As always, don’t hesitate to call with any thoughts and question and we will continue to stay in touch with you.

Thanks again for your trust and confidence in us.

Beach

Disclosure: The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Beach Foster and not necessarily those of Raymond James. Past performance may not be indicative of future results. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Rebalancing a non-retirement account could be a taxable event that may increase your tax liability. Investment strategies mentioned may not be suitable for al investors. Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.