The Market's Price of Admission

As we all can see, volatility is back in all the markets. Stocks, bonds, commodities have all seen huge swings up and down, with some of the biggest days right beside some of the worst days.

Periodically, the markets do a good job of finding out who are the real long-term owners of America’s companies versus who are just renting shares short-term hoping for a pop. It seems like we are in one of those periods. Times like this remind us of Warren Buffet’s quote "The stock market is a device for transferring money from the impatient to the patient."

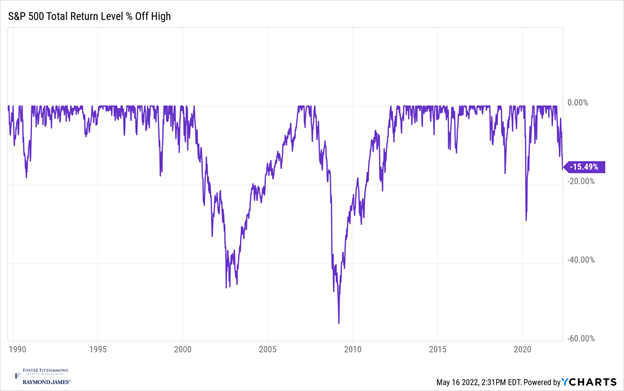

The chart below shows the drops of the S&P 500 that investors have had to endure since 1989. As the chart shows, investors’ resolve gets tested more regularly than we would like.

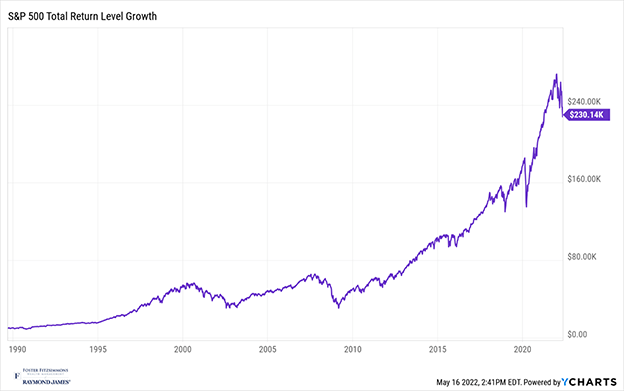

But, as the chart below shows, being a long- term owner of the companies in America has been a very rewarding experience for those who can look beyond the periodic spikes of volatility and benefit from the growth of profits in our economy.

The above chart shows the growth of $10,000 invested in the S&P 500 since 1989. As you can see, for investors with the temperament to endure the turbulence which markets provide, the returns have been significant. And importantly, this is the return for investors who stayed in the market the whole time – and who had the fun of seeing their monthly statements experience big drops from time to time.

Enduring these intermittent periods when markets go down is the “price of admission” to earn the market’s long-term returns.

As always, we are here to answer any of your specific questions, thoughts or concerns.

Thanks,

Beach

Disclosure: The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Beach Foster and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.