The Week in Review 8/14/2023

"If you don't have time to do it right, when will you ever have time to do it over?" - John Wooden

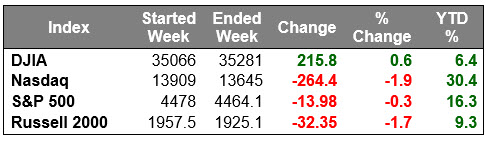

The Dow Jones Industrial Average was the only winner last week… the S&P 500, Nasdaq, and Russell 2000 all had modest losses. Trading last week reflected a corrective mindset that has taken root in August after a handsome run for the stock market since late March.

The S&P 500 did close below the 4,500 support level on Friday.

Volume on the NYSE was below average… ushering us into the “dog days of summer”.

There were several news bits that gave market participants an excuse to take money off the table this week…

Global growth concerns were fueled by weaker-than-expected trade data out of China, and much weaker than expected new yuan loan growth for July, along with a warning from Chinese property developer Country Garden Holdings that it anticipates losing nearly $8 billion in the first half of 2023.

Also, a slate of U.S. economic data came in mixed.

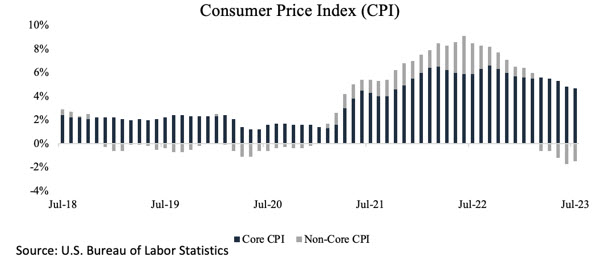

Total CPI and core-CPI were both in line with consensus estimates while the Producer Price Index for July was hotter than expected at the headline level, but not really too hot after accounting for downward revisions for June. Initial jobless claims, meanwhile, continue to run well below recession levels.

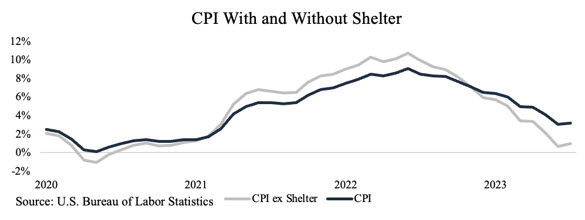

Shelter continues to be the main contributor, accounting for 90% of July’s total increase. Shelter’s annual rate remains very high at 7.7%, which is more than double the pre-pandemic rate.

If you strip out shelter from the index, that 3.2% rate falls to just 1.0%

Earlier in the week, Moody's downgraded the credit ratings of 10 smaller U.S. banks and put some bigger banks on watch for a downgrade, this also added to the pessimism in the markets.

On the earnings front… Dow component Walt Disney was a winning standout, jumping 3.2% on the week after reporting results, while UPS sank after it issuing disappointing FY23 revenue outlook, citing weakening e-commerce demand and an expectation for lower volumes following the improved labor contract for the lowered guidance.

The S&P 500 energy (+3.5%) and health care (+2.5%) sectors led the outperformers while the information technology sector (-2.9%) saw the largest decline.

Treasury yields continued to climb last week, acting as another “thorn in the side” for equities. The 2-yr note yield rose 11 basis points to 4.89% and the 10-yr note yield rose nine basis points to 4.17%.

Market Snapshot…

- Oil Prices – Oil prices are up on record demand. West Texas Intermediate crude (WTI) gained 22 cents, or 0.27%, to settle at $83.05/barrel. Brent crude futures rose 19 cents, or 0.22%, to settle at $86.59/barrel.

- Gold– Gold prices are on track for their worst week in seven, hurt by an overall stronger dollar. Spot Gold rose just 0.05% to $1,912.9246 per ounce. U.S. gold futures inched down 0.18% to $1,945.4. Silver finished the week at $22.748.

- U.S. Dollar– The dollar rose after a slightly bigger increase in U.S. producer prices in July lifted Treasury yields higher. The dollar index rose 0.31% to 102.85, after bouncing off a 15-month low in mid-July on signs of a resilient U.S. labor market. Euro/US$ exchange rate is now 1.091.

- U.S. Treasury Rates– The yield on the 10-year Treasury increased after producer prices were better than expected. The 10-year Treasury yield added nearly 8 basis points to 4.16%.

- Asian shares were down in overnight trading.

- European markets are trading mostly higher.

- Domestic markets are indicated modestly higher this morning.

Earnings are better than feared…Roughly 92% of the S&P 500 has reported earnings thus far. In aggregate, those companies continue to exceed analyst expectations with 82% reporting above estimates. The better-than-feared mentality has helped push stocks higher.

Earnings season is nearing its end but there are still a few prominent companies left to report. This week we will hear from Home Depot, Cisco, Walmart, and Deere to name a few.

This week will be relatively light. The retail sales report will be announced on Tuesday, and the Fed’s meeting minutes from its July meeting will be released.

Have a wonderful week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.