Market Update: Inflation 06/14/22

Sean C. Kelly, CFA®, CFP®, CIMA®, AIF®

Senior Vice President, Wealth Management

Managing Director

Last week I got to see the new Top Gun movie with my family. It was wonderful movie and very fun to share that theatre experience with my kids the same way I did with my father when I saw the original back almost 30 years ago. I won’t spoil anything here but if you haven’t seen it and you in any way enjoyed the original, I suggest you see it in the theatre as it’s quite the spectacle. Anyway, there was a moment early on in the movie where an Admiral chastises Maverick that the end is inevitable and that his kind is headed for extinction to which Tom Cruises character responds, Maybe so sir, but not today.

We’ll that exactly how I felt after Friday’s inflation report and the last 2 day’s in the capital markets. I know this turmoil we are currently mired in will come to end but unfortunately it won’t be today.

For those of you who read last month’s update you are fairly well informed with what’s driving today’s market action. Not a great deal has changed. If you haven’t read it but are curious about our detailed opinions on the current market environment, please check it out (market update.) For today, I just wanted to share a brief follow up to that piece given Friday’s report and the last few weeks action in the debt and equity markets. Don’t worry, this won’t be the short novel that our last edition was.

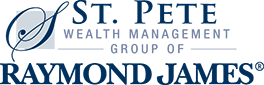

INFLATION

Well, we got May’s inflation reading on Friday and as you can imagine from the stock market’s reaction the last few day’s it was indeed ugly. The headline (all in) number showed an increase of 1% in CPI against April which brought May’s year over year inflation to 8.6%. For those unfamiliar with this, the Bureau of Labor Statistics essentially monitors a basket of goods representing a broad-based take of the economy and measures the change in price of each area. The basket intended to represent the entirety of the country is called headline and you would look at 8.6% and infer that an average citizen is spending somewhere in the range of 8.6% more than they did last year. The second reading is core inflation, which kicks out food and energy as those markets tend to jump around a lot which can, at times, give a misleading reading of inflation. The core reading for May was up 6%, which tells you that the highest levels of inflation are coming from those areas that tend to be more volatile. For the record, food and energy represent about 23% of the inflation basket represented in headline.

Please see the chart below for May’s reading.

Source: Bureau of Labor Statistics

I found May’s data quite interesting and even highlighted one particular sector which was the energy space. Clearly this sector has dislocated from the rest of those measured with categories like Gasoline and Fuel oil up 48% and 106% respectively. If you drive often and have had a $100 dollar fill up at a pump, I am sure you have noticed. Gas is currently at an all-time high based upon the national average which is currently over $5 per gallon according to AAA. Not exactly an ideal set up for the summer driving months.

Why this sector and inflation in general is happening is covered in detail in the previous letter but the short summary is that we have too much money chasing too few goods and services. The too much money part is due to a healthy economy where the average person has above average disposable income based on a robust job market and fiscal policy accommodations. The too few goods part is due to supply chain hangover as we recover from covid and the general lockdowns many countries employed as a solution. I find myself occasionally sparring with people on whether this is still an issue and for fun consider two points.

First, the anecdotal evidence where I was backed into in January; which left me with a cracked rear taillight. I’ve been waiting on a taillight replacement for my SUV (one of the most popular SUVs in the country) since January. Or consider that I’ve been waiting on a replacement part for the same SUV for over 40 days due to a cracked windshield from an interstate rock. What a mess, but I digress.

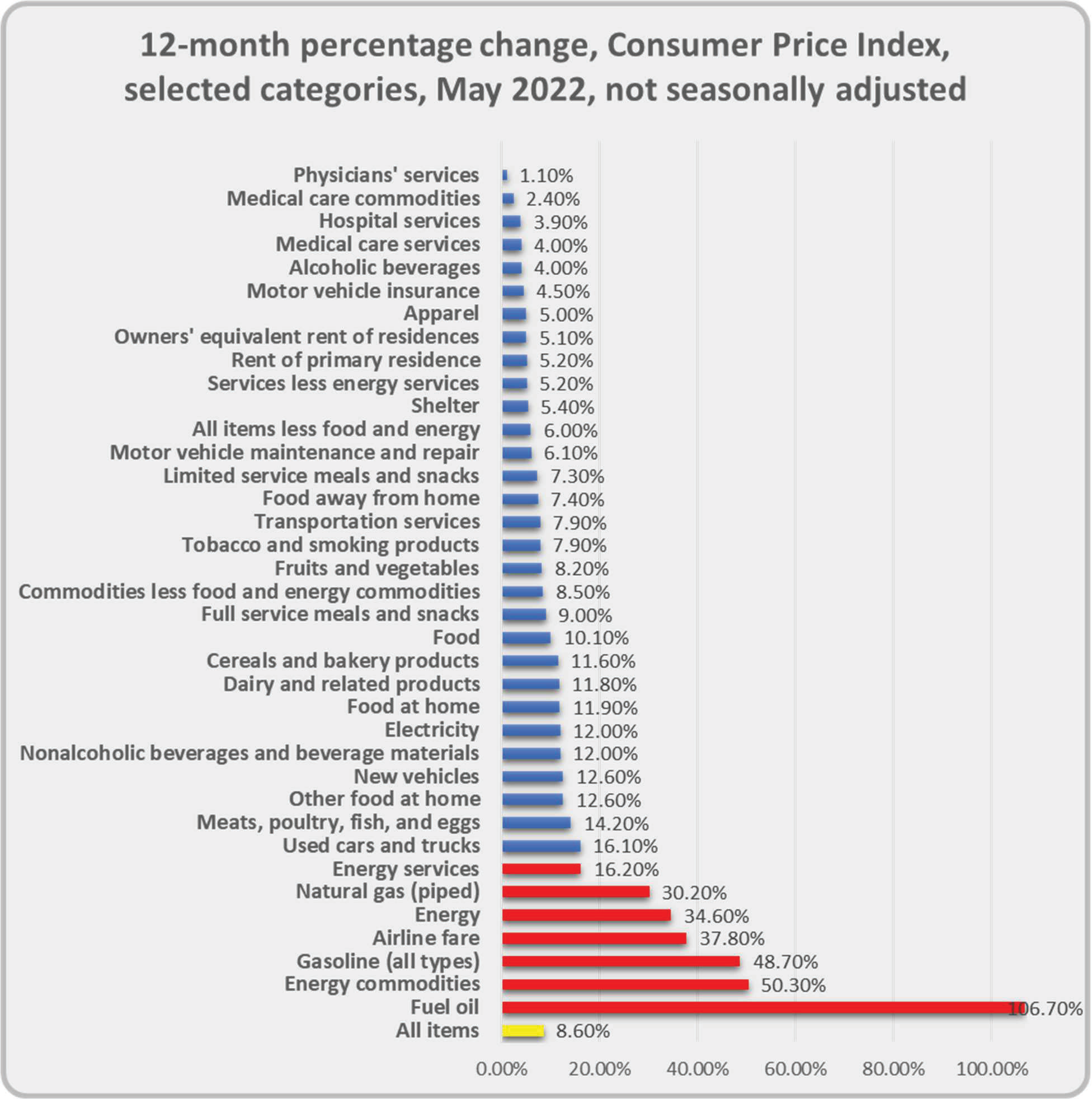

Second, please see the attached piece below which monitors the global supply chain. We have been as high as 4.4 standard deviations above normal which occurred in December of 2021. We currently sit at +2.9. For brevity, don’t get too caught up in the statistics. Instead, just consider that mathematically a 4.4 standard deviation event (>4 sigma) should occur once in a thousand-year time sample. Our current state of dislocation at 2.9 should occur once in a lifetime. These are odd times folks and again, mathematically ones that are unlikely to occur again anytime soon.

Source: Federal Reserve Bank of New York, IHS Markit, J.P. Morgan Asset Management

To conclude, combine an above average money supply with below average access to goods and you obviously get inflation. I will leave it there as not a lot has changed since the last update. The supply chain will continue to thaw as covid abates, lockdowns end and labor returns but as Tom said in TOP GUN, not today.

SO WHY THE SELL OFF AGAIN?

Common sense tells us that eventually inflation is quelled by higher prices destroying demand or in other words, if the good you are planning to purchase becomes too expensive, you just don’t buy. Instead you wait until it comes down in price or you find a cheaper alternative. This is the natural order of a capitalist society. The problem with letting that process play out on its own with inflation is that too many people are hurt in the process and the extremes can becomes really extreme before markets correct (see countries like Venezuela and Argentina.) A hallmark of the stability in the United States is our Federal Reserve which plays an active role in managing price stability and hence the bond market rate jump and stock market downside the last few days.

The S&P500 had gotten used to the idea that inflation had peaked when it rallied about 8% from almost the date of our last missive through this past Thursday. Also, the bond market had backed off the highs seen in early May. Unfortunately, with hot inflation print Friday, that narrative was smashed and the odds of the Federal Reserve taking a more aggressive stance increased dramatically.

Without rehashing the risk formula too much, the concern is as follows. Stubbornly high inflation leads to an overly aggressive Fed which will raise interest rates higher and faster to combat this condition. Historically speaking, an overly aggressive policy error has led to recessions. A recession is bad for almost all risk categories in the capital markets. That’s basically an Economics 201 class in a few sentences.

With inflation reaffirming that it hadn’t peaked yet, primarily due to energy and food, the odds of the federal reserve making a tightening error and sending us into recession just went back up and the market had to correct to that new possibility. Yields went up to reflect a faster increase possibility in the fed funds rate which last month Chairman Jerome Powell virtually assured us wouldn’t happen and stocks went down. Volatile yes and noisy for sure but not totally unexpected.

WHAT DOES IT ALL MEAN?

Well, nothing has changed since the last write up. In fact, the market is barely a few points lower than when the last update was composed where we warned that we might be in for some more pain before it’s all over. This is not out of a reasonable base case. So the advice we previously presented still stands.

These bad times happen, and they are never comfortable. That said, they do come and go, as will this. Continue to contribute to retirement accounts and make sure you that your allocations are appropriate given your investment time horizon and risk tolerance. Do this and you will make it to greener pastures just as you did in the previous times of volatility. Do not get overly spooked if the FED chooses to raise by 75 bps on Wednesday of this week or in July as there are quite a few economist I trust who believe this is exactly what the doctor ordered. Instead, stick to your plan and stay patient.

If you do find yourself in need of more specific council please do not, under any circumstances, hesitate to give us a call.

PARTING OPTIMISM

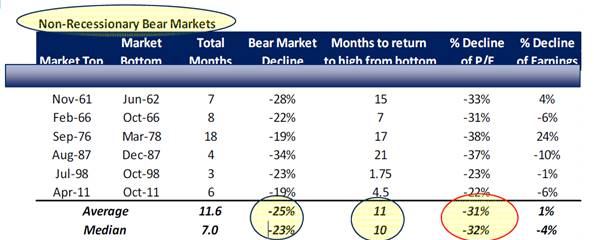

Let’s assume for a moment that the scenario I have been referencing for over a year does come to fruition. That the average consumer who is currently employed, with a historically low debt service ratio and a historically high cash balance doesn’t just roll over but actually plays dead. Let’s assume that the Federal Reserve isn’t interested in slowing inflation but instead breaking it and the collateral damage is economy. What then?

Well, this is exactly the sequence of events that occurred the last time we had robust levels of inflation in the headlines. For those interested in the historical role of the federal reserve, studying the Paul Volcker years is worthwhile. For those of you who had skin the game back in 1979 when he was appointed, I am confident that you will never forget.

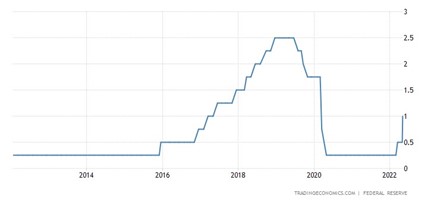

The point of this is that the last time the Fed decided to step on inflation, we were at persistent double digit inflation that reached 14% in 1980. The federal funds rate (currently at 1%) reached as high as 20% (yes, you read that correctly.) Unemployment varied between 7.5% and 11% during the time and this set up of battling inflation caused a double dip recession. A short one in 1980 where GDP declined 2.2% and a longer one between 1981-1982 where GDP declined 2.9%. It is widely accepted that both of these recessions were caused by simultaneous instances of high inflation battling FED policy and an energy crisis.

Sound Familiar yet?

The point of this is that during that period, (1980-1982) which covered about 20 months, the S&P500 dropped around 25%. We had a double dip recession, unemployment got as high as 11%, the FED funds rate rose to a ridiculous 20%. That backdrop virtually sounds uninvestable on its face and yet over the next 5 years, after the market bottomed in August of 1982, the S&P 500 tripled in value. Again, yes you read that correctly.

Now is about the time the lawyers want me to add 4 pages of disclaimers saying past performance is not indicative of future results and that any opinions above are just that. Opinions. And you know what? They are not wrong, what’s past is not necessarily prologue but without a doubt the lesson to be learned is that risk markets can and will react with expediency once it is believed that inflation is officially under control.

I have no doubt when considering a recovering supply chain and current FED movements that the time will come but as TOM said, just not today.

Thanks for the read. Please do not hesitate to give us a shout with questions.

Views expressed are not necessarily those of Raymond James & Associates and are subject to change without notice. Information provided is general in nature, and is not a complete statement of all information necessary for making an investment decision, and is not a recommendation or a solicitation to buy or sell any security. Past performance is not indicative of future results. There is no assurance these trends will continue or that forecasts mentioned will occur. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

State of the Markets 05/13/2022

Sean C. Kelly, CFA®, CFP®, CIMA®, AIF®

Senior Vice President, Wealth Management

Managing Director

After being spoiled with above average returns in the risk markets over the last couple of years as we recovered and grew our economy in the post Covid world, we’ve been brought back to reality with a very difficult start to 2022. Unfortunately, there has been virtually no asset class spared in the retracement of previous returns with a few small exceptions like commodities. The factors of Covid delays, inflation and a more hawkish Federal reserve have presented a very difficult backdrop to start the year and it has brought out many of the doomsayers on the financial networks over the last couple of weeks. It is with this in mind that we’d like to give you some straight talk around what is happening in the markets and a general guide as to what we are expecting over the remainder of the year.

For ease of reference I’ll separate this write up into 4 sections highlighting what I believe to be the major points of contention relating to the current state of the markets. They are the inflation story, the economy, the Federal Reserve, and lastly the risk markets. Candidly there is quite a bit more going on in the world as we speak but hopefully this gives you the high points and if we need to dive deeper into any subject we can do that in a one on one conversation in the coming days and weeks.

Before I get into the weeds however, I’d like to give a quick summary of where things are at for the folks that don’t want to read an entire essay on the state of the world. So for those individuals in a hurry, this one’s for you.

SUMMARY of conditions

In my opinion, the risk markets are reacting, in a very big way, to the page being turned on low interest rates and low inflation. This has been the backdrop for businesses and consumers for the better part of a decade. The bad news is that this type of transition comes with a lot of noise. When the FED decided to address inflation earlier than they had previously inferred, the interest rate curve on treasuries was sent into overdrive to accommodate for the coming policy change. Short interest rates shot up dramatically and this caused a cascading effect across almost all asset classes. To put it in perspective we’ve only seen this type of action in technology stocks which are very interest rate sensitive, a few times in history. Currently there are only 6.96% of NASDAQ stocks trading above their 50 day average. This is similar to market action we saw at the bottom of the 2015, 2018 and 2020 lows. As of today the NASDAQ is down around 27% YTD with the S&P500 down 17% and the Dow 30 down 12%. This is basically what we have been expecting in this market cycle with Value stocks dramatically out performing growth stocks but even for us this is a fairly large delta between the sectors.

Unfortunately, at least until this point in the correction, the story gets worse as the traditional safe haven for investments of bonds and cash are also under pressure in their own ways. Cash is under pressure in that we are experiencing significant inflation which is eroding the purchasing power of the dollar relative to goods and services. Simultaneously, the bond market as judged by the Barclays US aggregate bond index is having one of its worst starts to the year ever. Combine the two are you are seeing what is one of the worst starts to a year in the history of a 60/40 portfolio (60% stocks, 40% bonds) as both the stock market and bond market are moving in the same down direction.

That’s the bad news and if you want to read more in detail please continue to the sections below. Before we get there, however, there is good news. First and foremost, most intelligent economist we follow tend to believe inflation is peaking. The above average inflation readings are being attacked in 3 ways. First, the Fed is increasing interest rates and signaling to the world that inflation is their priority. Second, Covid restrictions and delays seems to be thawing a bit. I believe this is responsible for a little more than half of the inflation that we are seeing today. Third, the consumer and businesses will play a role in mitigating inflation as well. The runaway spending we saw in the 4th quarter and in some ways the 1st quarter of this year have died down a bit.

This is relevant because if inflation has peaked then the Federal Reserve can ease their foot off the gas a bit which in turn should roll rates back a bit from their meteoric rise and bring calm to the equity markets, inevitably staging a rally from the depressed levels we are at today. No, I don’t believe this is necessarily happening today or tomorrow but in the coming weeks as we digest the most recent inflation report, I suspect this is the chain of events.

As for equity markets, we are about as washed out as they get in the short term. Most specifically technology, communication services and consumer discretionary. Anything with momentum has been taken out to the woodshed already, which does present an interesting backdrop for investing on a go forward basis. While it is certainly possible that we are in for more pain in the short run, like 2000, 2008, 2011, 2015, 2018 and yes the Covid induced markets of 2020, we will recover from this period of time. Many of the telltale signs of a bottom are occurring right now from percentages of stocks trading at lows, to put call ratio’s, to sentiment, etc. At some point, hopefully in the not too distant future, calm will return and investors will pounce on the dislocations that have been created these past few months.

For those of you who have heard me speak on markets before, you know that I love the 3 steps forward, 1 step back analogy to describe the rhythm of capital markets. In 2020 and 2021 we took some giant steps forward. Currently we are taking a step back so that the dance can continue. This is always an uncomfortable but vital part of the process. Be patient as this too shall pass.

Please read on for more details and please feel free to give us a ring to discuss any specific questions that you have.

The Inflation Story

There has been few headlines that have grabbed as much attention in 2022 more than inflation. For those who have seen us speak recently or read previous updates by us or our CIO, Larry Adam, you are probably aware of the current predicament. For those that need a quick refresher the summary is as follows. After years of our country flirting with deflation, we have entered a period of inflation and it is truly unlike anything we’ve dealt with since the 80’s. Inflation, the rising of price in various materials, finished goods and services, can happen for several reasons. Developing scarcity or the lack in supply of a good or service can cause prices to rise. Also, increasing demand of a stable good or service can increase prices as well. Those are generally the major causes but how we arrive at scarcity or an overabundant rise in demand can vary. In 2022 we are facing supply issues not because we are running out of resources but because we have an impingement in our ability to deliver these resources to market. Whether it is factories in manufacturing nations like China that are struggling to return their workforce to pre pandemic levels or logistic suppliers like trucking companies in the United States (both in this case,) the effect is still the same.

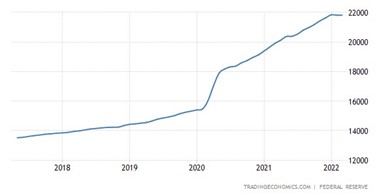

Compounding this problem is that concurrently, consumption countries like the United States are experiencing above average demand for things in the wake of Covid lockdowns and on the heels of an unprecedented rise in the M2 money supply thanks to PPP loans, stimulus checks, etc.

This condition, which is kind of a perfect storm for inflation to run rampant, is not necessarily a surprise in its effect but I think most economist and strategist (this one included) are a little surprised with how sticky the inflation upshot has been. This time last year when the early green shoots of inflation were taking hold, the estimates were to see relief in the spring of this year. Unfortunately, the Omicron Covid variant turned out to be wildly disruptive to labor and Russia decided to start a war. Both of these factors have clearly elongated the timeline necessary to ease inflation.

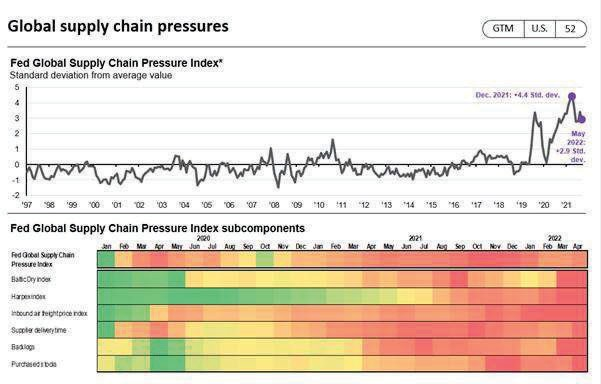

It isn’t all bad news though as with today’s headline and core CPI print we may have witnessed the opening scene of said easing. For April inflation came in at 8.3% year over year with an increase of .3% for the month of April (see left.) This was a large deceleration of the pace of growth in prices nationally as March’s increase was 1.2% for the month. Time will tell if this is a trend.

Please read some interesting points to further illustrate where we are in the inflation cycle and what is hopefully the early stages of relief. Numbers below are quoted spot prices on the commodity exchanges as of this writing and clearly subject to change.

- Shipping prices have come down. In 2021, a 40ft container shipping from Shanghai to Los Angeles would cost well over $12,500 and potentially higher depending up on the booking schedule. Today those prices have settled back down around $8,000 range.

- Energy while still up this month have dropped a bit with Natural gas down 15.19% this week, Brent and Crude oil down about 3% as of this writing.

- Precious metals like gold, silver and copper down around 6.6%, 17.8% and 13.6% respectively.

- Almost all industrial metals like aluminum, cobalt and zinc have come down this month though some are still quite elevated from this time last year.

- Agricultural traded products are mostly down in May or flat with the exception of lumber which is up 15.65% but down this time last year about 37%.

- Livestock while up against this time last year have started to reverse this month. Poultry up 9.9% year over year but down 3.9% this month. Beef up 6.16% year over year, down 1.51% this month.

So what from here? We’ll as you can see above, it does appear that the pace of inflation is slowing but the increases have not quite yet arrested. For the month of April food, shelter, airfares and recreation were all up. Apparel, communication and used cars and trucks were down (a welcome sign.) With Covid lockdowns still going on in China and the Russia Ukraine conflict continuing I’m a little skeptical that we are going to race back towards pre-Covid levels. That said, it should not be overlooked that a few of this areas have retreated a bit off highs to start the month a May.

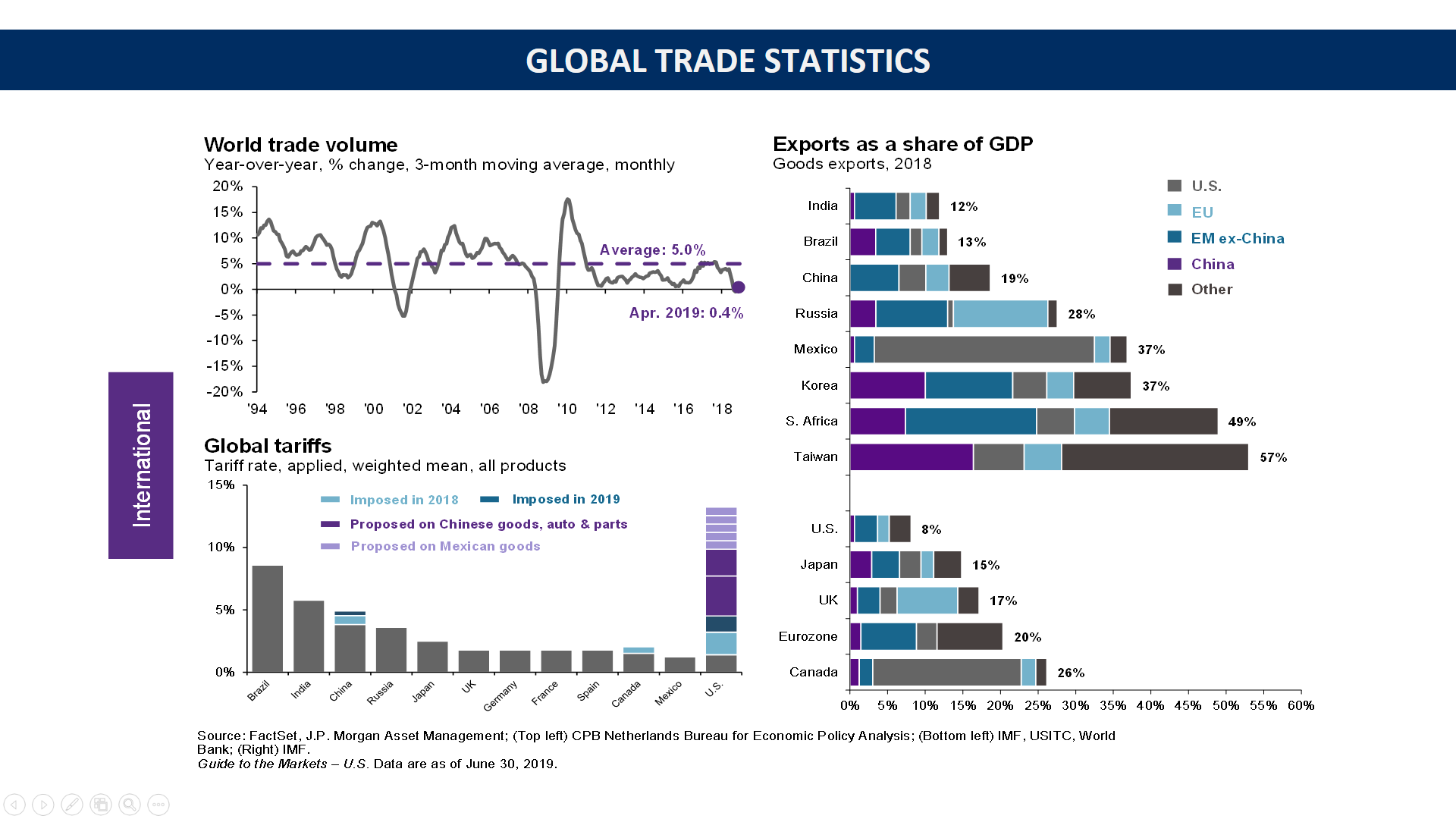

As far as the long term pace of inflation, the most recent FED survey predicts year end inflation to settle down to 6.3% on a year over year basis and the three year expectation has risen to 3.9%. Given the amount of money that was injected into M2 money supply seen to the left which was about 6 trillion or so, we expect inflation above 3% for some time.

The inflation story is far from over but in my opinion it is the lynchpin that holds the entire story together. The longer that inflation stays unreasonably high which signals increasing prices in the country, the more aggressive the FED is going to have to be to combat it and the higher the likelihood that we enter a recession sooner than expected.

This problem will end eventually either way as a friend of mine mentioned the other day when he said a nasty recession will end all this inflation talk straight away. Here’s to hoping we don’t get there. In the meantime, let’s check in on where the economy is today.

GDP growth

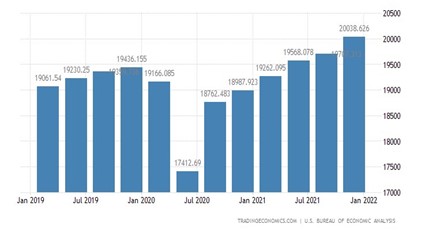

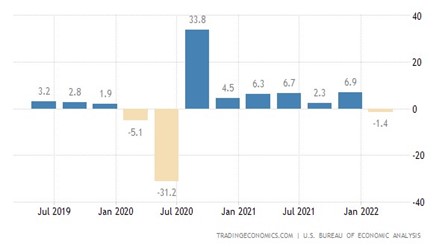

If there is a silver lining to the difficult headwinds we currently find ourselves in, it’s that the economy was carrying a significant amount of momentum into this year. For those paying attention at home not only had the US economy recovered entirely from Covid in terms of its size, we had actually resumed to trend as if Covid hadn’t happened. Now clearly the constituents of how our economy adds up has shifted as certain industries like air travel are still working their way back. But the aggregate size of our economy has taken a meaningful step forward. Q4 reading was one of the best quarters in recent memory as the economy grew by 6.9% on the back of greater inventory building and consumer spending. It is clear to me that the consumer and businesses in general in America were on sure footing. The labor markets were strong with over 10,000,000 job openings recorded in the country according to the jolts report and wages were up. Household debt service ratios were down and cash on hand was very high. Similarly, corporate earnings surprises were and continue to be well above average and cash on corporate balance sheets was ample. Overall, this is the best our economy has looked in some time.

Now, some will say that the 1st quarter negative GDP print was the canary in the coal mine predicting trouble to come but if you investigate the details of how the first quarter played out, I just don’t buy that. The contraction we experienced in Q1 of 1.4%, when expectations were for growth of 1.1% (a miss of 2.5%) was primarily due to a record trade deficit in the quarter where we as a country imported way more than we exported which is a negative to GDP as money leaves our economy. Also, there were contractions in inventory building which I believe was Omicron related to some extent and Government spending continued to slow. To the positive were consumer spending and fixed investment (particularly nonresidential.) I suspect that we will see a reverse in those inventories against Q1 this quarter as omicron effects (in our country at least) fade and a technical recession here will be staved off for a future day.

The million-dollar question of course is when you combine tightening financial conditions and rising prices with a burgeoning economy what do you get? Do you get an instantaneous roll over in activity which manifests a recession or do you simply get a slowing economy but still a growing one. My money, now is on the latter. Again, time will tell. Much of the responsibility to manage that equation lies with the Federal Reserve as the world’s most powerful purveyor of monetary policy.

The FEDERAL RESERVE

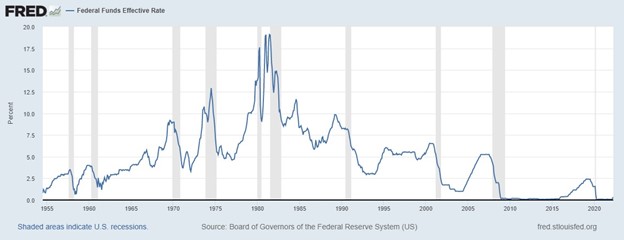

As you can see in the chart to the left the FED is already in the process of tightening with the FED funds rate having increased from 0- .25% to .75-1% so far this year. This number is on its way to 2% by year end. So why are they doing this? Well the Federal Reserve case is much easier to explain than the inflation one as the FED is simply reactive based upon the other conditions.

The Federal Reserve maintains three mandates. The first and most important as we’ll explain is to maintain stable prices in the country or said another way, to control inflation. Their second and third mandates; to encourage economic growth and support the labor market are frankly taking a backseat to their primary mandate at the moment. That said, if you were to look at the most recent FED communique, they state that their long term inflation target is 2%, economic growth target is 2.5% and employment target is 95% or 5% unemployment. Again, if you are paying attention at home, you’d see that the current annual GDP rate is 3.4% which is above their target and the unemployment rate is 3.6% which is below their target. On paper currently, the FED is achieving its core mandates with one major exception. Inflation.

To be clear, the FED has really put themselves behind the eight ball on inflation. In all likelihood, they stayed accommodative for too long which when combined with fiscal policy accommodation has meaningfully overstimulated demand and they completely underestimated the time necessary to repair our global supply chain network. The latter I can certainly forgive as Omicron, China lockdowns and Russia invading its neighbor were all somewhat unexpected events. Their delay in normalizing policy when the economy was booming last year, on the other hand, will be theirs to defend for all eternity but I suspect if they could go back and rethink, the likely would.

Regardless, we are here now, so let’s discuss their plan. Essentially it is their contention that a soft landing is possible. A soft landing is academic speech for bring down inflation to acceptable levels without killing the economy in the process. They will do this by raising the FED funds rate (as seen above) which is the core foundational lending rate in the country and by removing excess liquidity in debt markets starting this summer. In theory, disincentivizing leveraged spending or borrowing in areas like mortgages, credit cards, auto loans, business loans etc. by increasing the cost of that borrowing will decrease demand from its currently robust levels to a more normalized condition. Simultaneously, it is their contention that supply chains will thaw and consumption areas that are currently impinged, new cars for instance, will return to normal and prices on these high frequency items will ease.

Now how realistic is this? We’ll it’s very realistic. In fact it’s purely academic that uninhibited supply will increase over time to meet demand and demand will diminish as cost of borrowing increases. That’s economics 101. The trick here is can the FED execute this task without overshooting its mark and creating a recession. The parade of Fed governors frequenting the financial shows in recent weeks have parroted a simple message. Yes, they can. I admire their optimism and I sincerely hope they are correct but historically speaking, they have been unable to execute this maneuver successfully in past attempts.

So where does this leave us. Well the FED is tightening for sure but as you can see in the chart below, we are no where near tight. We are currently at .75% on Fed funds but keep in mind we were as high as 2.5% prior to Covid and as you read previously our economy is both greater in size and growing faster than it was at that time. So higher rates don’t necessarily scare me as they are inevitable.

It does scare me a bit that we could come too far too soon which could spook business and consumer sentiment to the point where a recession becomes a self-fulfilling prophecy. It’s an awful analogy but think back to the frog in the pot of water story you may have heard at some point. Drop them into hot water and they jump right out. Their behavior changes. Slowly increase the temperature over time and well, you know the rest. If financial conditions change to quickly then consumers and businesses will react quickly. Unfortunately, at the moment, time is not on the Federal Reserve’s side, much to their own doing.

In summary, this is why it is so important for us to see signs of cooling inflation trends and normalizing supply chains. If the trend is apparent the FED can be less aggressive on their way to combatting it and in turn the markets will return to fundamentals mattering. I have no doubt that we will get to where the FED would like us to be for the sustainability of our economy in the long term but how much pain will we need to feel to get there is still up for debate. Which brings us to markets.

Capital Markets

After almost 5 years of smooth sailing with one pandemic interruption in 2020, stocks and bonds are dealing with headwinds the likes we haven’t seen in some time. As you may remember from our previous missive, inflation is not all that bad for stocks. In fact, historically inflation has correlated with a rise in stock as we’ll as real estate prices. Tangible assets increase in value as inflation increases. Unfortunately, too much inflation can be a bad thing as it increases the likelihood of recessions as demand is destroyed by run away prices and monetary interventions (discussed above) are designed to disincentivize spending. That conundrum, without a doubt, is what we are seeing playing out in real time in the equity markets.

As I mentioned in the summary, both equity markets and bond markets have taken it on the chin as this uncertainty has crept in. This is not totally unexpected as the market does cycle between fear and greed daily but in some areas of the market like momentum stocks, this has gone off the rails a bit. Before I do a deep dive, let me remind of you one thing you probably need to hear. Corrections happen.

Since 1928 the average intra-year drawdown in the S&P 500 has been 16.3%. It was 34% in 2020, it was 20% in 2018, it was 12% in 2015, it was 19% in 2011 and 16% in 2010. You’ll notice I stopped there because the next two drawdowns to quote would be 2008 where we were in the great financial crisis and then 2000 during the technology crash. To the best of my knowledge and instincts, we are in neither one of those environments. Frankly, nor are we in 2020 as that correction was driven by extreme uncertainty due to the pandemic.

I’ll say it again. Corrections happen for various reasons. They have their own rhythm and timing but inevitably, markets will overshoot a reasonable downside target. Stocks dislocate from fundament value due to panic or forced margin selling, bottoms form and rally’s reverse the trend. The fear of being invested will shift to the fear of missing out and we will achieve new all-time highs. There has not been a period of time in market history where this wave of market sentiment hasn’t played out exactly like this.

Now the inevitable follow up question is how long this downtrend will last? I can assure you that neither I nor Warren Buffet can answer that question with certainty. In the business of investing it is purely a probability game where with every historical reference, every past correlation and yes, even anecdotal evidence you are able to form through mosaic theory (sorry for the wonky reference) an opinion. Doesn’t mean it’s right but when probabilities start to stack in your favor you start to become more likely right than wrong. So with that let me give you some interesting points.

- NASDAQ stocks trading above their respective 200 day moving average is below 10%. Could it get worse? Yes, but the only time it ever did was the COVID crash in 2020.

- The 10 year treasury yield reached 3.2% on Monday. A double from the 1.62% it was at last year. Since Monday and after the inflation report it retreated 40bps to 2.82% as of this writing.

- Earnings in the S&P 500 have surprised to the upside 78.5% of the time this quarter.

- Earnings are up average of 9.3% (expectations were 5.2% year over year.)

- Top line revenues are up 12.9% so far for the quarter.

- Through March sales at restaurants and bars are up 18.5% against Feb 2020 (pre-Covid) while restaurant and bar employment is still down 6.8%.

- There are currently 86 biotech firms with stocks valuations trading less than the cash on the companies balance sheets. All time high by a wide margin.

- In 2008 we experienced 23 3% down days in the S&P500. In 2009 we had 12. In 2020 we had 16. This year we are at 3.

- Stock buybacks among corporations are running at a 10 year high.

- US economy added 428,000 jobs in April. Expectation was 220,000.

SOURCE: Bloomberg, FactSet and First Trust

And now some historical data on how markets have reacted after performance shocks like we’ve had.

- Going back to 1933 there were 7 first quarters where the S&P 500 experienced a >10% drawdown. In only one case was the remainder of the year not very meaningfully (so much so that I don’t want to put it in print) positive. The lone exception was 2001 due to September 11.

- Since 1976 there have been 16 quarters out of 185 where stocks and bonds fell at the same time. 1 year later stocks were positive 73% of the time and bonds were positive 100% of the time. 3 years later stocks were positive annualized 93% of the samples (2008 and 1981 being the exceptions) and bonds were positive 93% of the time (1977 was the exception.)

SOURCE: Bloomberg, FactSet and First Trust

As stated above, corrections happen. They are a process. You don’t know it’s happening till you’re in it and you don’t know it’s over till you’re out of it. The only tools you have are to stack as many past experiences and benchmarks on your side to increase the probability in your favor. Above are a few of the many that we are considering. Absent from that list is any meaningful anecdotal evidence which frankly I find just as valuable when discounting valuations. I like to think of it as things that just don’t make sense.

For instance, in 2018, our group sat around on Christmas Eve at the office during the taper tantrum correction which saw the S&P briefly enter bear market territory of down 20%. During that day, I was noticing that action on the banking sector was approaching extremes seen during the financial crisis in 2008. I kept wondering, who is going out of business that we don’t know about as that was the environment back during the financial crisis. We’ll turns out, those stocks had been the victims of some panic selling and had truly dislocated from fundamental value. No one went out of business and those stocks very quickly traded significantly higher.

We’ll yesterday I noticed that Amazon, one of the largest companies in the world had traded all the way down to pre Covid levels. How can that be I asked? AWS (Amazon Web Services) alone makes around 70 billion a year and is growing by 40% annually. Certainly Amazon has increased in value during the pandemic? Right? The shipping and receiving of amazon boxes at my house, as well as my neighbors doesn’t seem to have slowed down one bit. Chalk that one up to something that doesn’t make sense currently.

FINAL SUMMARY

So if you are still reading you’ve earned a gold star. The point of all of this is to give you an in depth look into how we are evaluating the current market environment. The truth of the matter is that I suspect, given some of the above content, that we have already seen much of the downside in both stock and bond markets for this correction. That said, I am humble enough after 20 years of managing money to know that sometimes you are early, sometimes you are late and every once in a while you get it just right. Odds are it’s one of the first two options here. So could markets continue to struggle in the coming months given the economic and inflation back drop? Yes, they absolutely could. These two thoughts helps me deal with that fact though. First, even if it does get worse in the short term, the market will recover in time as it always does and second, moments like this are necessary to sustain upsides over the long term. With every downside day the market valuation on stocks becomes more and more attractive which means investors can take advantage of dislocations to increase their total net worth into the future.

Corrections happen. Diversification matters. Time will heal the downside were experiencing today.

Please call us with questions or to discuss specifics on your personal situation. If we see telling details about the economy or markets, etc shift we will of course continue to update you and act accordingly.

Thanks again for reading and we look forward to speaking with you soon!

Information contained herein was received from sources believed to be reliable, but accuracy is not guaranteed. Information provided is general in nature and is not a complete statement of all information necessary for making an investment decision and is not a recommendation or a solicitation to buy or sell any security. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

Any opinions are those of the author and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Investments mentioned may not be suitable for all investors. There is no assurance these trends will continue, or forecasts will occur.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

U.S. Treasury securities are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. Investments in high yield (junk bonds) or lower rated securities are subject to greater volatility, illiquidity, and possibility of default. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise.

Market Update 5/19/21

Is Inflation here to stay?

Sean C. Kelly, CFA®, CFP®, CIMA®

Senior Vice President, Wealth Management

Managing Director

We sincerely hope that the spring season has been treating you well and you are enjoying the early stages of getting back to normal. As per the usual, the last few months have not been dull and we have had a number of wonderful conversations with you all. It has been a bit since I’ve penned a general update out to you all and with last month’s inflation surprise I figured it was time. Many of you will surely remember that we’ve been saying since the election that we see a rapid and sustained rise in inflation as the single largest risk to markets. With that in mind, the objective today is to explain the fork in the road I believe we are at and to do our best on guidance regarding where we think it is likely to go from here. The variables driving price instability at the moment are fairly fluid and candidly there are a large number of very competent people on both sides of the inflation argument confusing things even more. As I said, never dull.

What is inflation?

To start, I think it prudent to give a little background on why this inflation conversation is so important and to remind everyone why some inflation is imperative to a healthy economy. So take a walk with me down common sense lane. Inflation is simply defined as a general increase in prices and fall in the purchasing value of money. Some of you just said, “Why is that a good thing?” Simply, a little inflation incentivizes consumption today vs delaying to the future. If you know the house, car, vacation, etc. is likely to be a little more expensive next year than it is today, you are then incentivized to consume now vs waiting. Conversely, if you believe that something is going to be less expensive in the future you are incentivized to wait and not spend the money today as you’ll get a better deal next year. This is known as deflation. It should be easy to see now that inflation levels have a direct relationship with economic output and the velocity of money.

As an aside, the Federal Reserve, was created in 1913 as the decentralized banking organization with the sole objective of overseeing price stability in the United States. This body, often referred to by me and others as the FED, is immensely more concerned with deflation than they are inflation. The reason is simple. It is significantly easier and less expensive to slow an economy down and curb higher inflation trends than it is to create economic momentum in the first place. Now that does not mean that they are agnostic to higher levels of price increases in goods and services. They most certainly are as I will explain next.

Why this matters?

Well as I said before, some inflation is good but intuitively, too much inflation is bad. Here is why. Decreases in the purchasing power of a dollar work kind of like a tax. If my income is stagnant but my living expenses increase due to inflation, then I have less disposable money left at the end of the day. Moreover, tangible assets like real estate tend to increase in price when inflation is present which may work in the favor of individuals who already own those houses but is simultaneously devastating to those who don’t as prices essentially run away from them. Put those two factors together and you can plainly see that while inflation affects everyone in some way, it is significantly more destructive to the lower income side of the populous which can lead to less purchasing power of the dollar and limited tangible assets to offset the difference. This is why, since its founding, the core mission of the FED has been to control inflation within reasonable boundaries trying to create that perfect scenario of a little inflation but not too much and certainly no deflation. In fact, if you only look at the last 10 years as a sample, the FED has spent trillions of dollars fighting deflation through maintaining a near zero FED funds rate and robust open market purchases of bonds. Both of these tools are designed to keep interest rates at historic lows, generally incentivizing risk taking and borrowing. Those two factors tend to be the mother’s milk of economic recoveries.

So, to conclude, why does this matter? Higher levels of sustained inflation are very damaging to society and they are most certainly inequitable in who is hurt the most. If the FED is forced to choose between runaway inflation and slowing down the economy, history has shown that they will worry about the economy after they have quelled inflation. Which leaves the questions, how much inflation is too much and secondarily, how long are they willing to let it run above trend before acting?

The two camps of speculation

As I said in the intro, there are undoubtedly two explanations for the above trend readings that we are seeing currently. Essentially one that projects the rising asset prices as transient and one that believes this is the beginning of the end for above trend monetary support. To be clear, if that latter case wins, and the Federal Reserve is forced into curtailing their current support levels in the economic recovery it could spell some problems for the risk markets. But before I get into that, let me explain the two camps perspective.

The transient camp believes that COVID did a number on production logistics around the world. We are seeing shortages in everything from lumber, to stainless steel, to semiconductors. The production centers around the world expected COVID to knock demand down substantially all the way into 2022 or later and last year these suppliers of both raw and refined goods scaled down production and employment in a massive way. Unfortunately for them, consumption demand not only didn’t decrease to the expected levels but essentially increased beyond pre-COVID levels in many cases due to all of the fiscal support individuals and companies received. PPP loans, stimulus and additional unemployment benefits essentially returned consumption statistics late last year in many sectors. Taking you back to Economics 101 class, when there is greater demand for something than available supply, prices HAVE to go up. And so they have in many materials and finished goods from gas to used cars to construction costs. That is irrefutable at this point. To stay with the fork in the road analogy from earlier, up until this point in my explanation both camps agree with the above comments but disagree on what happens from here. Hence, the fork in the road.

Continuing with the inflation is transient case, the believers of this, which does include the Chairman of the Federal Reserve, Jerome Powell, and other board governors, think that this mismatch of above trend demand and below trend supply will work itself out over the remainder of the year. Employment should repair itself come fall as additional unemployment benefits are scheduled to expire in September and the proliferation of the vaccine among working adults should return us to sense of normalcy. Simultaneously, production facilities around the world should be able to return to full production capabilities and with all of the above considered, asset prices of input materials like copper, steel, lumber, etc. which have seen meteoric increases should come back down to earth. With input costs retracing their gains and some demand cooling from spending reluctance due to the higher prices over the summer, finished goods like cars and homes, etc. will also moderate in price gains. If this does in fact occur, the Federal Reserve can continue their original course of supporting the economic recovery out into 2023 and capital markets will likely be in a prime position to generate further gains in the coming years. It is my hope that this is the case.

The pessimist in the crowd believes essentially the opposite will occur for the remainder of 2021 and the Federal Reserve will be forced to address inflation in ways that derail the recovery. Specifically, “the damage has already been done” crowd believes we have overstimulated the economy by injecting too much liquidity over too short a period of time in the last couple of years. They believe that the lingering effects of over two trillion in stimulus will continue to drive asset prices up and that we will see sustained levels of input prices which will simultaneously kill the recovery and potentially cause the FED to do an about face on their current FED funds policy and bond purchases. This will most certainly drive interest rates higher as that process plays out and exacerbate the negative impact to the economy started by the erosion of demand due to price increases. There is clearly more depth to this conversation that involves dollar index to continue to fall, employment to remain sluggish and the potential for a persistent period of stagflation to take hold but candidly that discussion is beyond the patience of most of our readers. If you are confused at this point, I can assure you that you are not alone as these topics are complex. To simply this side of the argument, the summary of the latter camp is in the concern that the stewards of monetary policy may have to slow down the economy to save the economy in the long run and slowing down an economy has always spelled trouble for stocks.

Summing it up

Generally speaking now, we are either going to see this inflation marginalize over the remainder of 2021 or this new normal is here to stay. If we have sustained levels of inflation admittedly higher than where we have been in recent years but not outside of acceptable ranges of the FED, then the current environment which has been favorable to risk assets will continue. Conversely, if the ship has already left the port with liquidity too readily available and resources too scarce, then the investing backdrop may change towards the back half of the year.

Regardless of the data, I feel it important to state that the crew at the reserve does not want to interrupt the recovery. In fact, it’s likely the last thing they would choose to do if given the option. They acknowledge that trillions have been spent on both the monetary and fiscal side of the house, significantly increasing the national debt to once unthinkable levels. They know a required remedy to inflation at this point in the recovery would be disastrous to the country. In my opinion, this reluctance does not mean that they wouldn’t act if necessary but it likely means that the traditional goal post of what constitutes actionable inflation has moved meaningfully.

What now?

Well, as silly as it sounds given the discussion above, now we wait. All we can say for sure is that inflation is here to stay for the next few months which is not ideal. What is ideal is that the leading indicators we monitor still look strong. Consumption looks good. The country currently has the largest number of available jobs since the Bureau of Labor Statistics started tracking. States are coming out of quarantine and people are getting vaccinated. I think there is ample evidence of the supply chain disruptions causing prices to increase in the near term. So for what it’s worth, our universe of experience and my common sense is telling me, no yelling at me, that the FED will be reluctant to upend the recovery. Plainly, these factors still has me in the transient camp and I am looking for cost increases to moderate in the back half of the year.

As always, we will continue to update you as variables shift and most certainly if we see leading indicators start to wane. In the meantime, we hope you are getting ready to enjoy your summer. If there are any questions at all about the above material or any changes that you’d like to make to investment accounts please do not hesitate to pick up the phone. Thank you for reading and we continue to thank you for the confidence you have in us. We sincerely appreciate each and every one of you.

Lifestyle, community, and market insights from your St Pete Wealth Management team

Creating a Successful Business Succession Plan

Sean C. Kelly, CFA®, CFP®, CIMA®

Senior Vice President, Wealth Management

Managing Director

An exit strategy helps business owners ensure the long-term success of their company

A good succession plan creates a blueprint for ownership transfer as you exit your business. It helps you prepare for your retirement, helping to ensure you have the income you need. And setting a well-conceived plan into motion protects the people around you, including your heirs, employees, and customers by laying the groundwork for a smooth transition.

Yet, despite these important benefits, many privately owned businesses don’t have a succession plan, leaving the business vulnerable to unforeseen circumstances. For instance, if the business owner dies or becomes incapacitated, there may be no one to step in and lead the company as it regains its footing. Planning early can head off these issues and produce other benefits, including having the time to retain key employees and potentially mitigating tax burdens triggered by a sale.

Making a plan

As a first step to creating a succession plan, assemble a team of professionals. Work with a lawyer, accountant and financial advisors who can help you make any necessary changes to your business’s legal structure and ensure the proper paperwork is in place.

Get an appraisal from a third party to determine the value of your business. An appraisal can help you set sale prices or set prices for ownership shares. If your valuation comes back lower than you expected, with the proper qualified professionals work to increase the value of your business before it’s time to sell.

Next, think about what kind of relationship you want with the business after you exit. Do you want to maintain an interest in the company? Do you want to stay on the payroll as a consultant? Would you rather cut all ties and never think about it again? Knowing where you want to land will guide your exit plan.

Create manuals for management and employees that allow your successor to jump in and get acclimated relatively quickly. Be sure there are employees who can take over your responsibilities and that there are no tasks only you know how to do.

Choosing a successor

Once you know the role you want to play, it’s time to choose a successor. Broadly, your options are:

- Heirs: Transferring ownership to another family member is a popular choice. Whether it’s your spouse, child or someone else, think objectively about their abilities. Do they have the skills necessary to run the business and the desire to take over?

- Business partner: If you want to sell your interest in the business to your partner or partners, set up a buy-sell agreement. A buy-sell agreement specifies when an owner can sell their interest, to whom they can sell and for how much.

- Employees: Selling to someone in management at the company can be a good way to ensure continuity in succession. Managers tend to have a good understanding of operations required to keep the business running smoothly. Transferring ownership to a group of employees is an option as well. An employee stock ownership plan (ESOP) can help. An ESOP is essentially a trust into which employees can put funds that convert to ownership shares later. Allowing employees an interest in the company’s future may encourage them to do whatever they can now to help the business succeed.

- Third party. If your heirs or employees are not interested in taking over your business, you can sell to an outside buyer. Plan for this possibility well in advance, as this option can take a lot of time and effort as you search for a buyer and negotiate the terms of a sale. Newcomers may ask you to stay on with the company as a consultant for a short time to smooth the transition.

Updating your plan regularly

A succession plan is only useful if it’s up-to-date. Set a regular schedule for reviewing your plan. As things change—say your chosen successor is no longer an option—update your succession plan accordingly. It can be the difference between the business succeeding under a new generation of leadership or ending with you.

This material was prepared by The Oechsli Institute, an independent third party, for financial advisor use. Raymond James is not affiliated with and does not endorse, authorize or sponsor the Oechsli Institute. Any opinions are those of the author, and not necessarily those of Raymond James.

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Prior to making any investment decision, you should consult with your financial advisor about your individual situation.

SOURCES:

- https://s3.amazonaws.com/mentoring.redesign/s3fs-public/SCORE-MassMutual-eGuide-Succession-Planning.pdf

- https://www.nceo.org/articles/esop-employee-stock-ownership-plan

- https://www.nolo.com/legal-encyclopedia/buy-sell-agreement-faq.html

2020 Election and Investments

Sean C. Kelly, CFA®, CFP®, CIMA®

Senior Vice President, Wealth Management

Managing Director

We sincerely hope that you have had a safe start back to some semblance of normalcy this fall as schools are back in session and many businesses, at least in Florida, are well on their way to reopening. We seem to have a decent split of clients and friends who are anxiously returning to work and some who are continuing to err on the side of caution. Whatever your direction these days, we hope you are all staying healthy and looking forward to a 2021 which hopefully offers less drama than this year.

The content of today’s note is to discuss the upcoming election and the likely effect on capital markets depending upon the outcome. As a reminder, we are a very diverse group of individuals at St Pete Wealth and at Raymond James and thus we see the world very holistically. While we have opinions on specific issues to be sure as we are all human, we are generally agnostic to politics with a few exceptions. To be clear, our job is to call balls and strikes with regards to how our clients’ money will be impacted based upon specific policy changes proposed or enacted and it is with that unbroken mandate that we write to you today. Our goal at the end of this longer than usual read, is that you understand how the election results may affect your money in the short term and the long term. Furthermore, if you feel like the projections we provide are outside of your comfort zone in any way, then consider this a significant call to action for you to set up a call with us right away.

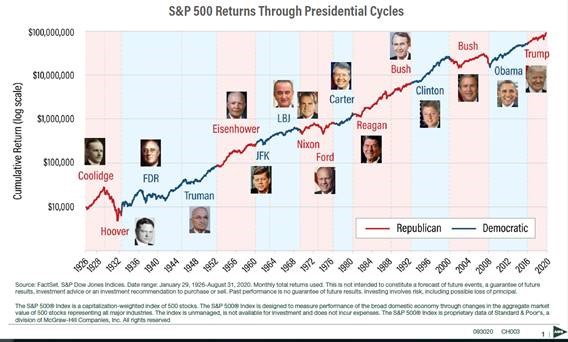

So without further ado, let’s dive into this election cycle by describing what it is and what it is not. To start with the latter, this election does not represent a permanent change in the formula that generates worldwide economic growth which in turn drives in the capital markets. For the skeptics, let me unpack that a bit before you judge the statement. The long term growth of the capital markets, as you can see in the chart below have historically been agnostic to politics as well. As we similarly stated 1 week out from the 2016 election, markets have risen with every variation of party control imaginable over time.

The reason for this is simple. Markets don’t care about politics in the long term. They certainly do care about policy in the short term but let’s not get ahead of ourselves. As you can see in the chart above the S&P500 used here has enjoyed growth equally during Republican and Democrat administrations at a very similar pace if you use the eye ball test. Looking closer, there are subtle accelerations and decelerations of the pace of growth which are clearly visible. In other words, times when the market has gotten a little ahead of itself (most visible and most recently following the Clinton years and the dot com bubble.) The reason the market might speed up or slowdown from the general pace of growth is in my opinion, primarily due to policy changes and periods of Rapid innovation. One could argue that we could potentially experience both factors in the coming years, but I digress for the moment.

The point of the slide and my interpretation of it is to demonstrate that markets have risen in the face of high taxes, world wars, recessions, financial crises and a myriad of other short term events. In the long term these moments tend to be smoothed out with rampant pessimism setting up opportunity (2008) and run away optimism setting up lost decades (2000-2010.) Regardless of the black swan of the day, the long term trend, as illustrated by the chart, has remained intact because real growth is generated in a different way.

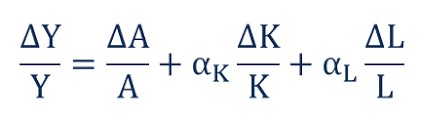

If any of you have seen me speak before you may recognize the growth accounting equation or as I refer to it, the Long Run Economic Growth formula. Don’t worry, there won’t be a test at the end.

It reads that the change in the output growth of an economy can be measured by accounting for the change in Labor supply (I like to think of as population growth) + the change in Capital stock + changes in productivity.

I often describe it in the simpler terms of how many people are on the planet + how much money is available in the world + what innovations or entrepreneurship have occurred that can make us more productive. Now whether you lean right or left, you will likely agree with me that populations worldwide continue to expand, capital is readily available and we are seeing amazing innovations that are changing the world. It’s really the last point that I believe is a tangible concept to everyone as it’s entirely possible that you are reading this on a wildly powerful smart phone over 5g network. If you consider the technological changes that have occurred recently and are continuing to grow daily, you likely share my confidence in the above formula continuing to drive opportunities for growth.

So, summarizing the long term trend conversation. Politics and the resulting policy adjustments can create a tail wind for growth or a head wind that slows it down but it will not stop the formula for working in the long term.

With that established we’d like to discuss the short term implications to capital markets within the various possible election outcomes.

POSSIBLE ELECTION OUTCOMES:

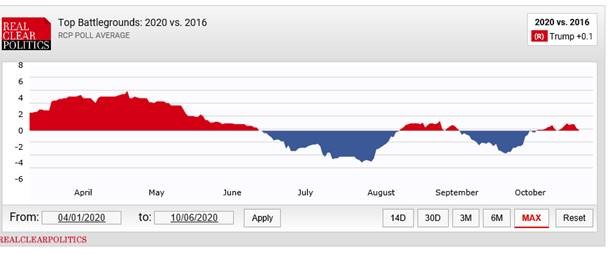

First and foremost, we have no idea who is going to win. Every data point we look at leads us to the same conclusion which is that Joe Biden is meaningfully ahead in the national popular vote on the backs of strong support in California, New York and Illinois but also that the battleground states are likely too close to call. While Trump is down in the polling averages of the top Battleground states necessary to win the Electoral College, he is at the time of this writing, polling slightly better than he was in 2016.

We would relish the opportunity to have a clear cut likely winner as our jobs would be much easier but given the data we are seeing, we feel it’s a bit of a fool’s errand to call a likely winner and therefore we should be prepared for all outcomes. Below are the scenarios we see as possible. Under each section, we’ll give a brief opinion on the capital market implications with the general goal of informing you what to expect. Clearly more explanation is given under the first scenario as it would come the greatest policy changes.

BLUE WAVE Scenario

In this scenario the Democrats take the white house, maintain numbers in the House and also take control of the Senate which would give the left full reign of government. Without a filibuster, the right would essentially be powerless to stop the left from rolling back the Trump tax cuts and increasing regulations both of which the Biden Harris campaign has promised. While the Biden campaign has walked back previous statements on fossil fuel action, we find it highly likely that a more climate change focused policy will take hold putting immense pressure on traditional energy companies and potentially providing a tail wind to clean energy focused stocks.

Emerging markets will likely get a boost as well as it is doubtful that the new administration will continue the current tariffs on the China and Middle Eastern countries. If we reenter a period of lockdowns as the challenger has suggested Is an option if the science warrants it, then many of the discretionary stocks in travel, leisure, hospitality, restaurants will likely be negatively impacted while the stay at home stocks which are primarily focused on the communications and technology spaces would outperform.

Without going down the rabbit hole of how every sector would be impacted, the general overview of this scenario is that in theory and in the short term, it would be bad for stocks. In the 1st debate, Joe Biden specifically referenced his interest in increasing corporate tax rates from the 21% established under the Trump tax cuts (previously 35%) to somewhere in the 29-30% range. In the short term, unfortunately, this is to be feared.

Now the reality of the change timeline is a little different, in our opinion, than what is being promised from the podium. Given the current state of the economy, we find it unlikely that the roll back of corporate tax rates, a primary focus of the campaign, will be enacted immediately as stated as the unintended consequences of a move of that magnitude could result in a double dip recession. There are already many corporations and states that are reeling in the wake of covid-19 mitigation and with that any meaningful impact to their earnings ability would likely result in more layoffs, cancelling of capital projects, acquisitions, etc. It’s not that we don’t think a Biden Harris administration will follow through on the promise but we just think that they would not risk hurting the economy to their detriment in the first months of the new term.

None the less, it is highly likely that the expectations of the above factors would present some downward pressure on stocks in the short term and to what degree that would balance out with the potential good that would come from another round of stimulus or an infrastructure bill which are both more likely under this scenario, remains to be seen.

SPLIT TICKET SCENARIOs

A possibility that many see as likely would be a split ticket scenario where either Trump wins but the Senate turns blue or Biden wins but Senate remains in Republican control. This is essentially the scenario that we saw for 6 of 8 years of the Obama administration. It is also the scenario most likely if we find that the electorate wants a change at the top but is not ready to give one party the power to enact that full agenda.

For those wondering, we see essentially no chance that the Republicans would retake the House of Representatives, so a RED Wave scenario is omitted from this analysis.

If we were to see a split ticket scenario play out that would mean that for at least the next two years, we would be in gridlock with the exception of a few items. From a social agenda this scenario may leave some voters wildly disappointed as major policy changes from either side would be few and far between. From an investment scenario on the other hand, we would be content as there are still some common ground items to be addressed with infrastructure and any economic support the country will continue to need but the elephant in the room (tax reform) will be pushed to the next election.

The major difference’s we do see with a Biden or Trump administration will be around foreign policy, the handling of future COVID mitigation and changes in regulations handled by the administrations cabinet members regardless of who holds the senate. The major implications of those however were already covered above.

One topic of note for constitutional hobbyist is that it is possible if the Senate were to turn blue and Trump stay in office than Democrats could attempt a second impeachment which this time would be unimpeded. That would certainly create uncertainty in the short term that would likely rock markets for a bit but even if successful the end result would be Pence presidency which would still not increase the chances of any major policy adjustments.

Generally speaking, we would likely see some short term downside pressure on risk assets if a change were to occur in the White House but the downside would be more limited in this scenario than the first.

STATUS QUO

In this scenario, Trump stays in office and the Republicans maintain the control in the Senate. There are varying likelihoods of this scenario playing out but generally across the board, this is the least likely scenario of the three though still possible as we learned in 2016.

Simply if this were the outcome markets probably have the exact opposite effect of the split ticket scenario in that in the short term, markets would likely run up a bit and then pause. Remember, markets in the long term don’t care about politics, they care about policy and essentially we would get some tailwind in the fact that the current policies in place, which I think is fair to say are business friendly, would continue for another 2 years at minimum.

CONCLUSION

Summarizing the points above, whichever scenario wins out we will essentially get a reaction that will come in two phases. The perception is reality phase, where policy changes discussed or implied by the winning party impact markets immediately regardless of how likely they are or the timing of when they would actually go into place. This phase will happen fast and it will be volatile. It will also be short in my opinion.

The second phases which I will call the reality is reality phase, will begin to take hold later this year as investors begin to discount what actually is likely in terms of policy and also what positive changes are likely to occur from the transfer of power, if there is one.

When all is said and done though, please remember that it is the formula that generates long term growth that will dictate the value of markets years from now, not who sits in the white house and if you don’t believe me, please reference the chart I included above.

Finally, we are getting asked with more frequency, what clients should do based upon the election and how we think it will end. The answer to them and the call to action for you today, is to ensure that your allocation to risk assets is appropriate given your time horizon. If you are months out from retirement for instance, you should have less exposure to risk as our time to make up lost ground is less ample than for someone who is years away. If you are not exactly sure if you are where you should be given your stage of life then that would be a great reason for us to have a conversation over the next week. We sincerely hope that you take us up on that.

The last reminder we will give everyone is that I highly suspect those looking for a clear cut winner on election night will be disappointed. Unless it is a runaway election for one side or the other, the odds are that ballots which can be counted in some states many days after November 3rd will be meaningful and therefore will hold up calling a winner. Expect the delay and you won’t be disappointed.

As always, we sincerely appreciate the relationships we have with each and every one of you. Thank you for the trust you show in us. We look forward to the speaking with you soon and please look out for the post-election update that we will issue when we have concrete guidance on the results. Until then we wish you the best and stay safe.

Preparing for Healthcare Costs in Retirement

Sean C. Kelly, CFA®, CFP®, CIMA®

Senior Vice President, Wealth Management

Managing Director

For many Americans, navigating the maze of health insurance options—from employer-based plans to individual policies—can be dizzying. Much of that changes at 65. That’s when individuals generally are eligible for Medicare, which covers routine health care expenses such as visits to doctors and prescription drugs. But the program doesn't cover everything. Here is a breakdown of how Medicare works—and your coverage options for filling in the gaps.

Inside Medicare

Medicare comprises four parts that cover different health care services and carry various financial obligations. People who are already receiving Social Security benefits before they turn 65 will be automatically enrolled in Medicare Parts A and B. Others can enroll online around their 65th birthday by visiting medicare.gov

Medicare Parts A and B are known as traditional Medicare. Part A covers hospital services, including in-patient stays, care in a skilled nursing facility, and hospice care. You can sign up for Part A coverage at no cost as long as you or your spouse have paid Medicare payroll taxes for at least ten years.

Part B covers doctor’s office visits and other outpatient services. You’ll need to pay a premium for Part B (about $144.60 a month in 2020). You’ll also need to meet an annual deductible ($198 in 2020), after which Part B will cover 80 percent of approved costs

Parts A and B don’t cover all expenses, such as the cost of prescription drugs. Individuals looking for more comprehensive coverage may want to consider adding Parts C and D to their Medicare plan.

Part D provides prescription drug coverage and is offered by private insurance companies. You will need to pay a premium for Part D coverage—about $42 per month in 2020.

Also known as Medicare Advantage, Part C covers the same benefits as Parts A and B, but through a private health insurance company. Plans vary, but you may also get vision, hearing, and dental benefits in addition to prescription drug coverage. You may be able to reduce your monthly premiums if you’re willing to take on a higher share of your health care costs and potentially have access to fewer providers.

Medicare supplemental insurance, also known as “Medigap,” can help fill in other gaps left by the Medicare program.

Medicare eligibility and enrollment

The initial Medicare enrollment period is different for everyone. You have a seven-month window to enroll, starting three months before the month in which you turn 65 and ending three months after the month in which you turn 65.

If you don’t sign up during this window, you could face late-enrollment penalties and pay higher premiums. But there are some exceptions: If you are still working when you turn 65, for instance, and you still get health care coverage from your employer, you can delay enrolling without facing penalties.

Long-term care insurance

Even if you have all parts of Medicare, you may lack certain health care coverage. Namely, Medicare and Medigap policies don’t cover long-term care, including assistance with day-to-day tasks due to chronic illness, disability, or old age.

According to the U.S. Department of Health and Human Services, this type of care can be expensive—the average cost of a semiprivate room in a nursing home is $6,844 a month. Long-term care insurance can help cover various costs, such as the cost of nurses and therapists you may need to assist you, the cost of nursing homes and assisted-living facilities, and some may even cover home modifications, such as wheelchair ramps.

How to buy long-term care insurance

Long-term care policies cost less when you’re younger and in good health. Waiting until your health is less stable may hinder your ability to find a long-term care policy at all, and you could be turned down due to a preexisting condition.

You can buy these policies through an insurance agent or broker. If your employer offers long-term care plans, you may be able to buy one while you’re still working and hold on to the policy after you retire.

Finding health care in retirement can seem like a daunting task, especially if you’ve had access to employer-based health care coverage for most of your life. But if you’re mindful of your enrollment period for Medicare and know where to turn for additional coverage, you can find the right policies to meet your health care needs in your golden years.

This material was prepared by The Oechsli Institute, an independent third party, for financial advisor use. Raymond James is not affiliated with and does not endorse, authorize or sponsor the Oechsli Institute. Any opinions are those of the author, and not necessarily those of Raymond James.

Market Update 7/29/20

GDP Report

Sean C. Kelly, CFA®, CFP®, CIMA®

Senior Vice President, Wealth Management

Managing Director

We hope that everyone has had as good of a summer as possible given the circumstances. I’ve let our general updates out to you all simmer for much of the past couple of months. Strategically, we have been in a phase of the recovery and evolution of the pandemic where from an investment point of view, further downside protection was largely unnecessary.

We referenced this is our last missive where we covered a number of frequently asked questions.

Since then we have seen a great deal of volatility, both good and bad, in economic data and regarding the virus but for the most part we have generally gotten what we expected. The negatives clearly anchored by the virus case numbers which have grown substantially across the country (though the new epicenter is in the southern states) and the economy, which faltered slightly in the 1st quarter and will likely show a dramatic downturn in the 2nd quarter data due out this week.