What All-Time Highs Really Mean

The S&P 500 recently returned to all-time highs—and if your first reaction was, “Did I miss it?” you’re not alone.

It’s a common feeling. But here’s the good news: history tells a different story.

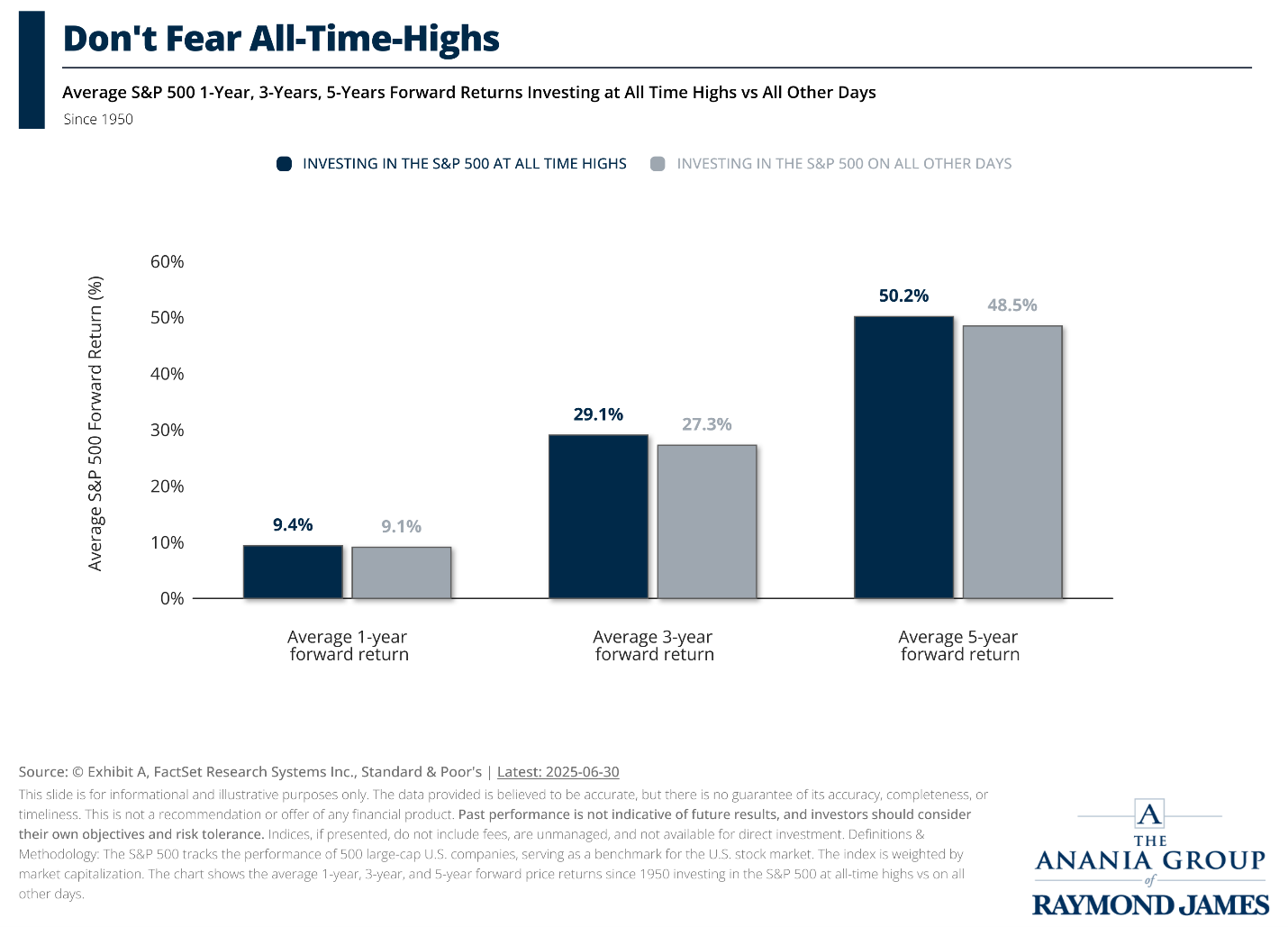

Since 1950, the market has actually performed better after reaching new highs than at other times. That’s right—new highs aren’t a ceiling. More often than not, they’re a sign of strength and momentum.

This might feel counterintuitive. We’re conditioned to think that buying at a high is risky. But the data shows that staying invested—and even adding to your strategy during these times—has historically been a smart move.

It’s a reminder that long-term investing isn’t about timing the market. It’s about time in the market.

As we begin the second half of the year, it’s a great time to revisit your plan—not because something is wrong, but because things are working. Are you still on track? Are your goals still aligned with your strategy?

If you’d like to talk through any of this, I’m here.

In the meantime, let the market do what it does best over time: reward patience, discipline, and perspective.

Any opinions are those of Michael Anania and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.