What are you waiting for?

- 05.30.23

- Markets & Investing

- Commentary

Nick Goetze discusses fixed income market conditions and offers insight for bond investors.

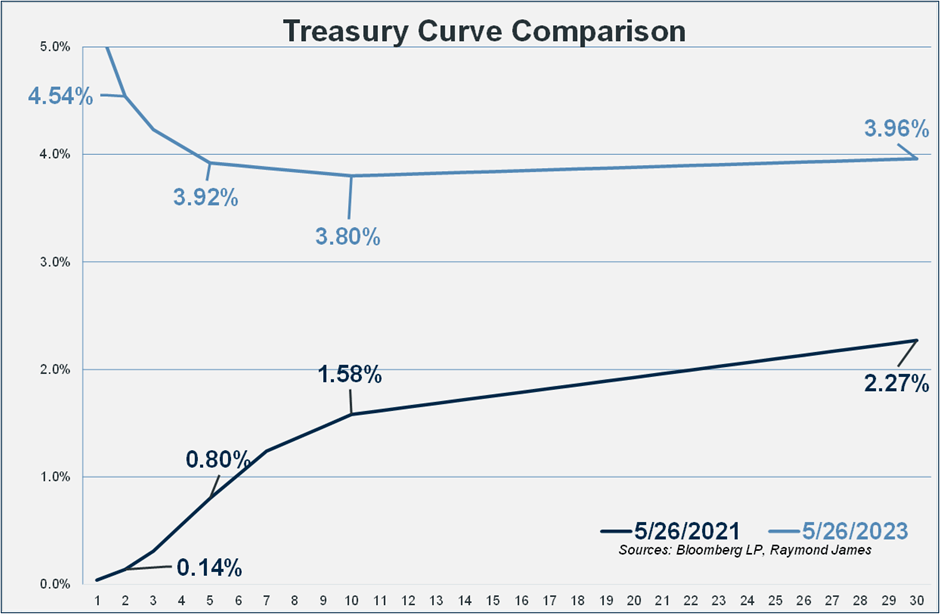

A confluence of events has given bond investors another great opportunity to take advantage of higher yields. The ten year Treasury yield is well over 3.5%, driven by fears of a Federal debt ceiling impasse, lingering higher inflation, and some sectors of the banking industry showing instability. Corporate and municipal bonds have followed suit hitting some recent highs that may align well with the income needs of investors looking for safety with very attractive income levels. Take advantage of this opportunity. These levels are likely to change.

As of Tuesday morning, it looks like a Federal debt deal will be reached. The Treasury market is already starting to rally (yields down). As more and more investors look to take advantage of municipal bond yields approaching 5% tax-free, the sheer size of investor demand will likely push yields lower. Corporate bond yields will likely follow Treasury yields back down if that trend continues. We have seen this pattern before.

For IRA investments five to ten years out, the corporate bond and mortgage-backed markets are offering high-credit quality bonds in excess of 5%. If you are looking to build long-term tax-free income portfolios, you can earn well over 4%. These are levels that we would have only been able to dream about for the past ten-plus years.

Where are the opportunities for the baby boomers? The largest generation in the history of our country is in or heading into retirement. They control more wealth than any previous generation. Many of these baby boomers are looking for ways to generate income/cash flow in retirement that they can live on. Your financial advisor can help develop and maintain custom portfolios that will perform regardless of interest rate moves with the comfort of controlling the outcome as to when the principal is returned.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.