Whiplash

It is hard to remember how many 1,000-point days we have had in the Dow Jones Industrial Average the last month or so. One tweet drops it 1,000 and another tweet makes it bounce 1,000.

This has been a period of extreme day to day market volatility, and the primary driver has been the on-again off-again pronouncements regarding tariffs.

As of today, May 13th, it seems like we are somewhat back to square one but trying to recover from a sore neck due to the whiplash of the past month.

One clear lesson from the last month has been that if you miss a day or two, you can miss a huge part of the stock market’s return. And yes, if you are prescient, you can miss some of the market’s huge down days also. The only problem is we have not found that prescient fund manager.

Trying to time the market is like dancing between raindrops trying to stay dry. It may work for a minute, but there is plenty of evidence that nobody in the investment industry has a consistent track record of accomplishing this.

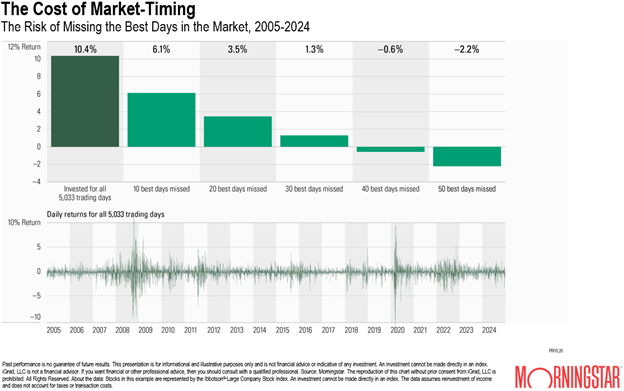

The chart below is hard to believe. It shows how incredibly important just a handful of days matter to your long-term returns in the market. It also shows in the lower part of the chart that the biggest up days occur along-side the worst down days.

In the last 20 years, just missing the best 10 days of the last 5,033 trading days would have caused your annualized return to drop from 10.4% to 6.1%. And missing 20 of those days would reduce your return to 3.5% annualized.

This is why you don’t see us moving your portfolio in and out as markets twist and turn. We do know that when the news is the scariest, the market has usually already reflected that.

The best strategy for investors is one they can stick with. There have been and will be times when it is very temping to get out and wait for that elusive time called “when the coast is clear”. It sounds so reasonable but is so dangerous. Dangerous because the coast is never totally clear and by the time investors perceive a better future, the market has usually rocketed up.

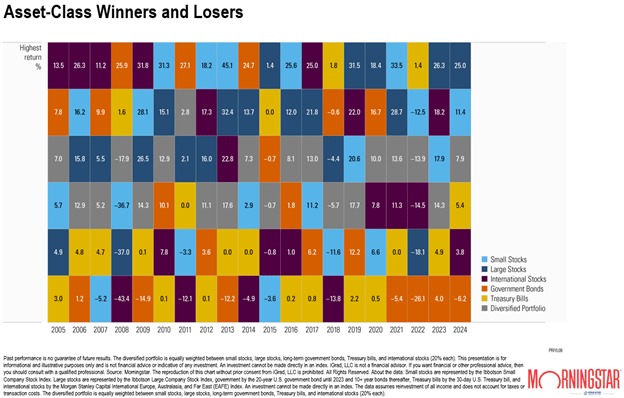

Our only answer to this dilemma is diversification. Below is a chart which represents the performance of different asset classes over the last 20 years. The gray box is a 60/40 stock/bond blend of these asset classes for the past 20 years.

The 60/40 portfolio is not for every investor. The right blend of assets is something that we structure based on your individual resources, goals, time horizons, and risk tolerance.

If we come across a prescient fund manager, don’t worry we will put his skills to work immediately with your portfolios. But if we don’t, we will have to stick with staying with long-term strategies that diversify your risk, increase your opportunities for returns, and keep you invested even during the periods that can cause some whiplash.

As always, thank you for your trust in us and please do not hesitate to reach out at any time.

Disclosures: The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Beach Foster and not necessarily those of Raymond James. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. The Dow Jones Industrial Average (DJIA) is a price-weighted index that tracks 30 large, publicly owned companies trading on the New York Stock Exchange and the Nasdaq. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Asset allocation and diversification do not ensure a profit or protect against a loss. Investment suitability must be determined for reach individual investor. If you no longer wish to receive these emails, please reply “unsubscribe".