June Client Letter

Born in 1930, Warren Buffett’s foray into the stock market began at the age of 11 when he purchased three shares of Cities Service for $38 each, according to CNBC. The stock briefly dipped, then rebounded to $40. He sold and booked a small profit.

After the sale, young Warren stood on the sidelines as he watched the stock surge, teaching him a crucial early lesson about the importance of patience and the difficulties investors encounter when deciding the right moments to buy and sell a stock.

A time to lead, a time to step back

At Berkshire Hathaway’s annual meeting last month, Warren Buffett announced he will be stepping down as CEO at the end of the year but will remain as chairman of the board.

“I’m not going to sit at home and watch soap operas,” he jokingly said, but he also acknowledged that he has slowed down and shared with The Wall Street Journal how much energy his appointed successor brings to the table.

At 94, Buffett said, “There was no magic moment. How do you know the day that you become old?”

His thoughtful approach to succession and recognition that now may be the right time to step aside offers us valuable leadership lessons.

Core beliefs

The legendary investor has often preached the importance of long-term investing. Widely known as the “Oracle of Omaha,” Buffett has long advocated patience and long-term investing over what he deems as riskier strategies, such as the glamor of day trading and the illusion of control that it generates.

“There’s a temptation for people to act far too frequently in stocks simply because they’re so liquid.” Instead, “The main thing to do is just buy into a wonderful business and just sit there with it.”

Buffett believes in buying high-quality companies and holding them for years, even decades. His famous quote, “Our favorite holding period is forever,” reflects a core principle rather than a philosophy that focuses on chasing short-term gains.

Put another way, “If you aren’t willing to own a stock for 10 years,” he said, “Don’t even think about owning it for 10 minutes.”

Broadly speaking, his focus is on individual investments, and he has an enviable long-term record, but his principles are timeless, and the wisdom he has accumulated over the decades can benefit both large and smaller investors.

As Buffett wisely observed, “The stock market is designed to transfer money from the active to the patient.”

The numbers

His track record and achievements speak for themselves, offering a powerful testament to his enduring success.

He proudly highlights his returns in his annual letter to shareholders.

Since 1965, Berkshire has provided an annual compounded return of 19.9% versus a still solid 10.4% for the S&P 500 Index (through 2024). Put another way, that is a 5.5 million percent return compared to 39,000% for the S&P 500.

Yet, while we may marvel at his returns over the last 60 years, let’s acknowledge that the widely quoted S&P 500 Index demonstrates a critical advantage of having a well-diversified portfolio for building wealth.

Creating a long-term financial plan: Lessons from Warren Buffett

Warren Buffett's philosophy on financial planning revolves around simplicity, patience, and discipline. As we have said, his approach prioritizes consistency over chasing quick profits.

Let’s review some of his key principles and how we incorporate his long-term approach.

- Invest in what you understand. Stick to your circle of competence by focusing on industries, companies, funds, and exchange-traded funds (EFTs) you truly understand. This reduces the likelihood of mistakes in areas where your knowledge is more limited. Further, it enhances decision-making confidence.

- Don’t get caught up in daily headlines and market volatility. Investing that feeds off emotions poses a risk to your financial goals. For example, exiting stocks during a steep market selloff usually lacks a foundation in logical reasoning and is often instigated by fear, doubt, and a tendency to follow the crowd.

Buffett views market fluctuations as an opportunity to exploit rather than something to fear.

Rather than reacting to short-term stock price movements, stay focused on the long-term fundamentals. Well-diversified portfolios tap into the long-term potential that the American economy has to offer.

Historically, the strength of the U.S. stock market has reflected the consistent growth of the broader economy. While we cannot predict how the stock market will perform in the next week, month, or even next year, its long-term track record is compelling.

Put simply, a growing economy lifts corporate profits. While the relationship is not perfectly linear, patience has been a virtue as rising stock prices have historically reflected this upward trend in corporate earnings.

- Stay the course. This principle aligns with the tenet above. One of Buffett’s key principles is emotional discipline—remaining committed to a long-term strategy despite market volatility. He warns against panic-driven selling and trend-chasing, encouraging rational patient investing.

Time and time again, he has downplayed market volatility.

After a steep selloff, the primary market indexes have regained a significant portion of the losses incurred during the decline in early April.

While we advise against making investment decisions solely based on market movements, if the volatility in early April caused any concerns, we’d be happy to discuss it with you.

- Harness the power of compounding. By reinvesting dividends, investors can significantly grow their portfolios over time. Buffett credits compound interest as a major factor behind his wealth.

- Minimize unnecessary fees and costs. Our recommendations are thoughtfully tailored to your unique goals and circumstances. That said, low-cost index funds remain one of the most effective tools for building long-term wealth. They offer investors, both large and small, efficient, broad-based access to the market with minimal cost and complexity.

We'll close with these two final remarks

In his letter last year to shareholders, Buffett was direct and unwavering in his perspective:

“I can’t remember a period since March 11, 1942—the date of my first stock purchase—that I have not had a majority of my net worth in equities, U.S.-based equities. And so far, so good,” he said.

Reflecting on his earliest investment, he recalled, “The Dow Jones Industrial Average fell below 100 on that fateful day in 1942 when I pulled the trigger (purchased my first investment) … America has been a terrific country for investors.”

In his letter in 2023 he included a poignant observation: “America would have done fine without Berkshire. The reverse is not true.”

Stocks rebound amid tariff threats

Aggressive tariff policies triggered significant market volatility amid a sharp early April selloff, which was followed by a sharp rebound when the most severe tariffs were delayed.

More recently, the market’s relatively muted reaction to tariff headlines suggests that investors are anticipating a reduction in trade tensions. At the very least, they do not foresee a prolonged escalation of tensions or a devastating trade war.

Late last month, Bespoke Group said the S&P 500 underperformed in March and April on days when trade headlines dominated. In May, however, investors generally took trade headlines in stride.

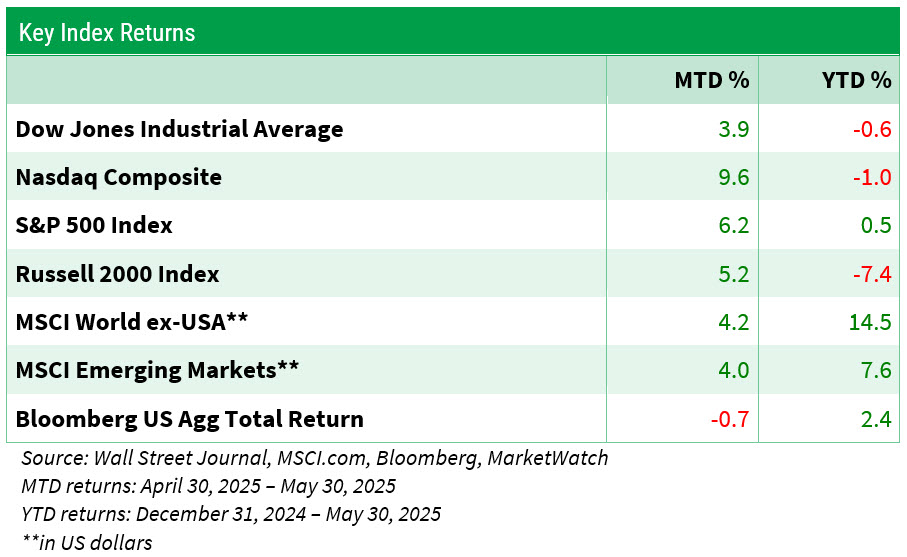

By the end of May, the Dow, the S&P 500 Index, the Nasdaq Composite, and the Russell 2000 Index of smaller companies had all risen above their levels from April 2, when the reciprocal tariffs were initially announced, according to MarketWatch data.

Besides a ratcheting down of trade rhetoric, let’s look at some of the other factors that have contributed to the market’s rebound and resiliency.

- The Treasury market has calmed down. The early April “Liberation Day” tariffs created angst among stock market investors, which led to a selloff in bonds and rising yields (bond yields and bond prices move in opposite directions).

Moreover, the dollar, which historically has been a magnet for foreign capital during heightened uncertainty, began to slip in value.

The federal deficit looms in the background, but the bond market's earlier jitters have settled down, restoring a sense of stability—for now.

- Recent inflation data has been soft. While uninspired, consumers haven’t thrown in the towel either.

- Although the Federal Reserve has been telegraphing that it is in a wait-and-see mode regarding rate cuts, significant cracks in the economy have yet to develop.

- The unemployment rate has remained steady, the economy is creating new jobs, and layoffs remain generally low, as evidenced by first-time claims for jobless benefits (Dept. of Labor data).

- First-quarter profits came in much better than expected, according to LSEG. While tariffs are generating uncertainty, forecasts provided by various firms during their respective earnings reports were generally favorable.

For the most part, economic data is backward-looking. It doesn’t definitively tell us how events will unfold.

However, when market volatility increases, we continue to suggest the approaches we have discussed in the past.

Keep your investments diversified, be aware of your risk tolerance during market downturns, concentrate on your long-term objectives, and refrain from making decisions based solely on the unavoidable fluctuations in market activity.

It’s an evidence-based strategy that paid off for Warren Buffett. We believe that it will help you achieve your financial goals.

I trust this review has been informative.

If you have any concerns or would simply like to talk, please contact me or any team member.

Thank you for choosing us as your financial advisor. We are honored and humbled by your trust.

Cheryl L. Myler, CRPC

Vice President-Wealth Management Advisor

Content prepared by Horsesmouth for use by Financial Advisors'. Horsesmouth is an independent organization and is not affiliated with Raymond James.

Any opinions are those of the author and not necessarily those of Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. Contributions to a traditional IRA may be tax-deductible depending on the taxpayer's income, tax-filing status, and other factors. Withdrawal of pre-tax contributions and/or earnings will be subject to ordinary income tax and, if taken prior to age 59 1/2, may be subject to a 10% federal tax penalty. Like Traditional IRAs, contribution limits apply to Roth IRAs. In addition, with a Roth IRA, your allowable contribution may be reduced or eliminated if your annual income exceeds certain limits. Contributions to a Roth IRA are never tax deductible, but if certain conditions are met, distributions will be completely income tax free. Unless certain criteria are met, Roth IRA owners must be 59½ or older and have held the IRA for five years before tax-free withdrawals are permitted. Additionally, each converted amount may be subject to its own five-year holding period. Converting a traditional IRA into a Roth IRA has tax implications. Investors should consult a tax advisor before deciding to do a conversion.

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 8% of the total market capitalization of the Russell 3000 Index. The MSCI ACWI ex USA Investable Market Index (IMI) captures large, mid and small cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries*. With 6,211 constituents, the index covers approximately 99% of the global equity opportunity set outside the US. The MSCI Emerging Markets is designed to measure equity market performance in 25 emerging market indices. The index's three largest industries are materials, energy, and banks. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.