How will recent news impact interest rates’ trajectory?

- 03.17.23

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Fed still likely to raise rates next week

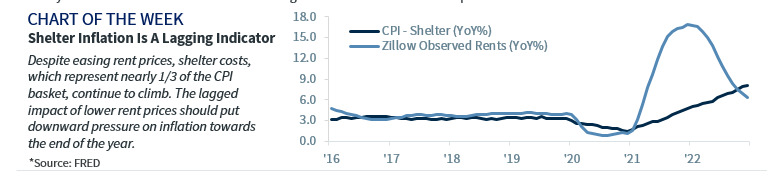

- Slowdown in housing inflation should ease price pressures

- Broader contagion fears should be limited

College basketball’s tournament kicked into high gear this week as teams strive to make their way to the early-April championship game. The next few weeks will likely bring a fair share of twists and turns, some unforeseen matchups and a few upsets on the road to the championship. Even with the best handicappers, the future is always difficult to predict. In many respects, there are some surprising parallels between the college basketball tournament and the financial markets. Over the last few weeks, the market has endured a number of twists and turns in the economic narrative (i.e., rotating between ‘soft,’ ‘no’ and ‘hard’ landing), dealt with three unforeseen bank failures and is now confronted with the potential fallout that could upset the Federal Reserve’s (Fed) game plan for tackling inflation. How will recent events impact the Fed’s economic outlook and the trajectory for rates?

- Recent events inject uncertainty into the Fed’s rate path | Fed policymakers have a lot to consider as they head into their policy deliberations next week at the March 21-22 FOMC meeting. Rapidly shifting narratives—from cooling demand and price pressures in January, to strong job growth and persistent inflation in February, to heightened financial stability risks in early March—is likely to make the Fed’s job more challenging. More specifically, how will policymakers strike a balance between the need to tame high inflation at a time of growing financial instability risks? Here are the key factors the Fed will be focused on and our view on how it will revise its economic projections and interest rate outlook (i.e., their updated ‘dot’ plots).

- Economic Growth | At the December FOMC meeting, the Fed lowered its 2023 GDP forecast from 1.2% to 0.5%. Since then, job growth and consumer spending have been more resilient than expected. In fact, the Atlanta Fed’s GDPNow is estimating first quarter GDP at 3.2%! This suggests a modest upward revision to the Fed’s 2023 growth forecast is likely. Our economist recently upgraded his 2023 growth outlook from 0.6% to 1.2%. However, a mild recession is still likely. This is based on three factors—tighter lending standards crimping demand, softening jobs growth leading to a slowdown in consumer spending and dwindling excess savings. Our view is predicated on a contained banking crisis (i.e. not widespread).

- Inflation | Inflation peaked last June, but the pace of disinflation has not been as fast as the Fed had anticipated and policymakers are losing patience. While Fed officials are worried about elevated inflation pressures, they run the risk of overtightening by placing too much weight on what has historically been a lagging indicator. Powell is well aware that housing inflation tends to lag other prices around inflation turning points due to the way it is calculated. In fact, shelter costs accounted for 70% of the monthly increase in this week’s inflation report. Excluding shelter, inflation for everything else in the CPI basket (~65% of the Index) rose at a 2% annual rate last month. We expect the disinflationary process to gather steam once the effect of falling house prices is captured in the CPI measures. The banking crisis may force the Fed to be more patient, removing the risk that it overtightens. If this happens, it would be welcome news for the markets.

- Unemployment | The ongoing strength in the labor market should not lead to any major adjustments to the Fed’s 4.6% unemployment projection in 2023. Our economist expects the unemployment rate to rise from 3.6% to 5% as companies tighten their belts. While not reflected in the unemployment level, job layoff announcements are spreading from tech-companies (i.e., Meta, Alphabet, Amazon, Microsoft) to other areas (i.e., Disney, FedEx, Hasbro). However, given the difficulties companies have had finding workers, we do not see large scale lay-offs that would lead to a severe recession.

- Federal Funds Rate | Prior to last week, Powell’s hawkish comments, combined with slowing, but still elevated inflation, suggested upside risks to the Fed’s previous 5.1% terminal rate forecast. However, with the fallout from the banking crisis still unknown, the Fed will likely tread carefully. Uncertainty calls for a more gradualist approach, particularly as the full impact of the Fed’s 450 basis points of tightening is still working its way through the economy. Research suggests that it can take up to twelve months or more and we just passed the one-year anniversary this week! While some economists expect the Fed to pause, or even cut rates, next week, we think the Fed will remain in inflation-fighting mode, delivering a 25 basis point rate hike and an eventual 5.50% peak fed funds rate. The Fed is still likely to lift its peak fed funds rate projection; however, the peak will be below the 5.7% rate that was projected before the three bank failures. Markets’ expectations of rate cuts in the second half of the year reflect a greater likelihood of broader contagion, which we do not see at the moment.

- Bottom Line | The three banking failures have injected uncertainty into the Fed’s rate-setting decision next week. The Fed will likely continue to prioritize fighting inflation as the new Bank Term Fund Program is designed to provide banks with the liquidity they need to restore confidence in the banking sector. Our call for a 25 basis point rate hike next week still stands.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.