It’s no secret, the buzz and unease of election years can rattle the most seasoned investors. If you’re getting caught up in the wave of media coverage and sensational headlines you’re not alone. But just remember when it comes to long-term investing, elections are just a temporary sideshow.

Try to tune out those news updates bombarding our devices 24/7 and avoid hasty or emotional decisions based on election results.

History shows that election years have minimal impact on long-term investment returns.

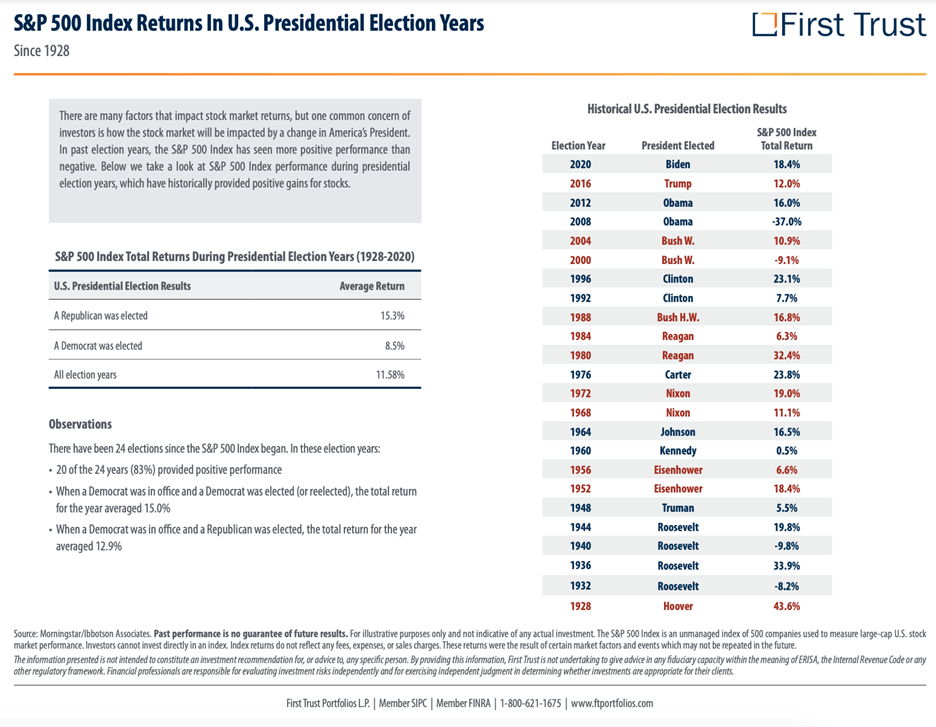

Out of 24 elections since the inception of the S&P 500 Index, 83% of the years following these elections saw positive returns.

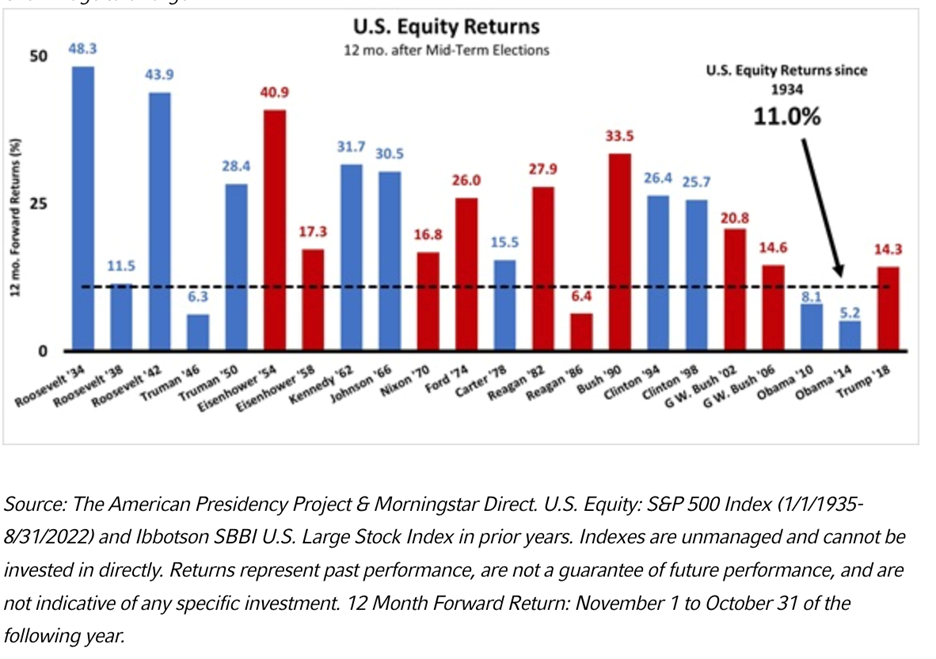

Market performance tends to remain robust for a year after most elections, with an average growth of 23% in the 12 months following midterms. This outpaces the long-term average of 11% for U.S. equities in all but 4 out of 22 instances.

Here are 3 tips to help you navigate all the noise:

As the election heats up, turn down the noise, stay focused on your objectives, and Remember investing is a marathon, not a sprint.

If you or your loved ones are concerned let's talk about it. We’re here for you.