Fixed Income In Focus: 2025 Mid-Year Recap

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

This year, so far, the world has been riddled with geopolitical news, resonating in widespread unrest, yet seemingly yielding less impact on financial markets. Let’s step back and examine the market influences and their consequential market outcomes as we transition into the second half of the year.

Among the global conflicts are the Gaza war between Hamas and Israel, along with the dispute between Iran and Israel, and the Ukraine and Russia war. The U.S. has not only attempted to negotiate peace on all of these fronts but has supplied military aid and even carried out an isolated bombing of Iran’s nuclear facilities. Ordinarily, that might spook the financial markets and even create a flight to quality. However, the fixed income market has shown strength and resilience in the face of these global conflicts.

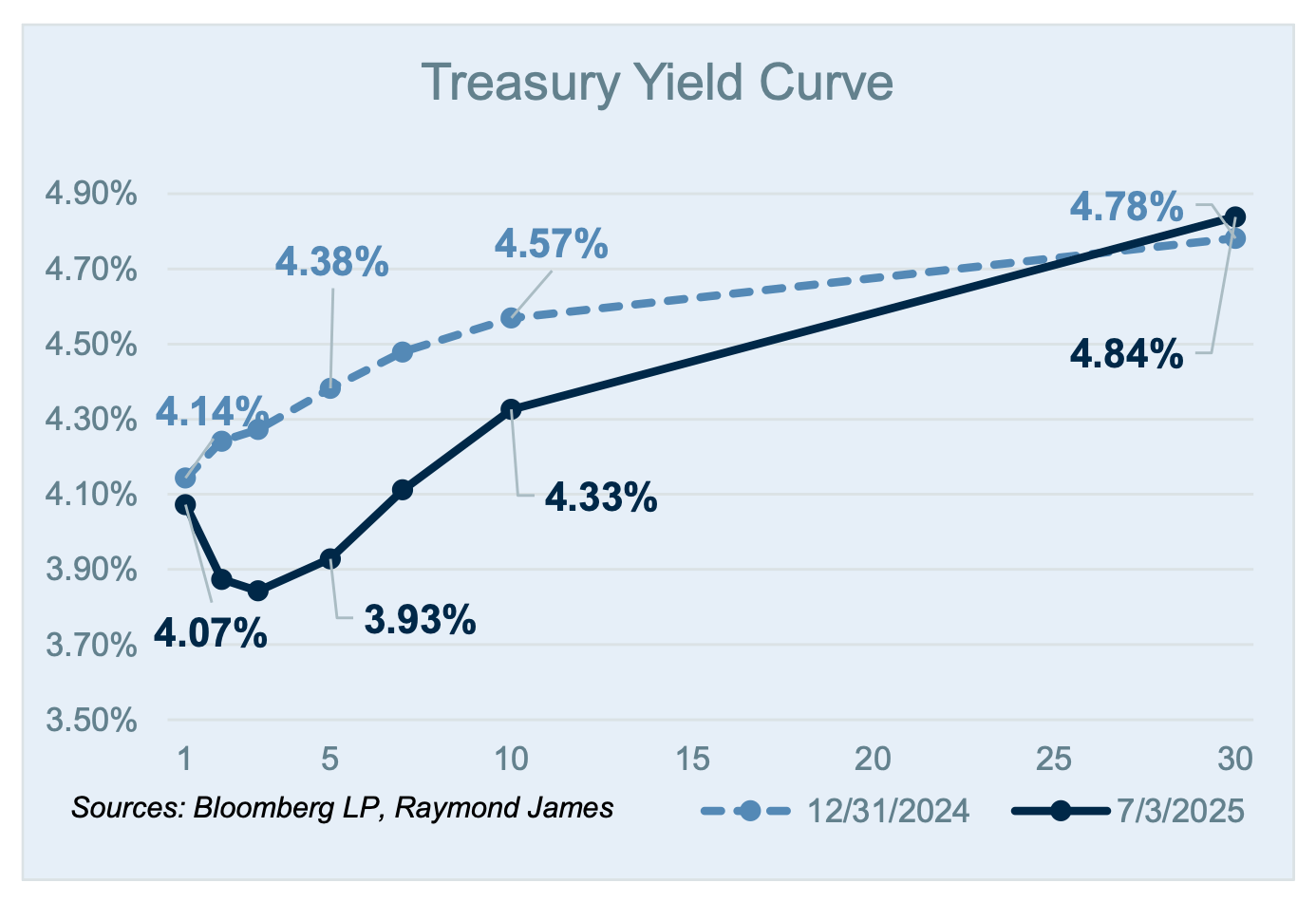

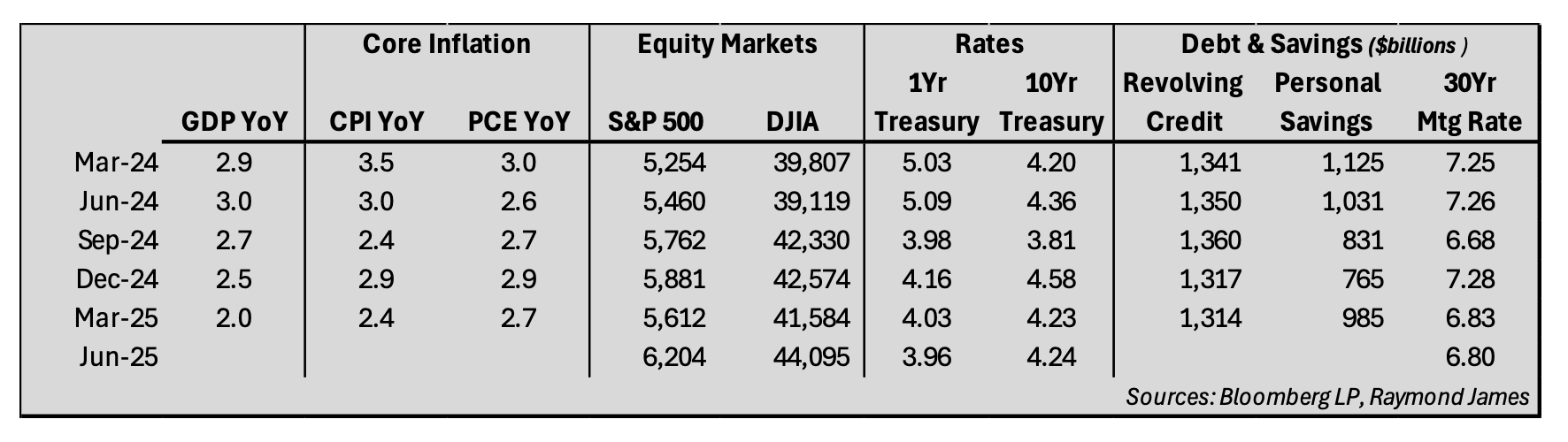

Treasury rates are within 50 basis points of where they started the year and, on most maturity points, even closer. Short and intermediate maturity yields are lower year-to-date while the long end of the curve is slightly higher. The FOMC has been torn between preventing a resurgence of inflation and the potential for consumer confidence to wane, which could push the U.S. towards a recession. So far, neither has unfolded, as inflation data has been static, the employment picture remains strong, and the U.S. consumer has remained resilient.

Inflation has still not met the Fed’s target of 2%, yet it has remained in check without showing signs of returning to June 2022 levels, when CPI YoY peaked at 9.1%. GDP data has tailed off but still reflects a growing economy. Employment data has remained solid, and it is theorized that as long as the US consumer is employed, they tend to spend money.

High-quality taxable bond spreads (the difference between Treasury and corporate yields) are essentially unchanged since the start of 2025. While 10-Year BBB-rated and A-rated corporate spreads are within 4 basis points of where they started, there have been pockets of volatility along the way. By early April, spreads had widened by 35 to 40 basis points and have gradually come back in since the peak to essentially end up where they started, to the 80 to 105 basis point range. High-yield corporate spreads at 10-years have declined by about 20 basis points to ~270 basis points after peaking at around 450 basis points in early April. Despite slightly lower benchmark yields and tighter spreads, investment-grade corporate yields remain at some of their most attractive yields of the past 15+ years.

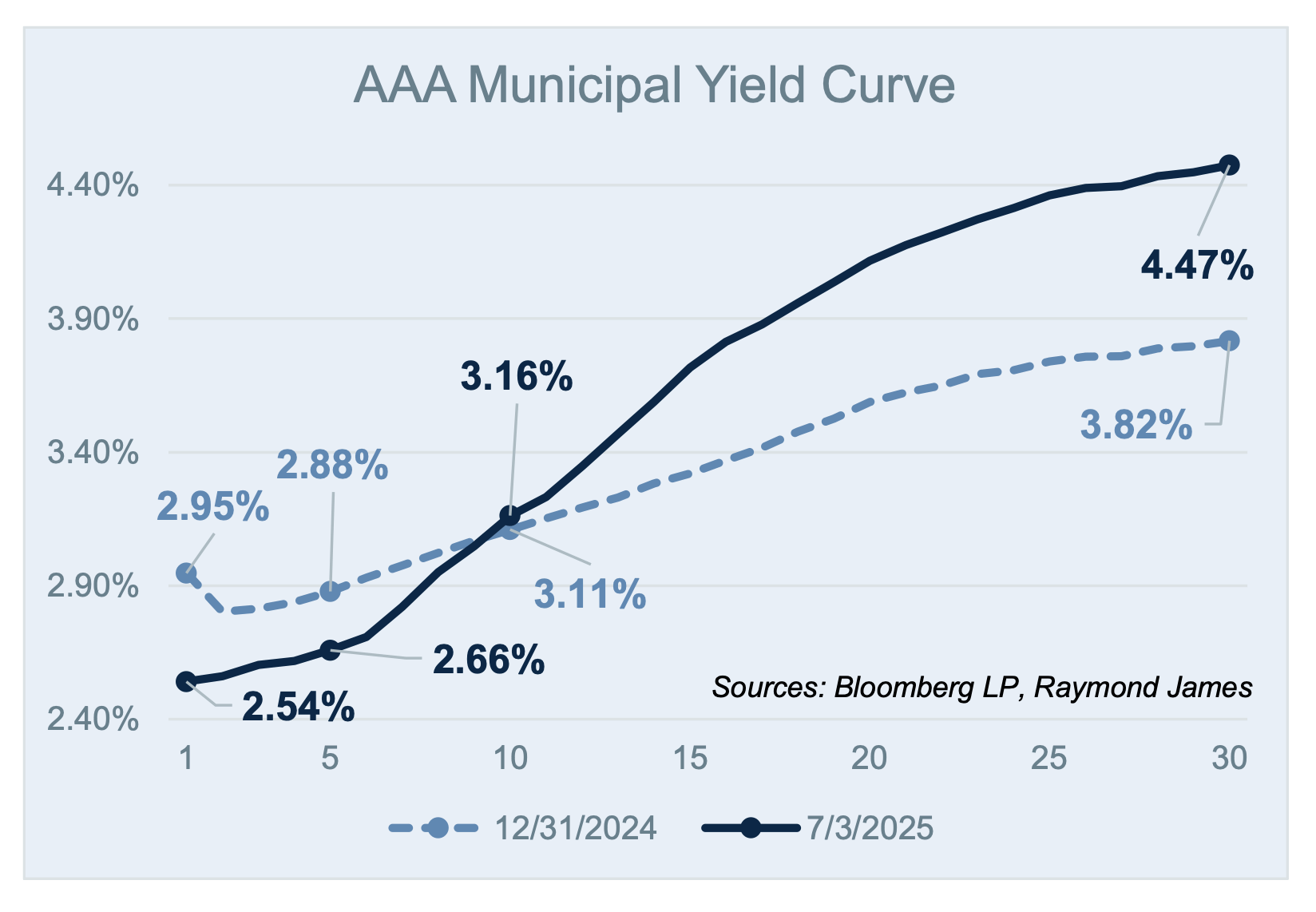

Municipal yields as a percentage of Treasury yields have gotten more attractive, especially on the longer part of the curve. The 30-year ratio has increased from 80% to 92% signaling increased relative value of tax-exempt municipal bonds compared to their taxable counterparts. The municipal curve has steepened sharply with the 1- to 30-year slope more than doubling, from 87 to 193 basis points. This has provided investors with increasingly attractive opportunities on the longer half of the municipal curve, as can be seen in the chart.

As noted above, the FOMC has remained on hold so far this year as market expectations for the next Fed Funds rate cut have been correspondingly pushed out. At the start of the year, the outlook was that there would have already been a 25 basis point cut by now and then one additional 25 basis point cut by the end of the year. As things sit right now, markets are expecting the first cut to happen either in September or October and then one additional cut in December.

The yields available across the fixed income landscape continue to provide some of the most attractive opportunities we have seen in the past 15+ years. Taxable bond yields, although slightly lower year-to-date, continue to offer attractive yields that allow many investors to hit their 4-5% yield targets in high-quality bonds. Municipal bonds, especially longer maturities, were attractive at the beginning of the year and have only gotten more attractive with moves higher in the 50 to 70 basis point range. What the second half of the year holds is anyone’s guess, so talk with your financial advisor today about how to take advantage of the opportunities that are currently available in fixed income.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.