New Year. New You. Sorta

I don’t know about you, but by January 7th (let alone by February!) the potato chips are back in my cupboard and there’s ice cream in my freezer again. What I’ve learned about myself over the years is that I love food, plain and simple. And making a New Year’s resolution to cut out all the unhealthy foods that I love will never ever be attainable. It’s far too lofty a goal or I’m just far too weak. But I think that’s a lot of us. We start the new year with great intentions only to find we set ourselves up for failure by setting unrealistic expectations. Rather than cutting out every delicious food, I now choose one or two. Instead of planning to “cook a healthy homemade meal every night of the week” we eat frozen pizzas once in awhile. But this is not a food blog, and I’m sure none of you are here for my frozen pizza recipe.

We tend to be the same way with our finances. Maybe you start out the year with plans to save more, give more and make more. You’re going to make better financial decisions and pad that savings account. You’ll make extra mortgage payments and get rid of those student loans. Again, the best intentions. But then life happens and once you discover your goals were too lofty you just throw in the towel on the whole deal. You are not alone, we’ve all been there. I am chief among you. So today I am going to share with you a few simple ways to improve your financial life in 2019. I know what you’re probably thinking, I missed the boat, it’s February. January tends to be the popular resolution month, but it also tends to be an impulsive month. January sneaks up on us after the holidays and we quickly jump into a new year’s resolution that is impractical. I want you to truly devote yourself to making better financial decisions in 2019, not to rush yourself into a resolution you can’t uphold. I strongly encourage you to only select one or two of these to implement in your own life. I’m a firm believer in pushing myself, but I’ve learned the hard way to remember to be realistic with myself as well. And I should mention, these strategies are not necessarily focused on saving for retirement, although I am always an advocate of making that a strong goal in your life.

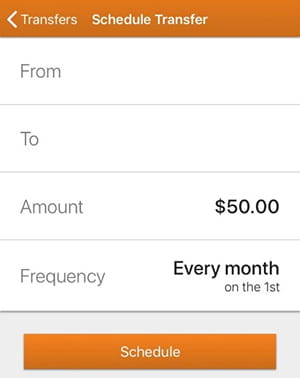

1. Set up an automatic monthly withdrawal from your bank account to your savings account.

Okay, maybe I skipped a small step; if you don’t have a savings account, open one. You can call your bank or hop online and easily set up a monthly draw from your bank account into your savings account. Above I snapped a shot of my bank app that allows me to set up a monthly draw right from my phone; yours probably does too. Notice that I didn’t tell you how much to transfer. That’s going to be different for everyone. If you can do $100 a month, awesome. If you’re more in the $10 to $25 a month range, that’s okay too. Just do something! What this does is take the decision making out of your hands. I’ve mentioned in previous posts the dangers of having to consciously save money every single month. It’s just too easy to not do it. If that money is moved out of sight and into your savings account automatically every month you never run the risk of simply not doing it. Now, while I would strongly encourage you to use that money for long term savings, that’s not necessarily the point of this. The point is to help you save money for something that is important to you. Maybe it’s a vacation you’ve always wanted to take, a charity you’ve envisioned giving to or a much needed emergency fund. Whatever it may be, it starts with getting the money out of your bank account and out of your mind.

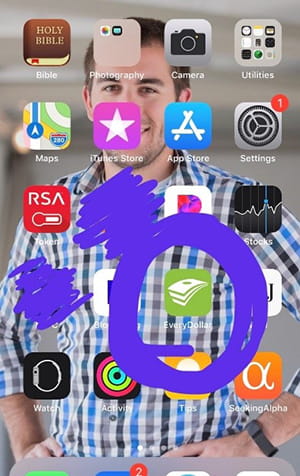

2. Commit to a written budget.

I’ve talked extensively about this in the past, so if you have detailed questions about this one, reference my previous posts. This is a great way to track where your money is going. A huge part of being a good steward of your money is simply knowing where you spend it. Tracking where you spend your money for an entire year will be eye opening and humbling. I guarantee it! And do yourself a favor… get an app. We love EveryDollar because it allows us to share our plan and input receipts before we even leave the store.

3. Sleep on it.

This one has changed the way I spend money. The first thing you do is select a dollar amount. You won’t want to do this for every $5 purchase you make, unrealistic. For me it’s $50. Any nonessential purchase I intend to make that exceeds my $50 limit must be slept on. The next morning you’ll either feel just as strongly about it and head out to make your purchase with a clear conscience or you’ll find (probably more often) that you don’t care about it as much as you did when you initially intended to purchase said item and you can just go without.

4. Grocery pickup.

If this isn’t something you’re already doing, listen up. Not only will this save you money but it will save your sanity as well. If you’re local to Billings the only place I know of that offers grocery pickup is Walmart, but Costco offers grocery delivery which is ever better although I do believe there is a charge associated with it and they encourage tipping. Anyways, grocery pickup allows you to fill your cart with all the things you need and none of the impulse purchases that rack up the bill. You can efficiently plan your meals for a week around what’s on sale. AND you don’t have to go inside Walmart. So yeah, you’re welcome.

5. Rearrange your furniture and buy some flowers.

Weird, huh? This last one is my favorite and is mostly psychological, but it works. In January, after I get all the Christmas stuff down, I’m usually ready for some change around the house. It happens every year and the first thing I want to do is run out and buy something new. Whether it be a new picture, new footstools, throw pillows, or plants, I just crave something different. I have found that two simply things help satiate my longing. When I get that itch every January I rearrange my living room furniture (this year we got to add a LOVELY kitchen set & hockey goals to our décor, as seen above. Thank you Grandmas and Grandpas) and buy a bouquet of flowers for my dining table. Simple as that and only costs about $20. I learned this from my dad. My parents only live a couple miles away but nearly every time I go to their house the furniture is moved around and it always looks fresh and new. Even when there isn’t a single “new” item in the room.

There are certainly dozen and dozens of other money saving tactics out there, but I hope you found at least one that grabs your attention. Notice how I was able to do the majority of these things right from my phone. You know you’re looking at it anyways, might as well do yourself some good! Setting goals shouldn’t be about placing the bar so high you can never realistically reach it. It’s about baby steps. Goals are achieved one decision at a time. And my goal is to help you make better financial decisions right where you are. Making a few of these simple changes won’t make you a millionaire overnight. But just like goals, millionaires are often made one decision at a time. And remember, smart savers make smart investors.

Any opinions are those of Molly VanBinsbergen and not necessarily of RFJS or Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Expressions of opinions are as of this date and are subject to change without notice.