Budgeting For Baby

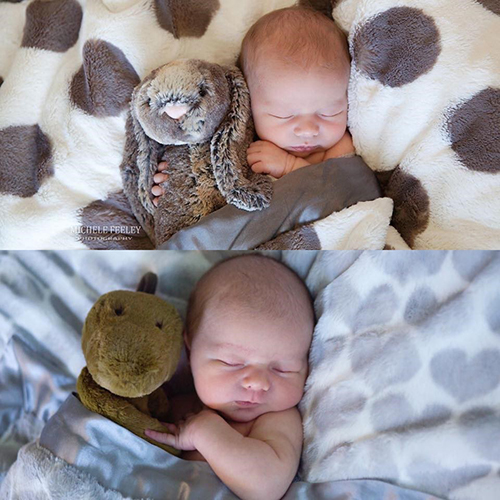

Alright, here’s where I really shine! New mom world. Unsolicited mom advice to be exact. As I’ve mentioned before, I am Mom to a wonderful 3-year-old boy, Roman, and a sweet 7-month-old, Bennett. They bring so much light to our world. My husband and I ask each other almost nightly, “what did we do before our boys?” Well I can tell you one thing; we had a lot more money. Whether you have children or not, you’ve probably heard people talk about how expensive they are, and it’s true. It’s surprising how much they cost given how tiny they are and how little they actually do in the first few months. Of course, there are some expenses associated with having a child that are non-negotiable. But, there are also a lot of unnecessary expenses that we burden ourselves with. So today is all about tips to help prepare financially for a new baby. And honestly, it’s the perfect excuse to go down the rabbit hole of baby pictures and include way too many, sorry in advance.

As I mentioned, there are some expenses that you cannot avoid when having a baby. The hospital bill tends to be non-negotiable. Contact your insurance early on and ask as many questions as humanly possible. Don’t feel bad for “wasting their time” or asking a few dumb questions. Understanding how your insurance works before the baby comes will help avoid any shock on the back end. Talk to the billing department of your hospital, clinic and children’s clinic. Find out the costs of every aspect of having your baby from prenatal appointments to a possible NICU stay, and find out where all the different bills will be coming from; they tend to not come from the same place (that was shocking to me for some reason). None of these costs can or should be avoided so being prepared is the next best thing.

Now, this next part may not apply to everyone, but decisions about maternity leave are incredibly important. If you’re a work at home mom, feel free skip right along to the next paragraph. But if you do work outside the home, you’ll have to do some looking into your maternity leave benefits. Talk to your HR representative or consult another mom at work who has been through it. All the Family Medical Leave Act (FMLA) is really required to do is protect your job and benefits. You cannot be fired because you took time to care for your newborn baby, but the duration of maternity leave will vary by company. Some companies will even pay their employees while on maternity. Husbands, check into paternity leave as well; while it is less common, some companies offer paid paternity leave. Assuming your company will not be paying you during your leave, or at best paying you a reduced rate, it’s important to have a plan for how bills will be paid during that time. Pinch pennies now so you can enjoy your maternity leave free of financial worries.

While planning for your maternity leave make sure you are also preparing for when your maternity leave ends. Childcare is not cheap, especially for newborns. Determine what fits in your budget and plan around it. Ask family, friends, and people at your church or workpace; word of mouth is the best way to find the childcare option that you are comfortable with. And you may surprise yourself with what you end up wanting. We brought a nanny into our home for a few months thinking we’d love it! It’s like the gold standard of childcare after all, right? Let’s put it this way, getting out the door each morning was like an episode of prison break. The gal who nannied for us was incredible, but we quickly learned having a nanny was not for us. There’s really no better way to ensure you are productive at work than having a childcare situation you feel comfortable with! Take the time to find out what that means for you and your family.

I am just like any other parent. The moment we found out we were pregnant I immediately started making lists of all the things we NEEDED for our baby. Now, 2 kids deep, I’m soooo much wiser and have discovered all the things I wish I hadn’t spent money on. I now have pretty clear splurge and save lists. As well as a list of things that merely took up space (hello wipe warmer!). These lists will probably vary from person to person as everyone parents a little differently. It’s just important to decide where you are willing to splurge and where you will save. We bought a fairly cheap, small rocking chair for our first son’s room. After a few weeks of practically living in that chair we traded up for an extremely comfortable lazy boy that took up almost his entire bedroom. So worth it! Other moms I’ve talked to said the rocking chair was purely decoration, but when people ask me what to spend money on my first response is usually a rocking chair. We found that a crib is a crib and a swing is a swing. Roman outgrew his swing in about 3 months and Bennett preferred being laid flat on the ground and left alone. Fortunately, our first was a hand-me-down and we purchased our second used, so it didn’t hurt as much when they sat vacant.

Baby clothes are another great place to save. While no one will ever knock you for the expensive coming home outfit or special holiday outfits, babies outgrow clothes so quickly. Carter’s clearance rack won’t leave you with a knot in your stomach when baby wears that outfit once. Garage sales and hand me downs are also great for the early stages as most outfits have only been worn a handful of times (at most). Before Roman was born, I turned my nose up at the idea of hand me downs. Then I saw the rate at which he ruins clothes. You’ll scrub stains for the first couple months, then one day you’ll look over and see your child eating like this and you’ll appreciate shirts that you spent less than $4 on and can just throw away.

And all the moms said amen! You need to put a value on your time and blackberry stains are for life. As far as things that just took up space, we registered for a diaper genie. It felt genius at the time. Then a friend gave us a small spool of “poop bags” (for lack of a better term) and we never used the genie again. Much cheaper option! Maybe you’re reading this thinking about how much you love your diaper genie or your $450 crib. That’s just fine! Everyone is different. It’s all about deciding where YOU are willing to splurge and where you’d rather save. Have an honest conversation with your spouse about what things are important in each of your opinions, then build your lists from there.

And of course, remember to always save for the unexpected. The second you think you’ve bought every baby product possible they outgrow their car seat and it’s time for a new one. We took a $2,000 ambulance ride (thank the Lord for EMTs!) in Hawaii to remind us of the importance of saving for the unexpected. Kids are expensive, there’s no way around it. But boy are they worth it! Prepare for the expenses that cannot be avoided by savings and having a clear understanding of what those expenses are. Decide where you are going to splurge and what items you’ll save on. And enjoy every second of your maternity leave by planning and saving early. Before you know it, they’ll be off to college (which is a whole other financial planning feat) and you’ll wonder where your tiny baby went. If you have any other great money saving tips please email me. It takes a village and I am always excited to use and share other peoples’ successes.

Any opinions are those of Molly VanBinsbergen and not necessarily those of RJFS or Raymond James.