What They Aren’t Talking About

There’s a very good chance that if you have social media or watch any of the mainstream news networks, you can tell me all about the president’s last tweet and Joe Biden’s most recent blunder. You probably know about the unrest sweeping large metropolitan areas across our country, and you likely know how many people in New York City were diagnosed with Covid-19 yesterday. While all of those things are important, how often does what you hear on the news change your day to day life? I’d very confidently argue, not often. The average American has a lot more to worry about than what some disconnected senator tweeted and deleted. So today I’m talking about a few of those things, the important things that they aren’t talking about.

- The spending. According to JPMorgan’s Guide to The Market, 67.7% of our GDP is consumer spending. Our economy is fueled by people spending money. Spending habits change when people begin to worry about their future income stream, whether that be because of a potential layoff, an extended sick leave or even the threat of a mandated business closure. The Federal Reserve Bank of St. Louis tracks personal savings rates and throughout recent history the average rate tends to be around 7%. In March of 2020 we saw the savings rate jump to 12.9% and peak at 33.7% in April, before coming down to 17.8% in July (still very high compared to the average). While we see this as a good thing for households, it certainly effects our economy’s ability to recover. Our economy simply will not experience a full recovery if people don’t have the confidence necessary to make them spend.

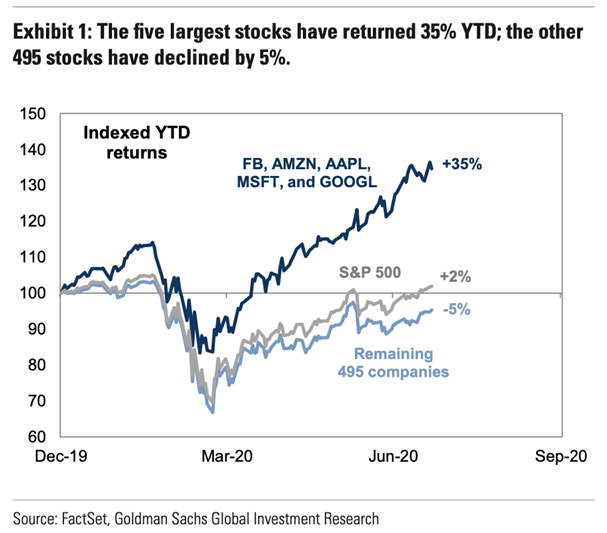

- The big five. If you follow the market much, you’ve probably noticed that it has been on quite the upward tear the past couple months. What we often times do not see, is how the underlying investments are actually performing. Markets are cap weighted, meaning not every company in the S&P 500 is represented equally. Because of this, performance from some of the heavier weighted companies will have a larger effect on the market than performance in the smaller companies. On August 12th, the five largest stocks in the S&P 500 were up over 35% while the remaining 495 companies were down 5%. What, on the surface, appears to be a booming market signaling a healthy economy, may really just be outperformance by a handful of big names.

- The layoffs. Putting politics aside, because we know that indicators like restaurant traffic slowed significantly in the weeks leading up to any mandated lockdowns, pandemics are bad for business. Maybe not every business, but a heck of a lot of them. We’ve all heard about the massive layoffs that took place early on in the pandemic, but there is likely another wave coming. The PPP portion of the CARES Act offered forgivable loans to small businesses given that a specified percentage of the loan be used for payroll costs. This helped a lot of small businesses retain employees through what was expected to be the worst of their business interruption. Fast forward to September, most of those loans have been used up and still many businesses across the nation remain closed. And that’s just small businesses. On August 25th American Airlines announced it will cut more than 40,000 jobs as demand has not returned for much of the travel industry (AP News, David Koenig). We expect unemployment numbers to get worse before they get better and there are a lot of industries that will never fully recover. Think about your own life; while we all long for a return to normal, we can likely all agree that some of our personal preferences have changed permanently. The number of people jumping at the opportunity to hop on a giant cruise ship has definitely shrunk over the past 6 months; not even necessarily for fear of falling ill. Watching thousands of people trapped on cruise ships around the world long past their intended vacation certainly gives people something to think about. Or it could be something as simple as people who ate out regularly learning to cook. I could talk for hours about how this past year could forever change the education system in our country. All that to say, we will likely see mass job change/retooling take place in the coming years.

- The third. Now, this is not necessarily Covid related, but it is scary! A third of Americans have nothing saved for retirement. A series of studies have been done on this topic over the past ten years, but they all come up with nearly the same results, a third of us are nowhere near ready for retirement. A 2018 study, done by GOBankingRates, found that 32% of respondents had $0 in savings. Another 41% had less than $5,000.

Cision PR Newswire

With more people turning 65 everyday than ever before, this unpreparedness creates multiple faults in our economic system. First, people will likely be forced to work longer. Because of advances in medicine over the past decade, 70 is really the new 65. That’s great news for those who aren’t financially prepared for retirement. It’s not great news for younger people entering the workforce or employers who are often times paying more senior employees higher rates than younger employees. Second, with social security already on the brink, any talk of cutting benefits can expect to be met with much opposition as more and more people come to rely on it as their sole source of retirement income. And third, we will likely see an increased popularity in HELOCs and reverse mortgages with homeowners seeking to tap their greatest source of equity, their home.

There’s a lot going on that the mainstream media isn’t talking about right now. And a lot of what they aren’t talking about is far more important to the average American than what they are talking about. I would strongly encourage you to commit to digging deeper than the headlines. Knowing what is going on in our economy under the surface will help make you a better investor, a better saver, a better voter and a better skeptic (haha just kidding, kind of). Do your research. I know, that used to be the media’s job.

Any opinions are those of Molly VanBinsbergen and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the forgoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making investment decisions and does not constitute a recommendation.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Prior to making any investment decision, you should consult with your financial advisor about your individual situation.