So, Am I Supposed to Spend This?

Dr. David Kelly with JPMorgan put it best, it’s not what keeps you up at night, it’s what wakes you up at night. 2019 was a year of de-risking for our office. We spent the later part of the year preparing clients for what we expected to be a rocky 2020. It was an election year and everyone knows election years tend to be volatile plus, we were nearing the end of the longest bull market in history. While many were anticipating a correction, it wasn’t clear what the trigger for that correction would be. And this time, it was something none of us expected, a pandemic. Covid-19 woke us up and in Q1 of 2020 the market sold off 34% and havoc ensued.

With the virus spreading and hospitals becoming overrun, state, local and federal governments began flexing their muscles and shutting down private enterprise. Now, we could debate all day about whether or not the government did the right thing, there are valid arguments AND very intelligent people on both sides. But the government made a choice and as a direct result of that choice millions of people lost their jobs (I am not even going to touch the long-term effects of printing and handing out “free money.” That is a can of worms all on its own and there aren’t enough hours in the day). This mass unemployment was not generalized; it unintentionally targeted lower wage workers, the already most vulnerable among us. So again, in steps the government to fix the problem…

Let’s run through our timeline. On February 3rd the United States declared a public health emergency. On February 19th the S&P500 began the steepest recession in history, peak to trough in just 34 days. By mid-March Covid-19 was present in the United States and the shutdown orders began. On March 23rd the S&P turned towards its rapid recovery and new highs of early September. And on March 27th President Trump signed the CARES Act into law, putting $1,200 in the pockets of individuals with income less than $75,000 (plus $500 for dependents). Whether you lost your job or got a promotion, you were getting a check. First quarter GDP was down 5% and second quarter was down 31%. By the end of 2020 household income had increased by $10 trillion and a second stimulus package with the same criteria as the first (even after 9 months of job loss information and specifics) was signed into law on December 27th.

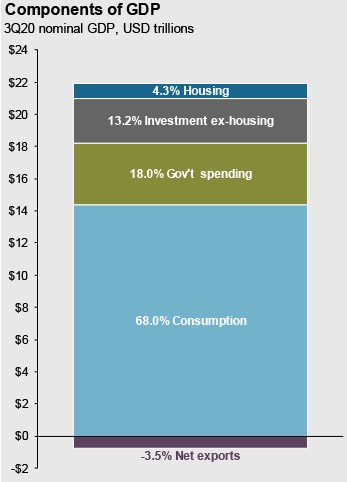

For many people, the stimulus checks and enhanced unemployment were much needed relief. For others, stimulus checks were “funny money,” as my husband puts it, and enhanced unemployment actually increased their income. According to the Becker Friendman Institute, the $600/week enhanced unemployment created a median wage replacement of 134%. The CARES Act was presented to the American public as stimulus for the displaced American worker, but If you pick through both relief packages line by line, you’ll see much of the money didn’t go directly to the American people. That is how government works after all, you only get what you want if he also gets what he wants and she gets what she wants and so on. It’s the ultimate pay to play, but we will call it compromise. Is it possible, however, that even the checks put in your pocket weren’t really meant for you? Rather they were put there for you to “stimulate the economy.” If we look at a breakdown of our country’s GDP, we find that consumer spending is 68% of the calculation. Government spending, on the other hand, is only about 18%. A healthy consumer is the most important part of our economy. If consumers aren’t consuming, our economy would never recover and as a result neither would our markets long term. By putting “funny money” in the hands of people who weren’t hurting financially they were betting on consumers to do what they do best… consume.

Now, I’m not suggesting there weren’t a lot of people hurt financially by the government lockdown orders, there absolutely were! And there are a lot of people who put each stimulus check away for a rainy day. But I personally know plenty of people who turned right around and spent that money. And why not?! If they weren’t hurting financially and their jobs were not in jeopardy, they enjoyed. On top of that, how many people have never had that kind of disposable income at their fingertips? It’s no wonder large retail profits picked back up almost immediately and third quarter GDP was up 33.1%. I’m not saying it was their only goal when they put that money in the pockets of consumers… but I’m guessing they’re not mad.

So, are you supposed to spend it? It’s my job to highly highly recommend you save and invest that money. And I do! But is that why it was distributed to you? We may never know.

Opinions expressed are those of Molly VanBinsbergen and are not necessarily those of Raymond James. All opinions are as of this 1/4/21 and are subject change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. Past performance may not be indicative of future results.