Summer Rally, Smart Money, and a “Big Beautiful” Tax Bill

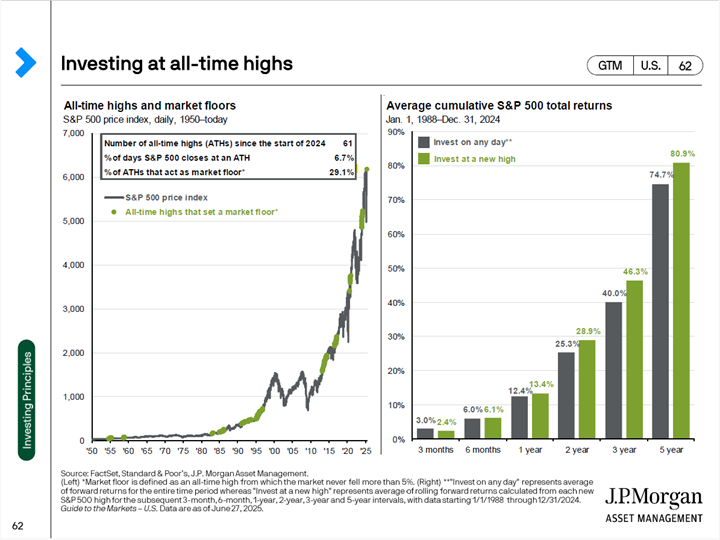

Markets have continued to surge, hitting all-time highs multiple times since June began. For some, this can feel unnerving—how can markets rally with so much unresolved uncertainty? But history tells us that investing at all-time highs is often more rewarding than investing on an average day (see the chart below). Strength tends to beget strength.While it may seem counterintuitive, most of the time markets trade near their highs. Trying to wait for a pullback can often leave investors behind. If you’re investing for the long term, the more important question isn’t when to invest—but how long you plan to stay invested.

So Why Are Markets Rising Despite Headwinds?

The S&P 500 has erased its early-year losses, overcoming a drawdown of nearly 20%. Valuations have climbed to around 22x forward earnings (well above the 30-year average of ~17x) (Source: JPMorgan Asset Management), yet investor confidence remains strong. The rally is being driven not just by AI enthusiasm or the Magnificent 7, but by broader corporate earnings strength, international markets, and optimism around stimulative policies.Behind the scenes, two powerful forces are driving demand:

- Retail Investors:Retail flows hit record levels in March and April, with net purchases exceeding $75 billion over those two months. Retail order flow hit a record 36% of market activity—up from a pre-pandemic norm of under 10%. While May cooled a bit, buying remains strong. (Source: JPMorgan Asset Management)

- Corporate Buybacks:Companies are also showing confidence, with April being the third-highest buyback month in over a decade. This suggests that firms see long-term value even at current valuations—and may be preferring buybacks over capital investments amid policy and trade uncertainty. (Source: JPMorgan Asset Management)

The Dollar Declines, Diversification Wins

The U.S. dollar has fallen roughly 10–11% year-to-date, marking its worst six-month performance since 1973. While this may feel alarming, it has been a boon for international stocks and validates the importance of global diversification.What's behind the drop? Rising deficits, high debt levels, foreign institutions reducing U.S. asset holdings (including Treasuries), and growing political uncertainty. But keep in mind: the dollar moves in long cycles, and after a decade of strength since the Great Financial Crisis, this pullback may just be part of a healthy reset.

What’s in the “Big Beautiful” Tax Bill?

Congress just passed a sweeping new tax bill. While some are hailing it as pro-growth and investor-friendly, it’s not without controversy. Here’s what you should know:

- 2017 Trump Tax Cuts Made Permanent:Lower tax brackets, larger standard deduction, enhanced child tax credit, and a higher estate and gift tax exemption.

- Senior “Bonus” Deduction (2025–2028):Tax deduction up to $6,000 (single) or $12,000 (joint) if income is below $75,000/$150,000. Income over this amount is subject to a phaseout.

- State and Local Tax Deduction (SALT):Starting in 2025, the SALT deduction is being increased from $10,000 to $40,000, phasing out at $500,000 income and reverting to $10,000 in 2030.

- Charitable Deduction for Non-Itemizers:Permanent $1,000 (single) or $2,000 (married) deduction after 2025 without having to itemize taxes (If you itemize, this applies only to donations over 0.5% of AGI).

- “Trump Accounts” for Newborns (2025–2028):$1,000 federal deposit for eligible children, with optional contributions from parents (up to $5,000/year) and employers (up to $2,500). Funds grow tax-deferred and are taxed at long-term capital gains rates when withdrawn for qualified purposes.

- Car Loan Interest Deduction (2025–2028):Deduct up to $10,000 in interest on new U.S.-assembled car purchases. This phases out at $100,000/$200,000 income.

- Tip Income & Overtime Deductions (2025–2028):- Tips: Up to $25,000 excluded unless income exceeds $150,000/$300,000.- Overtime: Up to $12,500 (single) or $25,000 (joint) deductible (above the line).

- EV and Clean Energy Tax Credits Ending:- $7,500 EV credit ends after Sept. 30, 2025.- Clean energy home upgrades credits expire Dec. 31, 2025.

- Reduced Student Loan Limits:This bill reduces the amount of student loans borrowers can take to pay for higher education.

Tariffs, Inflation, and What It Means for 2025

The current administration has argued that the latest round of tariffs on imported goods—especially those from China—will be borne by foreign exporters. But so far, the data doesn’t back that up.Recent U.S. import prices ex-fuel rose .3% in May and are up .8% year-to-date (Source: JPMorgan Asset Management). If foreign producers were truly absorbing the tariffs, we’d expect to see that index drop by the increased tariff rate to offset the higher costs U.S. importers are facing. Instead, it appears the cost burden is landing squarely on U.S. consumers and businesses.To make matters more difficult for foreign sellers, the U.S. dollar has already fallen around 10% this year, making their goods more expensive to American buyers even before tariffs are factored in. Many foreign exporters are already squeezed on margins and simply can’t afford to eat the additional costs.JPMorgan estimates that U.S. consumers will end up paying as much as 60% of these tariffs. As it stands today, it’s fair to say that tariffs are functioning as a hidden tax—quietly pushing prices up on everyday goods.This is likely to result in a modest uptick in inflation during the back half of 2025. The silver lining? Tariffs are generally a one-time price increase, not a persistent inflation driver. Once prices adjust, further inflationary pressure from tariffs should fade—assuming no further escalation.Looking ahead, I believe this short-term inflation bump will be followed by stimulative effects from the recently passed tax legislation. I expect many Americans to see larger tax refunds next year, which could fuel stronger consumer spending in 2026.In other words, we may experience a temporary economic slowdown in 2025, followed by a reacceleration in growth next year—assuming policy remains stable and global tensions don’t escalate further.

What to Do Now

With markets at all-time highs, tariffs pressuring prices, and major tax changes on the horizon, it’s natural to wonder whether any action is needed. Here’s how I’m thinking about it:

- Stay Invested with Purpose:Historically, markets that hit new highs tend to keep climbing. Trying to time the “top” often leads to missed gains. If your time horizon is long-term, your investment plan should reflect that—not the headlines.

- Expect Short-Term Bumps:Tariffs could cause a modest rise in inflation this year, and we may see growth temporarily slow before picking back up in 2026. That’s normal. Economic cycles don’t move in straight lines.

- Plan Ahead for Tax Opportunities:The new legislation offers some meaningful opportunities—especially for charitable giving, estate planning, and families with young children. Let’s make sure you’re positioned to take advantage of the credits and deductions that apply to you.

- Review Your Diversification:With the U.S. dollar weakening and international markets strengthening, now is a good time to revisit how globally diversified your portfolio is. A strong U.S. economy doesn’t mean you should ignore opportunities abroad.

- Lean on the Plan, Not the Noise:Markets are forward-looking. They’re digesting not just today’s uncertainty, but tomorrow’s potential. If your financial plan was built with your goals, risk tolerance, and timeline in mind, there’s no reason to overreact now.

Closing Thought

As always, my role is to help you cut through the noise, stay focused on what matters, and adjust only when it aligns with your long-term goals. If you have any questions about how the new tax legislation, tariffs, or market developments may affect your plan, I’m here to help.

"Any opinions are those of Michael Fitzgerald and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this material does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation." The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Raymond James and its advisors do not offer tax advice. You should discuss any tax matters with the appropriate professional.