Where did 2022 go?

Where did 2022 go? Right when I get used to writing 2022 on my checks, they change the dates on me. I guess the Venmo generation doesn’t have that issue.

When it comes to financial markets, 2022 will be a year most of us would like to forget. A year ago, the consensus expert predictions for 2022 was a stock market to be up 7.5% and earnings up 8%. However, the stock market as measured by the S&P 500 was down 19.45% for the year and earnings were down 11% through the third quarter.

Why do people continually try to predict what they know is unpredictable? I guess because that is what people want to hear. Many of these financial fortunetellers are very convincing but pay them no attention. If they knew what the future held, they would not be sharing that information. Warren Buffett’s observation of markets predictions is “Forecasts tell you a great deal about the forecaster; they tell you nothing about the future.”

You won’t find any predictions here, but hopefully some observations that can help you get through this disappointing period in the financial markets.

One of the observations is the historical growth of the earnings of the S&P 500. Below is a chart of the long-term trend of earnings growth, but also showing how volatile it can be year to year. This chart shows how patience and temperament are rewarded by not reacting to the inevitable recessions. These attributes are the big advantages wise investors can utilize to their benefit.

There is certainly a possibility that the extreme interest rate moves that the Federal Reserve implemented recently could lead the economy into a recession. Recessions are an unavoidable event for long term investors and can even provide a more attractive entry point for new funds which are to be invested. The question is whether the stock market’s poor performance in 2022 has already discounted a recession.

Below is a chart that shows how much earnings of the S&P 500 have dropped during past recessions. As you can see, the there is a wide range of earnings declines, and the average drop in earning is -19% which is how much the market was down last year. Maybe the market has already factored in lower earnings due to the potential recession.

How bad was last year for the bond market? It only had the worst performance since the bond market performance has been measured by an index. The good news is that this year bonds are starting the year off with many yields in the 4% range, so we are now earning some income from the portion of our portfolios that are intended to reduce volatility.

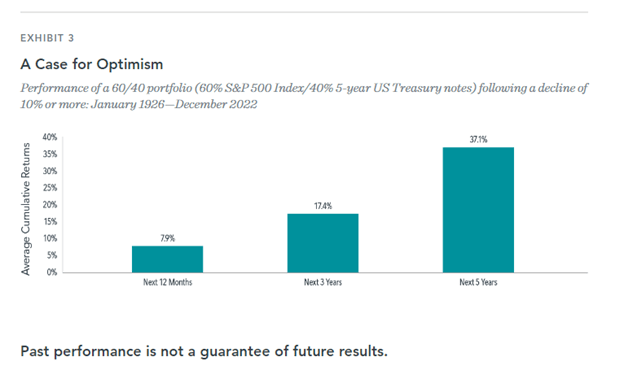

So what has this meant in the past for a balanced portfolio of 60% stocks and 40% bonds? A look back at how a 60/40 portfolio has performed after the stock market had a decline of over 10% is reflected in the chart below. As the chart says, past performance is not a guarantee of future results, but it gives us some perspective on at least what has happened since 1926 to that particular portfolio blend.

While 2022 was a year when nothing seemed to work, history gives us reasons to believe that perhaps better days are ahead for us.

As always, thank you for your trust and confidence in us. We hope 2023 is a better year for all of us. We will be in touch, but in the interim please don’t hesitate to call with any thoughts or questions. And a belated “Happy New Year!”

Thanks,

Beach

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Beach Foster and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.