Preparing for Unexpected Emergencies

Unexpected Financial Emergencies plague us all. How many of you think you are prepared for such an emergency?

Today, we are going to take a look at some of the ways to respond to these events, how to prepare for them, and what you can do to protect yourself from hardship later on down the road.

As always, if you have further questions about this topic, or want to know how to fit this into your financial plan, feel free to reach out.

This blog post isn’t going to follow a typical: intro, 3 points, & conclusion framework.

Instead, we are going to hit what an Emergency Fund is & how to get there. Then, 5 quick points with actionable items.

Emergency Fund:

Ok, so Emergency Funds. Yay. I know you are all super excited to hear about this *novel* concept. I know this is probably nothing new. You’ve heard me (and probably many others) talk about this many times before, but this really needs to hammer home because it falls into the category of essential tools against an unexpected emergency.

Most financial advisors are going to tell you to have an emergency fund set up, but obviously, that is easier said than done. Most of us do not have that kind of cash lying around. In fact, “more than half of Americans wouldn’t be able to pay for a sudden $1,000 bill from their emergency savings.”1 So, if you can cover this, then you are above average. If you can’t, then you are in good company.

Regardless, you should still consider an Emergency Fund, so here are a few basics and then we will get into how to get there:

- Emergency Funds need to be easily accessed – Think of liquid assets like cash in a checking or savings account, money market mutual funds in a brokerage account, or even a High Yield Savings Account – The money in your emergency fund needs to be available for you to withdraw when that emergency pops up.

- We are going to recommend having several months of expenses saved in case of a prolonged emergency like a serious injury, job loss, etc… You can decide what that means for you or talk to a financial advisor about your specific situation.

- I also consider adding funds for other emergencies that could come up from different situations.

- Maybe your dog decides to eat one of your socks.

- Your car breaks down.

- The dog decides to eat a ball of aluminum foil.

- The A/C unit at the house blows.

- Your dog decides to eat an entire bowl of chocolate ice cream.

Do you see where I am going with this? There are many different one-off emergencies to protect yourself against.

Now, how to get there:

Yes, saving is easier said than done – Most of us do not have the cash on hand to deal with such emergencies, as I mentioned before – and instead, credit cards are used to cover these expenses, and this just compounds the problem – literally.

To protect ourselves from further financial harm, it would be wise to take a different route. If you don’t have the cash lying around to drop into an emergency fund, then you need to make sure you are budgeting and saving for this properly.

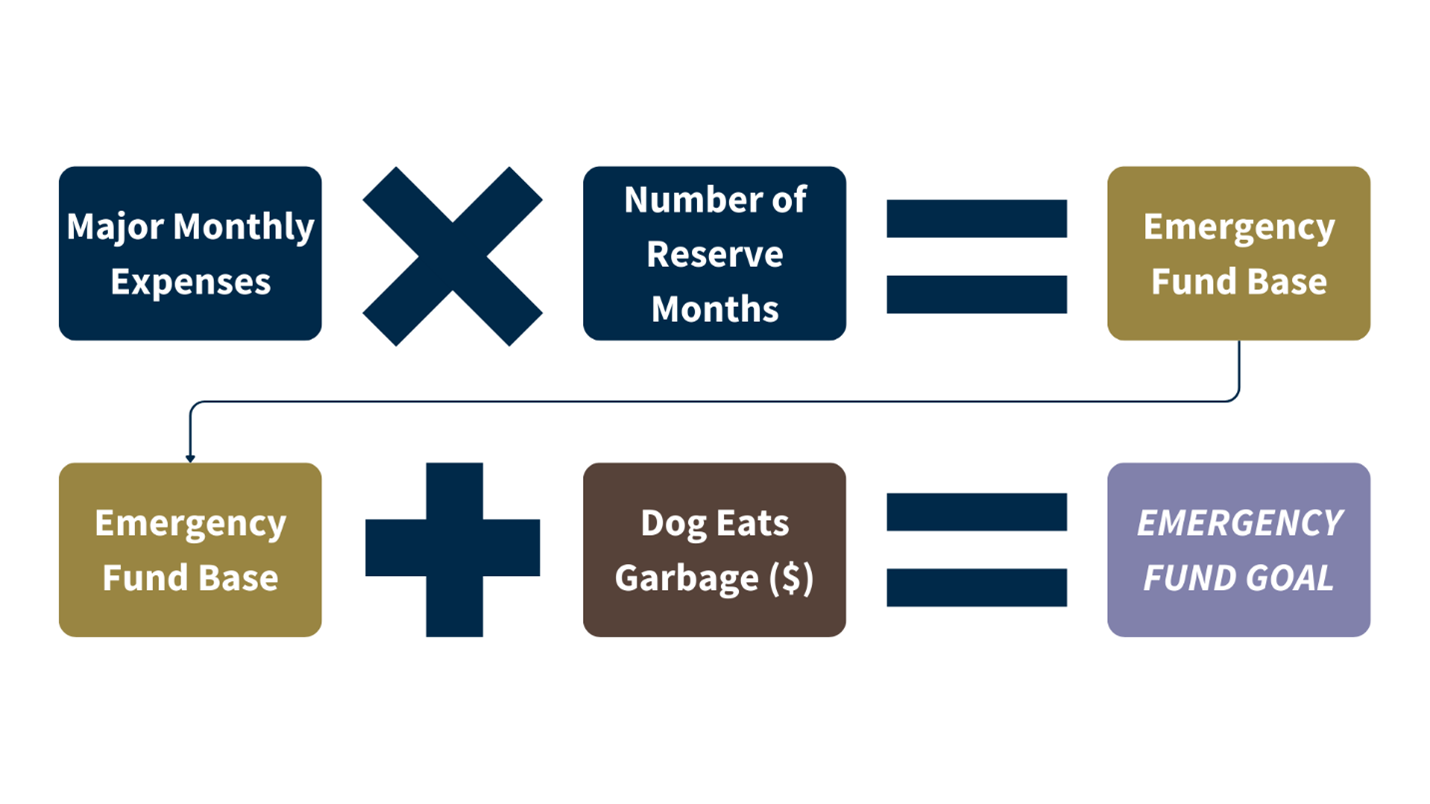

I look at it by totaling my major expenses from my monthly budget (What is included in this is up to you, but consider basics of living – rent, food, gas, etc…). Then I multiply that figure by the number of months I want to have saved (“Reserve Months”), then I consider the cost of some of the other things I mentioned above. At the end, I have a target Emergency Fund Goal.

It looks a little something like this:

Now, this may take you some time to save up depending on your current expenses, debt payments, etc… but you should target saving this amount over a defined time period (I would use months to break it down easier) and build that into your budget (Remember, it’s the little things!).

For example, if you want to have a total emergency fund of $20,000 in 2 years, you will want to target ~$800/ month to meet that goal.

Action Items:

When it comes to these unexpected emergencies, there are other ways to prepare and handle these issues. So, now that you have the basis for an emergency fund, here are some other ideas to consider:

- Insurance Coverage – Adequate insurance for your home, car, health can drastically reduce the out-of-pocket cost if you have an emergency.

- There are also select cases in which I think you should consider a form of life insurance, but that varies person to person.

- At the end of the day, just make sure that you are covered by the basics and determine if something needs to change about your situation.

- Budgeting & Financial Planning – Financial Advisors do not just work with uber-wealthy individuals to invest their money! We also work with people who want help with budgeting, paying off debt, planning to build emergency funds and meet retirement goals.

- If you want to find out how I serve people in this position, fill out this Contact Form and we can set up a free consultation to talk more in depth.

- Side Gigs & Other Income Sources – If you are dependent upon one income source to cover all of your expenses, there may be opportunities to bolster your savings by diversifying your income streams.

- Keep in mind that a side-gig could be an excellent way to build up your emergency fund if your expenses use all the income from your primary occupation.

- Debt Management – Lots of great information out there on debt management. This is a topic that we could explore all afternoon, but simply: Getting out of debt allows you to use your income for better purposes and frees up some room in your budget to save for these emergencies and build wealth in the process.

- Learn – Last point is to encourage you to keep doing what you are doing. Use your resources to learn about different strategies, tips, or plans that you can follow to improve your situation and protect yourself from financial hardship.

Emergencies are no fun. But, being prepared to tackle these when they come up can save you a lot of stress and heartache down the road. So, make sure you continue to take control of your finances and find ways to achieve your financial potential.

All the Best,

Gil Brandon IV, AAMS™

Source:

1 https://www.bankrate.com/banking/savings/emergency-savings-report/#emergency-savings

Any opinions are those of Gil Brandon IV and not necessarily those of Raymond James