Everyone Is Talking About Crypto Again. Should You Buy?

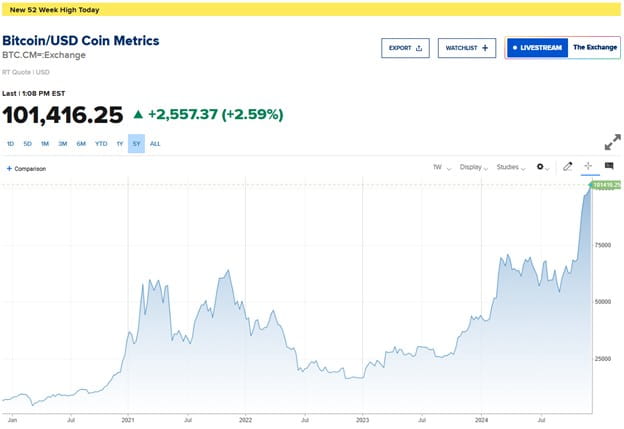

It’s the holidays, and as you gather around the table, the chances are high that someone will mention Bitcoin. Anything that creates overnight millionaires is bound to grab our attention. As I’m writing this, Bitcoin has risen above $100k for the first time. The funny thing is that when Bitcoin declined over 70% in 2022, most of the talking heads in the media wrote crypto off as a silly get-rich-quick scheme that deserved no place in investment portfolios. Now, those same people (Jim Cramer, to name one) claim to be crypto believers. Yet, the true believers who held on from the beginning are laughing their way to the bank.

Now that crypto is mainstream again, I feel it’s important to comment on two things. First, why cryptocurrency is being perceived as legitimate again. And second, its place in your portfolio given the risks and benefits (spoiler: I do think it belongs).

Why is Crypto Legit Again?

There’s a growing unease about the stability of government currencies. The U.S. Government continues to spend money it simply does not have and is doing so at an unsustainable rate. Since Trump’s election, we’ve seen bipartisan support to reduce government waste and the creation of DOGE (Department of Government Efficiency). All of this goes to say that people have a serious distrust in the government's ability to handle its fiscal problems responsibly. The incoming Trump administration is viewed as “crypto-friendly,” adding even more fuel to the fire.

Many crypto disciples will tell you that the currencies offer a stable quantity (money cannot be printed out of thin air) and all transactions are public. This adds a level of transparency and stability to some of the most popular coins, like Bitcoin. Couple this mentality with a sprinkle of speculation, and prices are off to the races.

Source: CNBC.com

Risks and Benefits

The Risks of Crypto

Investing in cryptocurrencies carries significant risks due to their high volatility and speculative nature. Prices of cryptocurrencies can fluctuate dramatically within short periods, leading to substantial financial losses. Unlike traditional investments, cryptocurrencies are not backed by physical assets or government guarantees, making them highly susceptible to market sentiment and speculative trading. Additionally, the lack of regulation in many jurisdictions means that investors have limited protection against fraud, market manipulation, and other illicit activities. This unpredictability can make it challenging for investors to make informed decisions and manage their portfolios effectively.

Another major risk is the security of cryptocurrency exchanges and wallets. Cyberattacks, hacking incidents, and technical failures can result in the loss of funds, as cryptocurrencies are stored in digital wallets that can be vulnerable to breaches. Furthermore, the irreversible nature of cryptocurrency transactions means that once funds are lost or stolen, they are often impossible to recover. Investors must also be wary of scams and fraudulent schemes that promise high returns but are designed to deceive and steal from unsuspecting individuals. Given these risks, it is crucial for investors to conduct thorough research, stay informed about market trends, and consider their risk tolerance before investing in cryptocurrencies.

The Benefits of Crypto

The first benefit is no surprise: the attraction to cryptos is primarily driven by their high growth potential. Cryptocurrencies like Bitcoin and Ethereum have shown significant appreciation in value over the past decade, providing substantial returns for early investors. This growth is often fueled by increasing adoption, technological advancements, and the potential for cryptocurrencies to disrupt traditional financial systems. Additionally, cryptocurrencies offer a level of accessibility and inclusivity that traditional financial markets often lack, allowing individuals from around the world to participate in the financial ecosystem without the need for intermediaries like banks.

Another key benefit is the diversification that cryptocurrencies can bring to an investment portfolio. Cryptocurrencies often have low correlation with traditional asset classes such as stocks and bonds, meaning they can help reduce overall portfolio risk and enhance returns. Furthermore, the decentralized nature of cryptocurrencies provides a hedge against inflation and currency devaluation, as they are not controlled by any central authority. This can be particularly appealing in times of economic uncertainty or in regions with unstable financial systems. Overall, while cryptocurrencies carry risks, their potential for high returns, accessibility, and diversification benefits make them an attractive option for many risk-seeking investors.

Where Does it Belong in a Portfolio?

Know Your Risk Tolerance

The number one factor when buying crypto is your ability to handle risk. Have an honest conversation with yourself – how would you react during a 70% sell-off? If you’re selling and worried about protecting your assets, this probably isn’t for you. If you’re holding or buying more, have a conversation with your advisor about how this all pieces together within your portfolio.

Conclusion

There is a time and a place for crypto, but blindly buying without a plan in place is not an investment strategy. Failing to plan is planning to fail. Talk to trusted advisors and gather advice before embarking on the crypto journey.

- Brett Miller, CFA, CFP® - Financial Advisor

Any opinions are those of Brett Miller and not necessarily those of Raymond James. The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. Expressions of opinion are as of this date and are subject to change without notice. Prior to making an investment decision, please consult with your financial advisor about your individual situation. The prominent underlying risk of using bitcoin as a medium of exchange is that it is not authorized or regulated by any central bank. Bitcoin issuers are not registered with the SEC, and the bitcoin marketplace is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involves a high degree of risk. Investors must have the financial ability, sophistication/experience and willingness to bear the risks of an investment, and a potential total loss of their investment.