The recent oil price spike is unlikely to drag on

- 06.20.25

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The recent oil price spike from the Israel-Iran conflict is unlikely to drag on

- Geopolitical tensions have historically not derailed the equity market

- Treasury yields have been unfazed by the Middle East conflict

Tensions in the Middle East and their effect on oil prices have dominated the recent news headlines—and for good reason. A rise in oil prices, especially if it lasts, can push up inflation and slow down economic growth. Federal Reserve Chair Jerome Powell has even noted in recent testimony that a $10 increase in oil prices could raise overall inflation by 0.2% and reduce growth by 0.1%. Any signs of escalating conflict could make the Fed’s job even tougher, especially as it also navigates uncertainties around trade tariffs. While the Fed often tries to look past temporary, geopolitically driven oil spikes, this conflict comes at a particularly fragile time for the economy. Even though market volatility is likely to stay elevated, we believe the US economy and financial markets are resilient enough to ride out this geopolitical storm with minimal lasting impact. Here’s why:

Oil Price Spike Is Unlikely To Drag On | The jump in oil prices since the Israel-Iran crisis started—a classic knee-jerk reaction to unrest in the Middle East—could soon add ~$0.20/gallon at the gas pump. The key question now is whether this spike in energy prices will be sustained for a long period of time and drive up inflation. Our prediction: probably not. Within days of the conflict starting, Israel reportedly gained control of Iranian airspace, putting Iran at a clear disadvantage. Some reports even suggest that Iran has called for peace talks. This situation stands in sharp contrast to Russia’s prolonged war in Ukraine, where early thoughts for a rapid victory in 2022 gave way to a drawn-out conflict.

- Iran Plays A Smaller Role In The Oil Market Than You Might Think—Iran produces ~3% of global oil supply, but because of its large population (~80 million people) and high domestic demand, only around half of that is available for export. While Iran does control the Strait of Hormuz—a key waterway that ~20% of global oil shipments pass through—it’s unlikely that it would try to block it. Doing so would hurt Iran’s ability to export oil and risk alienating its major trade partners like China and India, who depend heavily on Middle Eastern oil. Right now, there are no signs that the current conflict will lead to an actual disruption in oil supply, something that would have global consequences. But if that were to occur, OECD countries collectively hold around 1.2 billion barrels of emergency oil stockpiles, enough to cover ~60 days of shipping volumes passing through the Strait of Hormuz.

- Focus On Fundamentals: The Oil Market Is Oversupplied—If it were not for this crisis, oil prices would likely still be near 52-week lows. As always, it’s important to consider supply and demand from a worldwide perspective. In 2025, worldwide oil demand is expected to grow by less than 1%, held back by ongoing trade tensions and the rapid rise of electric vehicles in China. In contrast, oil supply is on track to grow 3x faster, as OPEC+ unwinds its production cuts and a near record number of new oilfields in countries like Brazil and Norway are ramping up output. With demand lagging and supply rising, the global oil market is becoming oversupplied—which tends to push prices down. That’s already showing up in the futures market, where prices are expected to trend lower over time.

How Does This Impact Our Asset Class Views? | This crisis is a fresh reminder that investors shouldn’t get too complacent—unexpected risks can emerge at any time. While the latest flare-up comes at a time when the broader economy is still trying to digest the effects of the recent tariff shock, history suggests that geopolitical events like this often have only a short-lived impact on markets. Here are our latest thoughts on how this may impact the equity and bond markets:

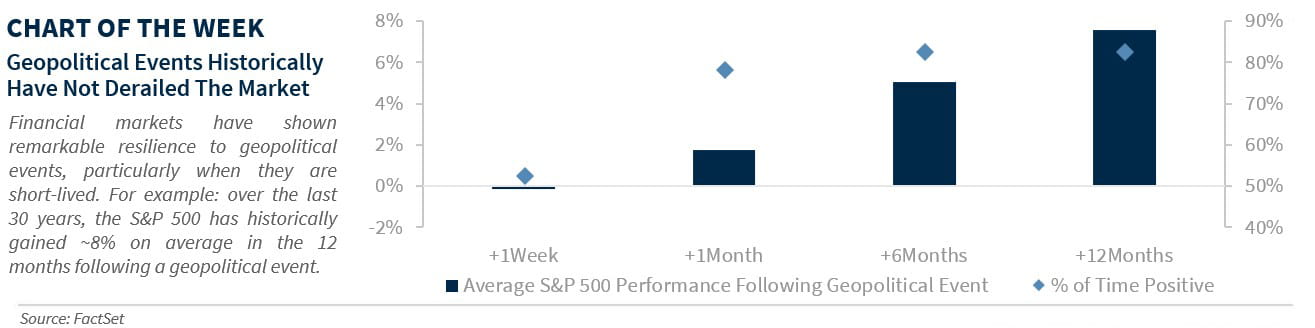

- Impact On Equities Should Be Short-Lived— Fundamentally, the conflict should not have a meaningful long-term impact on equities. S&P 500 companies derive only 0.1% of their revenues from Israel and Iran combined, so any effect on corporate earnings—aside from a short-term rise in energy costs—should be limited. In the near term, market moves are more about sentiment. Geopolitical tensions like these often spark volatility, and this time is no different. Worrisome Middle East headlines, coupled with already high stock valuations and lingering concern over trade tariffs, have left the market vulnerable. Still, history offers some perspective. Over the past 30 years, markets have shown resilience, with the S&P 500 gaining an average of ~8% in the 12 months following similar geopolitical events.

- Treasury Yields Are Unfazed By The Conflict—Geopolitical tensions often spark quick market reactions, including increased volatility and a shift toward less volatile assets like US Treasuries. But in this latest Middle East crisis, the impact on bond yields has been muted. The yield on the 10-year Treasury has moved modestly since the initial strikes on Iran and still hovers around 4.4%. While the conflict has raised concerns about a possible spike in oil prices—and the inflation that could follow—Treasury yields have been shaped more by weakening economic data and the recent unexpectedly cool inflation numbers we have seen. If the conflict were to intensify and an actual supply disruption push oil prices higher, it could complicate the Fed’s efforts to manage inflation. But for now, we expect the crisis to be relatively brief. As a result, 10-year Treasury yields are likely to stay within their recent 3.75% to 4.75% trading range.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.