This Week In Review 06/30/25

A fool and his money are soon elected – Will Rogers

Good Morning,

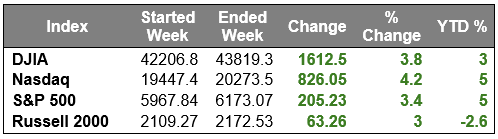

The stock market had a very strong week of trading in which a ceasefire between Israel and Iran, positive earnings reports, better-than-expected economic data, and some rate cut hopes culminated in the S&P 500 and Nasdaq Composite eclipsing and finishing with record highs.

Geopolitical headlines stirred the markets to open last week following news that the U.S. destroyed three Iranian nuclear facilities on Sunday; but reports that Qatar was notified by Iran preemptively of a counterstrike on a U.S. airbase in the region garnered optimism from the markets that a resolution to the conflict was ahead.

President Trump announced a ceasefire between the two nations that was initially violated but has since held.

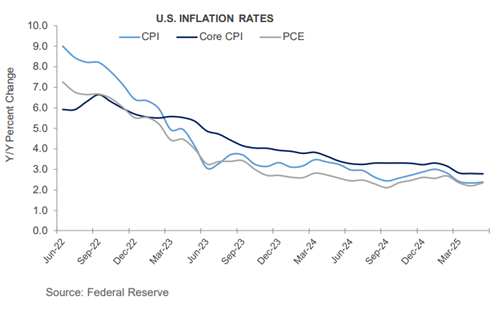

Tuesday marked the first day of Fed Chair Powell’s semiannual monetary policy report before Congress. Mr. Powell reiterated his wait-and-see approach to a rate cut, but conceded that many paths are possible, one of which is that inflation could be cooler than expected, which would suggest the Fed could cut sooner.

The CME FedWatch Tool now predicts an 80.9% probability that the Fed leaves rates unchanged in July. But there is now a 76.8% probability that the Fed cuts a ¼ point in September.

The response from the market to the Fed Chair's testimony was optimistic, especially given that his comments followed comments on Monday from Fed Governor Bowman who said she could support a rate cut in July if inflation pressures remain contained.

Hopes of an easier monetary policy increased further on Thursday when The Wall Street Journal reported that President Trump is considering naming Fed Chair Powell’s replacement for when his term ends in May 2026 by September or October, if not sooner.Mega Cap Growth led the surge in market prices last week.

The impact of the mega-cap stocks also manifested itself in the outperformance of the communication services (+6.2%), information technology (+4.7%), and consumer discretionary (+4.4%) sectors, all of which house mega-cap components. The strong performance of the tech sector was bolstered by an impressive earnings report and outlook from Micron.Micron's report translated into more gains for the white-hot semiconductor group. The Philadelphia Semiconductor Index surged 6.4% last week, leaving it up 29.9% for the second quarter. NVIDIA has been a key player in that move and was a key story stock throughout the week as it broke out to a new all-time high and stole the title of being the largest company in the S&P 500 by market capitalization.The mega-cap stocks may have been the leaders this week, but there was broad-based support that featured fine performances from the small-cap and mid-cap spaces, and from value stocks as well as growth stocks.

The energy sector (-3.5%) was the worst performing sector last week. Oil prices dropped approximately 12% to $65.07 per barrel, as the Israel-Iran ceasefire assuaged concerns about potential supply disruptions in the Middle East.

The real estate sector (0.8%) also underperformed, trading in the shadow of some relatively weak existing and new home sales data.

Those reports were part of an economic calendar that featured a decline in consumer confidence in June, a surge in durable goods orders in May, a dip in weekly initial jobless claims, a downward revision to Q1 GDP, and a decline in real personal spending and an uptick in the year-over-year rates for the PCE Price Index and core-PCE Price Index in May.

The decline in real personal spending didn't stop the consumer discretionary sector from advancing on Friday, as it found support in the 15% gain in Dow component Nike following its earnings report and outlook.

Earlier in the week, the sector was also bolstered by an encouraging earnings report and outlook from cruise line operator Carnival.

Friday's session also featured some added volatility, with President Trump announcing that trade talks with Canada have been terminated due to its 400% tariff rate on dairy products and digital services tax.

The president added that the U.S. will let Canada know the tariff it will be paying to do business with the U.S. Stocks sold off on that news, but true to form, sprung back on buy-the-dip interest.

Separately, there was plenty of reporting throughout the week on the Senate's negotiations over the "One Big, Beautiful Bill."

The Senate, reportedly, had an aim to hold a vote on the bill last weekend, and Treasury Secretary Bessent told CNBC that he thinks there is a very good chance of the bill making it to the president's desk by July 4.

We have a shortened holiday week as we celebrate Independence Day on Friday.

Have a wonderful 4th of July!!

Michael D. Hilger, CEP®

Managing Director

Senior Vice President, Wealth Management

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.