The Week in Review 07/14/25

“Corrupt politicians make the other ten percent look bad.” – Henry Kissinger

Good Morning ,

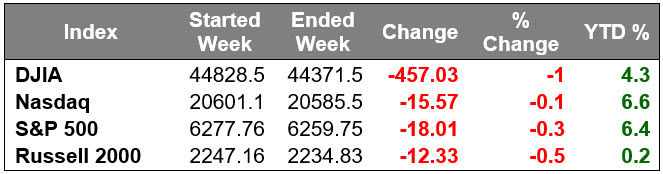

The stock market had a challenging week last week, but just barely lost any ground.

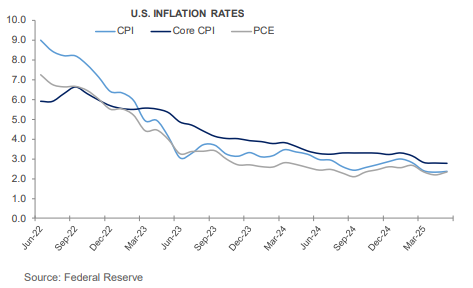

The difference was Friday’s session, which culminated with modest, but broad-based losses linked to inflation concerns driven by tariff actions.

Last week featured a string of tariff letters to US trading partners indicating that they will be facing higher tariffs starting August 1 if they cannot work out better trade terms for the U.S.

That included Japan and South Korea, which face a 25% tariff rate… the market managed to hold up well amid the threat of higher tariff rates, largely because most of the countries receiving the letters were not consequential trading partners, other than Japan and South Korea.

That changed later in the week, with Brazil getting a tariff letter announcing a 50% tariff rate, and then Canada getting one that sets a 35% tariff rate on imported goods not covered by the USMCA.

For good measure, it was also reported that the EU will be getting a letter; and President Trump declared that most trading partners will see a tariff rate of 15% to 20%, which is higher than the current 10% baseline tariff.

All things considered, the indices held up relatively well… as market participants embraced the notion that the tariff letters were being used as a negotiating tactic, and hopeful that there is still time to work out less onerous terms.

Nonetheless, the tariff overhang, which also featured a 50% tariff on copper imports starting August 1 and the threat of a potential 200% tariff on pharmaceutical imports, dulled some of the market’s bullish enthusiasm.

That enthusiasm was not entirely diminished, however.

The S&P 500 and Nasdaq Composite climbed to new record highs last week, aided by a better-than-expected Q2 earnings report and reassuring outlook from Delta Air Lines and investors watched AI giant NVIDIA surpass a $4 trillion market capitalization.

The mega-cap stocks, as a class, showed resolve, which was a calming factor for the stock market.

Last week, at times, featured some renewed interest in small-cap and mid-cap stocks, but that favoritism unraveled on Friday, bringing the Russell 2000 and S&P Midcap 400 Index to losses for the week.

In terms of the S&P 500, its best-performing sectors were energy (+2.5%), utilities (+0.8%), industrials (+0.6%), information technology (+0.2%), and consumer discretionary (+0.1%). The biggest laggards were the financials (-1.9%), consumer staples (-1.8%), and communication services (-1.2%) sectors.

The Treasury market, for its part, had a similar showing. It traded with a resilient tone through most of the week, which included $119 billion in new supply, but came under selling pressure on Friday in a curve-steepening trade led by losses in the inflation-sensitive back end of the curve. The 2-yr note settled the week at 3.91%, while the 10-yr note yield settled at 4.41%.

Some of Friday’s selling was linked to ruminations that the push for higher tariff rates starting August 1 could leave the Fed in a sticky wait-and-see mode that forestalls a rate cut.

The U.S. Dollar Index seemed to reflect that view, having increased 0.7% this week to 97.87.

This week kicks off earnings season with gusto… we will hear from some large banks and trade uncertainty will be the focus.

The week ahead…

Have a wonderful week!!

Michael D. Hilger, CEP®

Managing Director

Senior Vice President, Wealth Management

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.