Threats to the Fed’s independence undermine its credibility

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Trump cannot fire Powell because he disagrees with the Fed’s policy stance

- Threats to the Fed’s independence undermine its credibility

- Presidents generally have limited power to stack the Fed board in their favor

Will he or won’t he? That’s the question on investors’ minds as tensions rise between President Trump and Fed Chair Jerome Powell. This week, lower than expected inflation (from both the CPI and PPI reports) has only deepened Trump’s frustration with Powell, who has so far resisted calls to cut interest rates. For months, there have been whispers that Trump might even appoint a so-called ‘Shadow Fed Chair.’ Until now, those rumors haven’t led to any concrete action. But things escalated this week. Congress launched a formal investigation into Powell’s management of a major Fed HQ renovation—an inquiry that, theoretically, could be used as grounds to remove him ‘for cause.’ Meanwhile, Trump floated the idea of firing Powell before his term ends in May 2026, but later walked back the comment. Whether it’s just political posturing or a serious threat, the idea of removing a sitting Fed Chair would be unprecedented—and could shake investor confidence and global markets. Below, we address the top three questions we’ve been hearing.

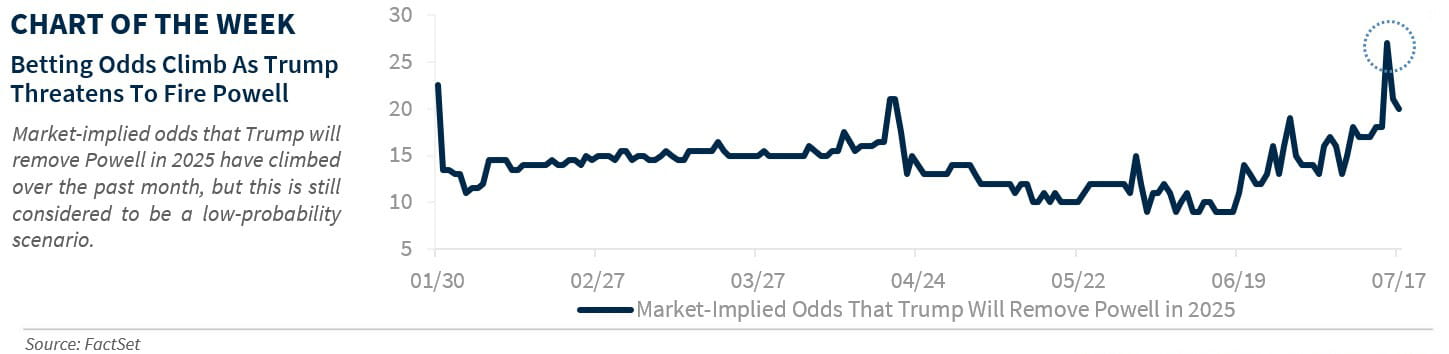

- Can The President Lawfully Fire A Fed Chair? | This would be unprecedented. While President Trump has frequently criticized the Fed, the Federal Reserve Act of 1913 does not give presidents the legal authority to remove Fed officials simply because they disagree with the Fed’s monetary policy. In fact, a recent Supreme Court ruling that expanded presidential power to remove leaders of other independent agencies—like the National Labor Relations Board—explicitly carved out protections for the Fed. This suggests that removing Powell would face a much higher legal bar, and for now, he appears relatively secure in his position. That said, the law does allow removal “for cause”—a clause that’s never been tested. This is where the controversy over the Fed’s HQ renovation comes in. Originally proposed in 2019, the project has faced delays and cost overruns, partly due to health-related upgrades like asbestos removal. Critics argue Powell may have mismanaged the project or misled Congress, potentially laying the groundwork for a challenge. Whether these claims have legal merit remains uncertain, and in our view, the case is unlikely to hold up. Still, the increased scrutiny has led to a modest rise in market-implied odds that Powell could be removed before the end of the year—though those odds remain low, at around 20%.

- Is The Fed’s Independence At Risk? | The Federal Reserve isn’t immune to political pressure—and President Trump isn’t the first, nor will he be the last, to clash with the central bank. Still, his calls for lower interest rates are unlikely to sway the Fed’s decisions. That’s because the Fed operates independently (since 1951), with legal authority to set interest rates without interference from the White House, Treasury, or Congress. Lately, concerns about the Fed’s independence have grown louder as Trump has become more vocal about wanting to replace Chair Powell. But the institutional guardrails in place are designed to protect the Fed from political influence. History shows that when central banks are free to make decisions without political pressure, economies tend to perform better, with lower, more stable inflation and greater market confidence. If Powell were to be abruptly fired/replaced, his successor would need to prove to markets that he/she is a serious, independent policymaker and not just following orders from the Oval Office. While the risks to the Fed’s independence may be higher than in the past, undermining its credibility—especially at a time when inflation remains uncertain—could pose an even greater threat to the economy. Therefore, we expect the Fed’s independence to endure, regardless of the heated political climate.

- Does The President Have The Ability To Reshape The Fed? | In general, the president has limited power to reshape the Fed—and that is by design. The twelve voting members of the FOMC consist of seven members of the Board of Governors (including the Chair) and five District Fed Presidents, four of whom rotate on an annual basis. The president can only nominate the seven Board members, subject to Senate approval, and their 14-year terms are staggered to prevent any single administration from quickly stacking the board. However, the stars may align with an early departure of a board member, giving the president more influence. Trump’s first opportunity (assuming he doesn’t follow through on threats to fire Powell) will come when Adriana Kugler’s term ends in January 2026. He will likely appoint a close ally who shares his views on interest rates. The front-runners for that seat and/or the Fed Chair include Kevin Hassett (Trump’s National Economic Council Director), Kevin Warsh (former Fed Governor), Scott Bessent (Treasury Secretary), and Chris Waller (current Fed Governor). Powell’s term as Chair ends in May 2026, though he could stay on the Board until 2028. However, most Chairs step down from the Board after their term ends. If Powell leaves, Trump could appoint another dovish policymaker. With the FOMC already leaning slightly dovish, 2 new appointments could shift the balance further toward a more accommodative Fed, aligning with Trump’s economic agenda.

Implications For The Financial Markets | This week’s trial balloon provided a glimpse of how the financial markets would react if Trump terminated Chair Powell. The knee-jerk reaction was largely as expected—a short-term spike in volatility, a weaker US dollar, softer equities, and a twist in the yield curve, with lower short-term yields (on expectations for rate cuts) and higher long-term yields (due to higher inflation expectations). While the tussle between President Trump and Powell will likely persist and could lead to intermittent bouts of volatility, we ultimately do not expect Trump to follow through with his threats to oust Powell before his term ends, as the risks outweigh the benefits.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.