Seeking Truth in a World Full of Noise

In the fast-paced world of stock investing, the importance of seeking facts cannot be overstated. As investors and portfolio managers, we must prioritize doing the investigative work, checking sources, and most importantly, doing the deep research. This commitment to truth is not just about making informed decisions; it's about taking responsibility for what we communicate with others.

Learning from the Past

History has shown us the destructive power of propaganda and how it can divide us.

Timothy Snyder, in his book On Tyranny, highlights how misinformation was used in pre-war Germany to manipulate public perception and control the masses. The Nazi regime employed propaganda to spread lies and create an environment of fear and hatred. Similarly, during the Vietnam War, the U.S. government used misinformation to justify continued military efforts. Leaflets, films, and print media were used to spread psychological scare tactics and instill doubt. These historical examples remind us of the importance of verifying information and being vigilant against propaganda.

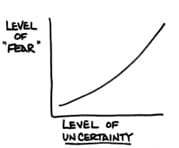

Václav Havel, in his essay The Power of the Powerless, poignantly stated, "If the main pillar of the system is living a lie, then it is not surprising that the fundamental threat to it is living in truth." This quote underscores the power of truth in dismantling systems built on falsehoods. As investors, embracing truth is our strongest defense against the manipulation and control that misinformation seeks to impose. In times like these, it is elevating our sense of fear and lack of control.

The Role of Disinformation

Disinformation is a tool often used to manipulate and control. It creates an environment of uncertainty and fear, which can be detrimental to our investment strategies. Snyder notes that disinformation can lead to the denigration of truth, as seen in authoritarian regimes. By understanding the role of disinformation, we can better protect ourselves and our portfolios from its negative impacts.

The bulk of our media outlets and sources are rewarded by eyeballs, clicks and views. Therefore, most media outlets focus their attention on producing “click-bait” – hyperbole, fear-inducing and fantastical headlines proliferate our media sources. Opinions, not news, are what we are inundated with. Many of these opinions, themselves, are formed from others’ opinions and devoid of fact.

A Note on Politics

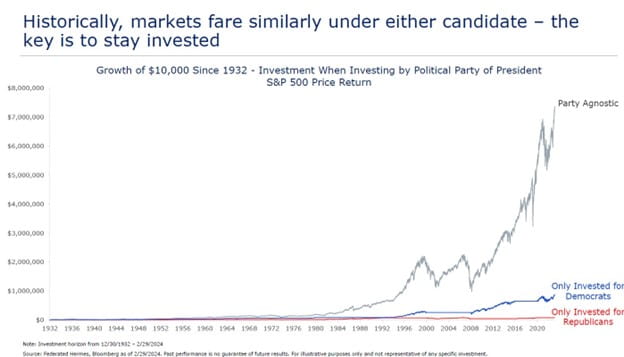

If this post feels political, it is. The party of the market, however, is not red or blue; it is purple. As we have indicated in the past, there is very little difference in the performance of the markets when Republicans are in control or when Democrats are in control. We say the markets are purple because history shows that the markets tend to do best when there is a balance of power between the executive branch and the legislative branch.

As individual citizens, we have differing ideas of how to best move forward as a country. We are of the belief that people, overall, want a better life for their kids and grandkids. We care about each other and our neighbors. I live in the fantasy world that we are all purple – somewhere right or left of center but with empathy for the people with differing opinions on how to best move our country forward.

As your advisors, we have the obligation to be politically agnostic because the markets are agnostic to politics – until politics impact the markets. This is where we find ourselves today. According to the Federal Reserve Bank of Philadelphia's Survey of Professional Forecasters in January, the annual-average real GDP growth for 2025 was projected to be 2.4%.1 A recent survey taken after “Liberation Day” by Wolters Kluwer Blue Chip Economic Indicators predicts a much lower growth rate of 0.8% for 2025, highlighting the potential for a near-stall or even a recession due to the lingering effects of the tariff wars and increased market uncertainty.2

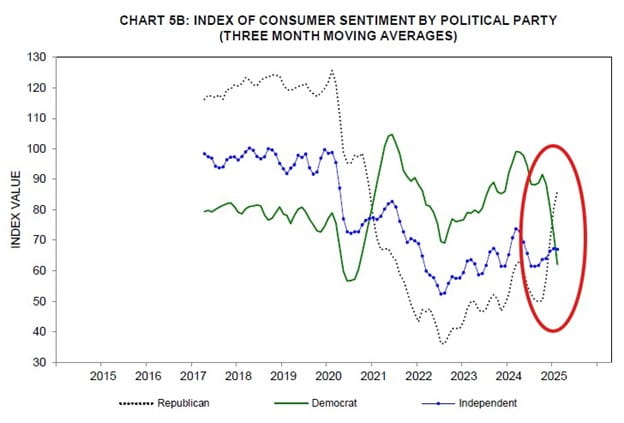

However, if you ask many Republicans today, they feel better now than they did at any time over the past four years. Democrats, conversely, feel even worse than they did during the first Trump administration.

Logically speaking, this does not make sense. The market has just gone through the worst period from Inauguration Day through April 8th, in the S&P 500’s history! How can that feel better than two successive double-digit up years in the market (2023 & 2024)? This returns me back to the information we are consuming. It is very apparent by looking at the consumer sentiment by party, that the information we are being inundated with through social media, our families, friends, churches or even the mainstream media (be it Fox News or CNN) are providing very different “narratives” to what is happening in the world, not to mention what we are concerned with here, the economy.

Our Commitment

History permits us to be responsible: not for everything, but for something. As your portfolio managers, we are committed to focusing on what truly matters and what we can control. We pledge to base our decisions on thorough research and verified information, ensuring that we provide you with the most accurate and reliable advice. Together, we can navigate the complexities of the stock market with confidence and integrity. We will continue to stick to our time-tested disciplines that are built to remove emotion from the investment decision making process.

We recognize that the current administration’s flood of policy changes, challenges to the status quo and the realignment of longstanding commitments and international ties has provided the markets with much to digest. While the optimists believe this is all part of a master plan to get us to a more efficient economy, the toll of the uncertainty will continue for some time as the investment community will take much longer to regain trust in the long-term intentions of the administration, barring some grand reversal of its current trajectory. With that said, whether you are a Republican, a Democrat or non-partisan – patience will likely be our greatest asset moving forward.

In the meantime, we need to do our part in not “taking the bait”, doing our own research, considering what we are consuming and what we share with others so we can all do our small part in being great neighbors and community members.

If you read this far, thank you for taking the time to do so! Please reach out with any questions or comments. We recognize we are wading into sensitive waters – but we all yearn to have healthy discourse about the issues we are facing. We are always ready to listen, seek to understand and empathize with disparate views and emotions. And, we will do our best to focus on the facts, wherever they may lead us! Warm Regards,

JOSH J. MILES, CPWA®, BFATM

Managing Director

Private Wealth Advisor

Financial Advisor

Sources:

Philadelphia Federal Reserve Bank: https://www.philadelphiafed.org/surveys-and-data/real-time-dataresearch/spf-q1-2025

USA Today: https://www.usatoday.com/story/money/2025/04/14/economy-weak-growth-recession2025/83048077007/

Chart 5B. University of Michigan – Surveys of Consumers: https://data.sca.isr.umich.edu/charts.php

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Josh Miles and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Holding stocks for the long-term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. This is not a recommendation to purchase or sell the stocks of the companies pictured/mentioned. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. You cannot invest directly in an index. Index returns do not reflect any fees, expense, or sales charges. These returns were the result of certain market factors and events which may not be repeated in the future.

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal.

Private Wealth Advisor is a designation awarded by Raymond James to financial advisors who have demonstrated mastery in anticipating and managing the expansive financial needs of high-net-worth individuals, families and organizations.