Strategic wealth management that aligns with your values

Welcome to my website

I am Natalia Kimberg, a Financial Advisor with Raymond James & Associates. I provide comprehensive financial planning and investment management services. As your trusted advisor, my role is to be your financial hub, offering guidance and coordinating specialized resources to meet your individual needs.

Who Are My Clients?

My clients are individuals or families seeking a knowledgeable professional to navigate important financial choices. They look to me to help them gain clarity and control over their money and make informed decisions that align with their principles. I can guide my clients to invest in companies whose corporate strategy reflects their belief systems.

What Is the Service?

FINANCIAL PLANNING

In majority of cases, we begin with financial planning. This initial stage focuses on working together to gain an understanding of your current situation, future goals, and available resources.

This will help us to identify your unique needs. This process typically involves 2 or 3 meetings where I'll ask for supporting documents and information.

INVESTMENT MANAGEMENT AND OTHER STRATEGIES

Once we have this financial framework in place, our focus shifts to designing your investment strategy and addressing any other identified needs, such as insurance, estate planning, building multi-generational wealth, charitable giving, or succession planning.

Depending on your specific circumstances, I can collaborate with additional professionals like your CPA, estate planning attorney, or our Raymond James home office partners to generate and implement your customized financial plan.

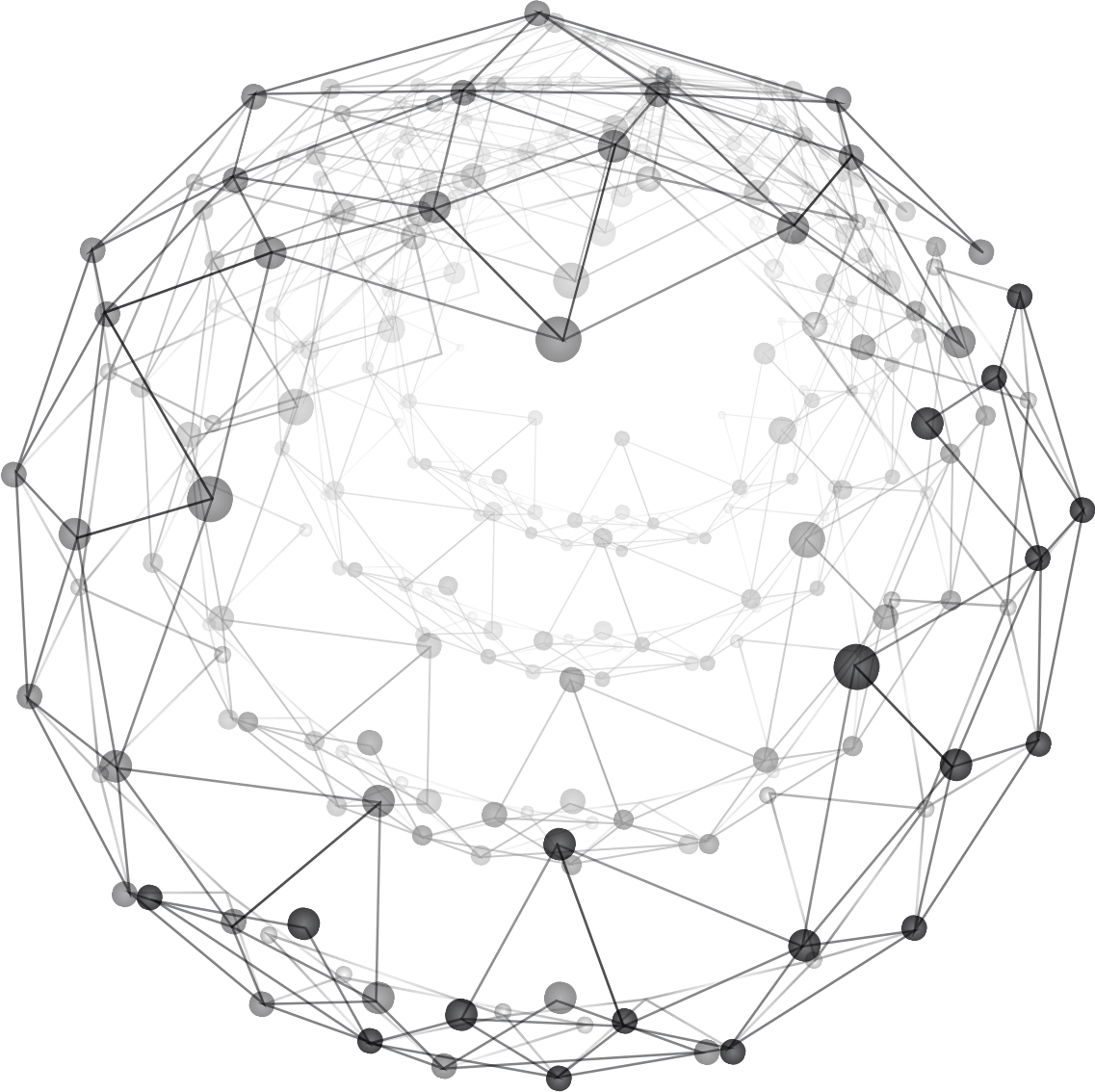

What is value-aligned investing?

By working with me, you will gain an opportunity to invest in a portfolio that aligns with your values. There are two main benefits in choosing a value-aligned portfolio:

- Provides a means to help you achieve your financial goals while minimizing investment risk.

- Invests in securities that reflect your personal belief system and your vision of a responsible corporation.

ALIGNMENT WITH YOUR PRINCIPLES SHOULD NOT COMPROMISE YOUR FINANCIAL GROWTH

A common misconception is that sustainable portfolios yield lower returns than non-sustainable ones. Numerous studies over the last twenty years have proven that this is simply not the case. In fact, sustainable criteria, including ESG (Environmental, Social and Governance) screening, serve as powerful risk-management tools, providing information advantages to money managers. Intelligent and knowledgeable investment in a sustainable, principle driven portfolio provides equal or better returns than non-sustainable ones.

I am committed to your long-term financial future

My services are designed for clients seeking an ongoing relationship with a trusted advisor. I take the time to truly understand you – it’s my favorite part of the job – and I am here to see that your finances support you throughout life’s twists and turns.

As your circumstances change, I will monitor your plan and work with you to adjust it to suit any new situation.

CONSISTENTLY LOOKING FOR NEW OPPORTUNITIES

I advocate for you by continually searching for the best solutions to your needs, even if your circumstances have not changed. I stay abreast of industry developments and look for new products or services that may allow you to reach your goals faster, lower costs and take on less investment risk.

Ready to get started?

Book a 15-minute introductory call to discover whether I am the best advisor for you. This is an opportunity to discuss your financial goals, ask questions and determine if we're a good fit.

This is a complimentary consultation, and you are under no obligation to become a client.

If you need more time or more information, you can opt-in to receive occasional emails and keep an eye on how we do things. I only send informative emails with case studies, useful tips or event invitation and you can unsubscribe at any time. I look forward to e-meeting you!

Comprehensive Planning

There’s more to your financial life than just investments. Comprehensive planning encompasses an in-depth review and analysis of all aspects of your financial life – to help you see the big picture and enable us to personalize a plan for addressing every detail.

Get to know Our Team

Information & insight