Sharing knowledge and experiences

“Art enables us to find ourselves and lose ourselves at the same time.”

– Thomas Merton

Socially Responsible Investing

What is socially responsible investing? Well, it’s a lot of things to a lot of people. It can be hard to pin down because some people believe one thing is socially responsible while others don’t. Socially responsible investing is not a pure sport.

But it is an important one. And it is a growing concern and coming to an investment near you.

A little background.

Socially responsible investing (SRI) was the early concept regarding doing social good with one’s investments. It typically used a negative screen, a “no” list to exclude certain industries like no tobacco, no fire arms, stuff like that. Anything else could be acceptable - just don’t buy investments that include companies that do whatever was on the “no” list.

This concept of socially responsible investing then morphed into what is called environment, social and governance (ESG). ESG investing, while related to SRI, adds to the “no” list with a “yes” list, desiring to invest in companies that have high ESG scores relative to their peers. The idea hear is to boycott, if you will, those companies that do the bad stuff and reward those companies that do the good stuff.

And then there’s what’s called impact investing. This adds a level of shareholder activism to investing. Impact investing is a mix of SRI and ESG but goes further. First, it explicitly focuses on companies with the best SRI/ESG scores but adds a second mandate which is actively pressing companies to improve their ESG practices.

EXAMPLE: As this story goes, an investment company that ran a mutual fund had a company in its mutual fund that purchase cotton from a third world country. What the investment management company discovered was that during harvest time no kids were in school. An obvious child labor issue. So the investment management company went to this company to explain the problem and encouraged them to stop doing business with this vendor. So when the company went to pick up its order of cotton and handed over the check to pay for it they said that it was the last check because they were going to find another vendor from which to buy cotton.

This shareholder activism had an IMPACT. In fact, this same investment company tells their investment traders that if they were going to sell out of an investment in the fund to keep at least 1,000 shares so the activist side of the investment company could always have input at shareholder meetings.

Pretty cool, huh? That’s impact investing.

But does all this matter? Do you really care? An interesting twist on this story is that when I told it to a client group dinner a woman who grew up in a 3rd world country noted that these kids and their families lost that income which was essential to their livelihood.

See, how do you define socially responsible?

Most people looking for an investment tend to “read the menu from right-to-left,” that is, look for the highest return investment and buy it. Don’t know what’s in it, just buy it because it has (had) higher returns. That’s like going to a restaurant and reading the menu from right-to-left, looking for, let’s say, the cheapest thing on the menu and buying (and eating) that. Could be fried turnips but hey, it’s cheap. Might even be allergic to fried turnips, but hey, it’s cheap.

Needless to say, probably not a good way to invest … or to eat.

Without going into a deep dive of all the metrics one can, and probably should use in making investment decisions, where does socially responsible investing come in? Or does it?

More and more the answer is a resounding “yes.”

More and more people are concerned about the environment, fossil fuels, gun control, gender equality and equal pay. The list can get long. It is suggested that millennials are leading the way on this but we have several baby boomer clients who are equally adamant about socially responsible investing. The point is, the ball is moving, kinda like a snowball that gathers more and more snow as it rolls, getting bigger and bigger.

It’s happening.

What’s particularly interesting too is that corporations are listening. This ever increasing social consciousness is driving the public and the investor, to demand that companies run their operations to be sustainable, green, to provide equal opportunity to everyone and equal pay, the whole list.

For instance, Marc Benioff, the CEO of Salesforce, was adamant about equal pay between men and women. So he did something about it. He said, “It’s a crucial part of building a good business.” Studies showed that women working full-time, on average, earned about 79% of what men did. Or to put it another way, men, for the same work were being paid 126% of what women get paid … for the same work.

With the help of Cindy Robbins, his success chief, they assembled a cross-functional team and developed a methodology with outside experts that analyzed the entire employee population to determine whether there were unexplained differences in pay. When the results came back a few months later, they were tough to swallow. Salesforce did have a pay gap: glaring differences were scattered throughout every division, department, and geographical region. The virus, in other words, was everywhere.

Equalizing pay wasn’t an easy process, or a cheap one: “After our third pay assessment, we’d spent a total of $8.7 million addressing differences in pay based on gender, race, and ethnicity.”

I won’t go through the entire article so I’ve attached it here. It’s a great, encouraging read. Source: https://www.wired.com/story/how-salesforce-closed-pay-gap-between-men-women/

Many corporations are finding that profit may not be the sole purpose of a company. Rather, social good has crept to the top of the list.

In his 2019 letter to CEOs, Larry Fink, CEO of Blackrock, the biggest investment firm in the world, stated in his Purpose and Profit letter to CEOs that companies, both public and private are increasingly addressing issues ranging from protecting the environment to gender and racial inequality. “Fueled in part by social media, public pressure on corporations builds faster and reaches further than ever before. Stakeholders are pushing companies to wade into sensitive social and political issues.”

“Companies that fulfill their purpose and responsibilities to stakeholders reap rewards over the long-term. Companies that ignore them stumble and fail. This dynamic is becoming increasingly apparent as the public holds companies to more exacting standards. And it will continue to accelerate as millennials – who today represent 35 percent of the workforce – express new expectations of the companies they work for, buy from, and invest in.”

“Attracting and retaining the best talent increasingly requires a clear expression of purpose. With unemployment improving across the globe, workers, not just shareholders, can and will have a greater say in defining a company’s purpose, priorities, and even the specifics of its business. Over the past year, we have seen some of the world’s most skilled employee’s stage walkouts and participate in contentious town halls, expressing their perspective on the importance of corporate purpose. This phenomenon will only grow as millennials and even younger generations occupy increasingly senior positions in business. In a recent survey by Deloitte, millennial workers were asked what the primary purpose of businesses should be – 63 percent more of them said ‘improving society’ than said ‘generating profit.’”

But how do you find the right socially responsible investment, one with companies that are paying attention to and doing something about the environment, sustainability, equality and the things that matter to you?

First you need to determine how you define socially responsible investing?

One might assume that most people want a high environment score and low fossil fuel score. But how do you feel about supporting LGBT issues or pro-choice issues? There are some Catholic run funds that do not support these issues and exclude companies that do.

How do you define socially responsible?

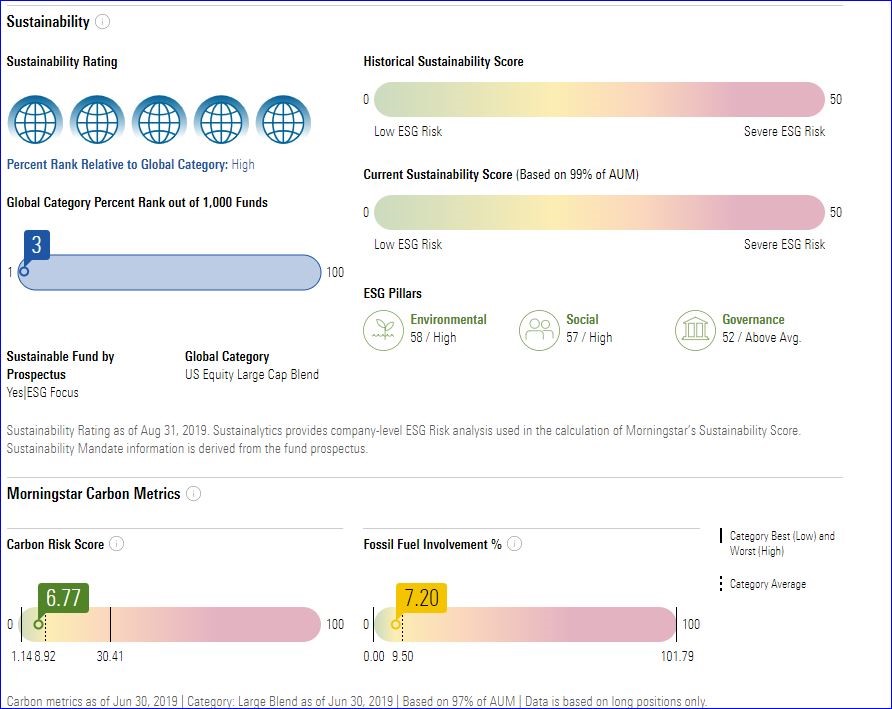

Once you’ve defined what’s important to you how do you find the right investments that comply with your goals and interests? Morningstar, an investment analysis firm, has developed their own scoring mechanism based on the work of research company Sustainalitics that ranks investments on several issues. Here’s an example.

The five (5) Globes mean that this investment scores the highest on sustainability. Below that is a large numeral “3” which represents a top ranking also – you want a low number here. Under the Carbon Risk Score you see 6.77 (again, the lower the number the better). Morningstar explains this score with this:

The portfolio Carbon Risk Score is displayed as a number between 0 and 100 (a lower score is better). A portfolio’s Carbon Risk Score is the asset-weighted sum of the carbon risk scores of its holdings, averaged over the trailing 12 months. The carbon risk of a company is Sustainalytics’ evaluation of the degree to which a firm’s activities and products are aligned with the transition to a low-carbon economy. The assessment includes carbon intensity, fossil fuel involvement, stranded assets exposure, mitigation strategies, and green product solutions.

Under the Fossil Fuel Involvement you see7.20 explained as:

Fossil Fuel Involvement % is the portfolio’s asset-weighted percentage exposure to fossil fuels, averaged over the trailing 12 months. Companies with fossil fuel involvement are defined as those in the following subindustries: Thermal Coal Extraction, Thermal Coal Power Generation, Oil & Gas Production, Oil & Gas Power Generation, and Oil and Gas Products and Services.

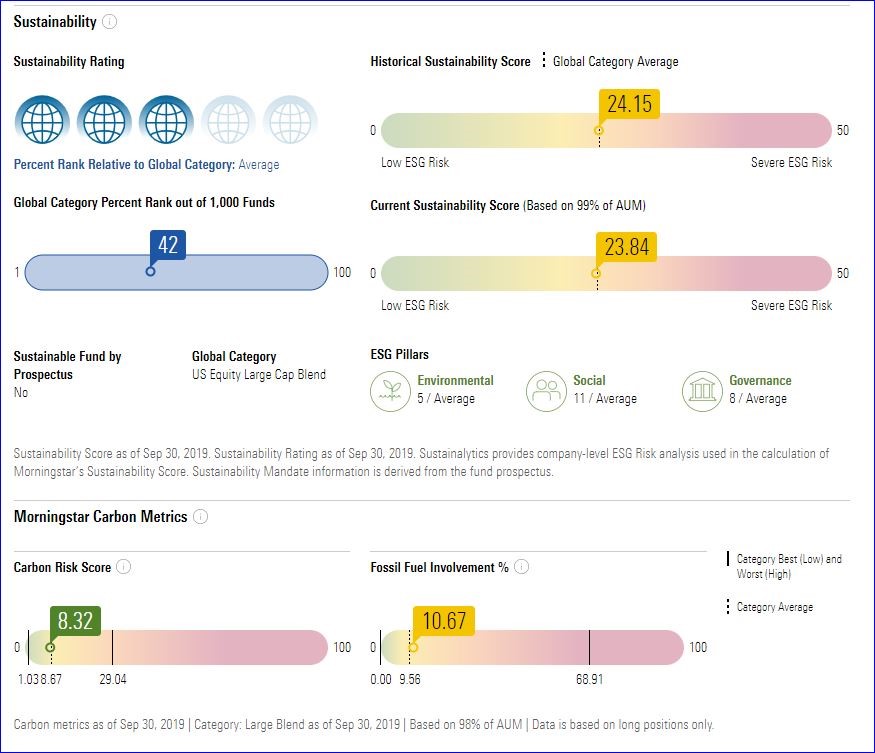

Many people feel just investing in an S&P 500 Index fund is sufficient. Here’s its Morningstar’s ESG Score:

Something else to note: some investments actually mandate socially responsible investing, like in their prospectus, others do not but can still score high in socially responsible investing.

But do I give up performance for being good?

From the beginning there’s been the criticism that “doing good,” doesn’t pay, that you sacrifice performance for being good. While that may have been true years ago it seems not to be true anymore. More and more, better business purpose results in better corporate performance. A Morningstar report states, “Studies supports the view that ESG considerations are material to companies’ financial results. Environmental stewardship is not just good for the planet—it’s also about controlling costs, avoiding damaging incidents, and positioning for tomorrow's economy. Treating workers well benefits society but also helps a company attract and retain talent—critical in the knowledge economy. Good governance leads to better corporate decision-making. Companies that consider ESG are likely strategic in nature—focused less on beating next quarter's earnings and more on creating an enduring franchise.”

The bottom line is that socially responsible investing is becoming more and more an important issue running a company and in investing. It will continue to grow as companies continue to develop a more robust socially responsible purpose not only because it is good business practice but also because of investor activism

We at NEUNUEBEL BARRANTES WEALTH MANAGEMENT TEAM take this very seriously and are prepared to discuss this with clients to help you make better investment decisions.

Sincerely,

David Neunuebel CFP, ChFC, CLU, CIMA

Senior Vice President, Investments

Views expressed are not necessarily those of Raymond James & Associates. Information contained herein was received from sources believed to be reliable, but accuracy is not guaranteed. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success. Past performance is not indicative of future results.