Sharing knowledge and experiences

“Art enables us to find ourselves and lose ourselves at the same time.”

– Thomas Merton

Stocks, Bonds & Cash - 2020

That’s pretty much it, at least in the relatively liquid investment space. Clearly real estate is an asset for living in and investing in, but for now let’s stick with these more liquid investments.

Stocks - First there can be a distinction between a company’s worth and its stock price. For instance, on a price adjusted basis, IBM stock price closed on Thursday, Oct. 15, 1987 at $35.03. After “Black Monday,” Oct. 19, 1987 it closed at $25.81. That’s a decline of $9.22 per share or -26.32% in just two trading days (Note: Oct. 17 & 18 were Saturday and Sunday). (SOURCE: Yahoo Finance).

It would be hard to make a case that IBM as a company was worth 26% less in two days.

The stock market is what is called a leading indicator, an economic factor that changes before the rest of the economy begins to move in a particular direction. This suggests that the stock market looks into the future and decides how to value that future. We’ve certainly seen that in March as the stock market has “seen” or priced in a global recession in the future. Would you buy a stock if it represented a company that was going to lose its sales revenues and earnings or, in an extreme case, even go out of business? You might want to sell before that happened - thus the recent market declines, pricing in these perceived realities. Has the market priced in all the “bad” news? Dunno! We’ll see. As the saying goes, “No one rings a bell at the bottom!”

This past week, however we’ve seen the stock market looking forward and trying to price in a flattening, if not declining, virus curve, pricing in some encouraging news about the future, a better future, a less severe recession, possibly better earnings and profits, etc. Of course, two days does not a trend make but that’s kinda how the stock market works: looks forward and buys the future, not the past. I suppose I should say this now: “Past Performance is not guaranteed into the future.”

Actually, lately that may be a good thing.

Bonds - Bonds are fixed income debt instruments. With stocks you actually own an equity interest in a company. With bonds you own a loan, a debt obligation. There are, of course, many kinds of bonds: U.S. Treasury bonds, corporate bonds, municipal bonds, to name a few. Bonds are rated by rating agencies as AAA, AA, A, BBB, BB, B, CCC, etc. and also NR (not rated). The top four ratings (AAA, AA, A and BBB) are what are commonly called “investment grade.”

Many buyers of bonds, for instance, banks, can only purchase investment grade bonds, which is why they also have been called “bank quality.” Bonds can get downgraded because the underlying company loses some of its financial strength to back up the periodic interest payments, if not its principal value, when the bond matures. If this were to happen to, say, a BBB bond and it became a BB bond, it would fall out of its “investment grade/bank quality” status and those companies that are mandated not to own lower than investment grade bonds would have to sell these bonds. This selling pressure can drive the price down, pushing its yield up.

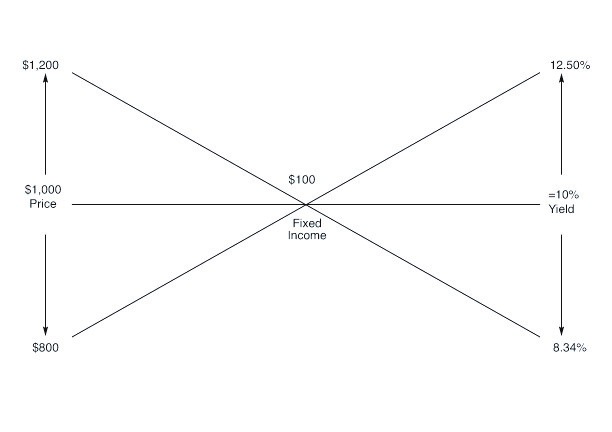

But no matter what the bond quality, here’s a little exercise in the inverse relationship of a bond’s price and current yield.

Let’s say a bond was initially issued at par ($1,000 per bond) and would pay $100 per year in interest. That’s a yield of 10%. Fantasyland right now but in the late 1970s and early 1980s it was pretty real.

So, as the price of a bond goes down (because investors are selling them), its yield goes up and as its price goes up (because investors are buying them), its yield goes down. Everything pivots on the fixed income the bond pays.

So that’s some simple math on bonds as fixed income instruments - the $100 per year interest is fixed but the price is not which can affect the yield.

One point to make here is that while there can be a general instinct that bonds are safe, let’s say safer than stocks, bonds, too, can be volatile and can lose (or gain) value.

Again, per above, not all bonds are the same. There is generally a spread (I use that term carefully) between the current yield of AAA Treasury bonds and say BB corporate bonds, commonly called high-yield bonds or “junk” bonds.” This spread can sometimes suggest over bought or oversold conditions and, if oversold possibly a buying opportunity and, if over bought a selling opportunity

For instance …

Let’s say the normal spread in yields between a 10-year Treasury and a non-investment grade bond is BB bond is 400 basis points (Note: 100 basis points = 1.0%; 50 basis points = 0.50%; 25 basis points = 0.25%.)

So, if the normal difference in yield between a 10-year U.S. Treasury bond and a BB corporate bond is 400 basis points, or 4.0%, what does it tell us if that difference, that the spread between the two yields becomes 1,000 basis points as it is today? It can suggest that the BB bond has been sold off substantially and its price dropped so much to make its yield higher. It also suggests that the 10-year Treasury has been purchased so much as to push its price up and its yield down, thus the widening spread in yield between the two. (By the way, the spread in 2008-2009 was 2,200 basis points so this is not 2008.)

Going back to the graphic example above, would you buy the $800 bond to get, in the example, a 12.5% yield? Or, as a farmer friend of ours said, “Would you buy $14.00 soybeans for $6.00?”

Lot’s in that question but I hope you get the point.

Currently we’ve been seeing these kinds of spreads widen like this. Investors flee lower rated bonds for the safety of U.S. backed bonds, pushing high yield bond yields up and pushing U.S. backed bond yields down – widening the spread.

Another interesting feature regarding the yield of things that relates both to stocks and bonds is that whenever the dividend yield of the S&P 500 is higher than the

10-year Treasury it’s generally a buying opportunity for stocks. Currently the yield on the 10-year is 0.735% while the dividend yield on the S&P 500 is about 2.0%.

NOTE: This is not a buy recommendation or a sell recommendation. But it is an example of what happens in the bond market from time to time.

Cash - There is a saying, from time-to-time (and this seems to be one of them) that “Cash is King.”

For awhile.

Just a few months ago we bemoaned the fact that cash (money markets, savings accounts and the like) had pretty much no yield. Okay, not zero but pretty close to zero. So, the question was, can I get greater than zero in something else? Lately of course, zero sounds pretty good when compared to more volatile asset classes. Zero is better than minus 10% or minus 30% to be sure.

For awhile.

In 1980 you could get 10% on cash, money markets. Of course, mortgages were 13%+. I know, I had one.

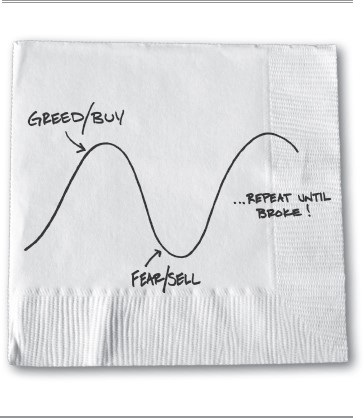

Durable Portfolio Construction - The concept of durable portfolio is to try to construct a portfolio that is designed to better hold up during times of stress, endure the slings and arrows and storms that always come about and be well positioned for the eventual clearer skies. Of course, often the “durability” of a portfolio can also have to do with the durability of one’s emotional state of mind. But we feel this is a wiser approach than trying to time markets because trying to time markets can look like this:

SOURCE: The Behavior Gap, Carl Richard

We spend our working days thinking about this for clients, using several different programs, risk-return tools and portfolio management analytics to help us construct and monitor each portfolio as we also monitor the well-being of each client. The goal is to try to discover and monitor the risk-return characteristics, not only of individual investments, but also entire portfolios, in order to find the best fit for each individual client. The primary goal is to work along-side clients to help them define their needs, wants and wishes and also to better understand how their incomes, assets, investments and financial resources might perform to accommodate those needs, wants and wishes.

Lately, and understandably, most people are pretty much focused on the “needs” part of this, forgoing wants and wishes of vacation trips, new cars, weddings and new kitchen remodel.

The point here is that generally, most people will have all three – needs, wants and wishes as well as stocks, bonds and cash. The question is, how much cash, stocks and bonds to have to make sure (as sure as one can be) that we can meet our needs, wants and wishes over the long term.

Final thought!

We should remember that any recession on the horizon was self-induced. By that I mean we were forced to shut down, forced not to go to work, not to travel, not go shopping, not go out to dinner, and the like. This was not caused by a bank failure. In fact, banks are stronger than they’ve ever been, mainly due to stronger balance sheets required from the 2008 recession.

This virus will be figured out. In fact, here’s a CDC site; Diseases You Almost Forgot About (Thanks to Vaccines)

https://www.cdc.gov/vaccines/parents/diseases/forgot-14-diseases.html

Hang in there.

Sincerely,

David, Lisa & Nicole

David Neunuebel CFP, ChFC, CLU, CIMA, ADPA, CASL

Senior Vice President, Investments

Lisa Barrantes de los Santos, CRPC, ChFC, CLU, CASL

Financial Advisor

Nicole Saragosa

Senior Client Associate

Information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the advisors and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation or an offer to buy or sell any security referred to herein. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. High-yield bonds are not suitable for all investors. The risk of default may increase due to changes in the issuer's credit quality. Price changes may occur due to changes in interest rates and the liquidity of the bond. When appropriate, these bonds should only comprise a modest portion of a portfolio. The projections or other information generated by Goal Planning & Monitoring regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Goal Planning & Monitoring results may vary with each use and over time. The investment profile presented is hypothetical, and the asset allocations are presented only as examples and are not intended as investment advice. Please consult with your financial advisor if you have questions about these examples and how they relate to your own financial situation. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. High-yield bonds are not suitable for all investors. The risk of default may increase due to changes in the issuer's credit quality. Price changes may occur due to changes in interest rates and the liquidity of the bond. When appropriate, these bonds should only comprise a modest portion of a portfolio. Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation.