Rising Policy Uncertainty Leads to Increased Market Volatility

Monthly Market Summary

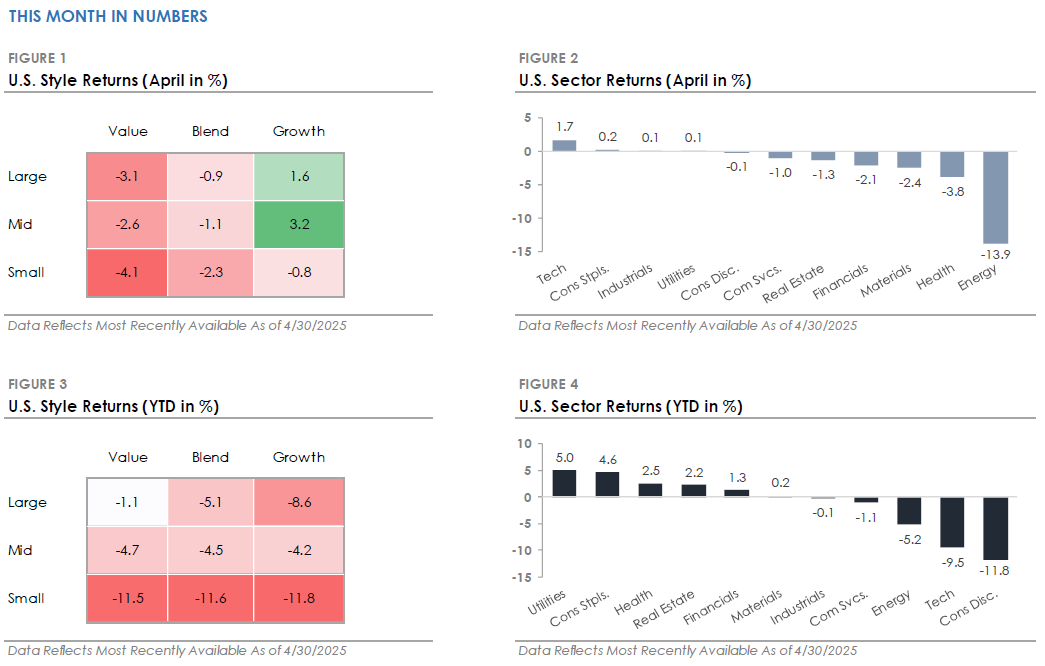

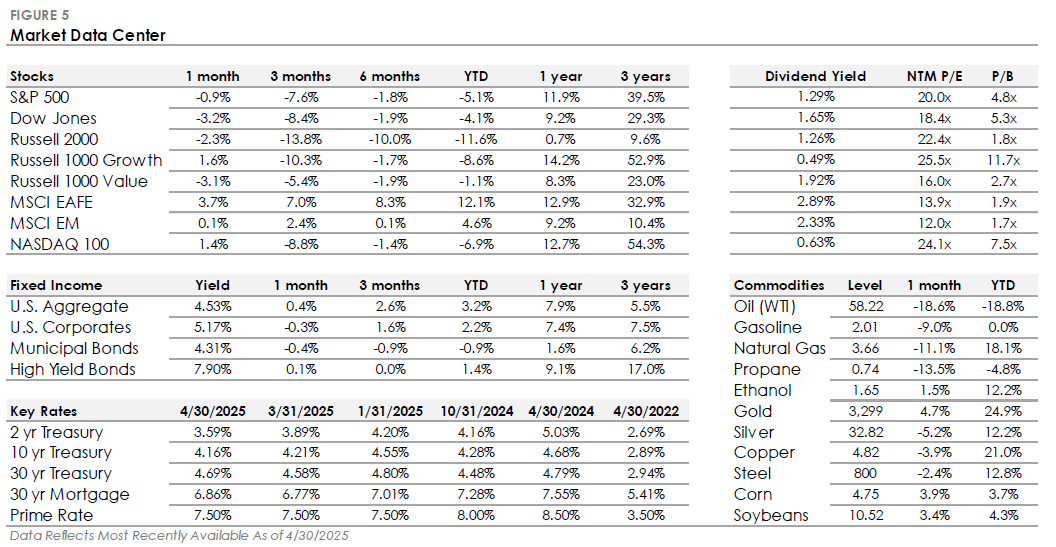

• The S&P 500 Index returned -0.9%, outperforming the Russell 2000 Index’s -2.3% return. Technology was the top-performing S&P 500 sector, followed by Consumer Staples, Industrials, and Utilities. Energy returned -13.9% as oil prices fell -18.6%.

• Bonds ended the month unchanged despite intra-month volatility, with the U.S. Bond Aggregate posting a +0.4% total return. Corporate investment- grade bonds produced a -0.3% total return, underperforming corporate high- yield’s +0.1% return.

• International stocks traded higher and outperformed the S&P Developed Markets gained +3.7%, while Emerging Markets returned +0.1%.

![]()

Markets Rebound from an Early-Month Selloff as Trade Tensions Ease

Stocks declined in early April after the White House unveiled sweeping tariffs, with the S&P 500 falling over -10% in the first week. However, after the administration paused tariffs and trade tensions eased, the S&P 500 rebounded to finish the month with a loss of less than -1%. Interest rates were volatile in April as the market navigated tariff headlines and economic uncertainty but ultimately ended the month unchanged, with Treasury and corporate bonds flat. Outside the stock and bond markets, gold surged to a record high amid increased market volatility. Elsewhere, the U.S. dollar weakened due to concerns about the direction of U.S. policymaking. As discussed below, Washington policy has had a significant impact on global markets this year.

![]()

An Update on This Year’s Biggest Market & Economic Trends

This year’s major market trends have centered around a key theme: rising policy uncertainty. There’s been a notable shift in Washington policy, with the introduction of tariffs leading to increased caution among businesses and consumers. The uncertainty is impacting financial markets, which are focused on how tariffs will affect future economic growth and corporate earnings. Recent economic data indicates that tariffs pulled forward some consumer demand, but forward-looking surveys suggest growth could slow as policy uncertainty delays spending and investment decisions.

2025 has seen a significant change in stock market leadership. The Magnificent 7, a group of leading mega-cap technology stocks, is down over -15% year-to-date after gaining over +60% in 2024. In contrast, defensive sectors are outperforming. Utilities, Consumer Staples, Health Care, and Real Estate have all traded higher this year, even with the S&P 500 down -5.1%. Global stock market leadership has also shifted. International stocks outperformed the S&P 500 in Q1 for the first time since Q3 2023, marking one of their strongest quarters of relative performance since 2000.

The bond market is experiencing increased volatility, with Treasury yields moving sharply in response to tariff developments, fiscal debt concerns, inflation risk, and economic uncertainty. Corporate credit spreads, which tightened to 2007 levels late last year, have widened, causing high-yield bonds to underperform as investors price in a wider range of potential outcomes. Meanwhile, the Federal Reserve’s rate-cutting cycle remains on hold as it balances inflation with the potential for slower economic growth. The market is now forecasting four interest rate cuts in 2025, with the first cut expected in June.

The information herein was obtained from sources which MarketDesk Research LLC (MDR) believes to be reliable, but we do not guarantee its accuracy. Neither the information, nor any opinions expressed, constitute a solicitation of the purchase or sale of any securities or related instruments. MDR is not responsible for any losses incurred from any use of this information.

The financial advisors at Phases Financial Group operate as independent financial advisors for Addison Avenue Investment Services. Financial advisors offer securities through Raymond James Financial Services, Inc. Member FINRA/SIPC, and securities are not insured by credit union insurance, the NCUA or any other government agency, are not deposits or obligations of the credit union, are not guaranteed by the credit union, and are subject to risks, including the possible loss of principal. Phases Financial Group is not a registered broker/dealer and is independent of Raymond James Financial Services. Additionally, First Technology Federal Credit Union and Addison Avenue Investment Services are not registered broker/dealers and are independent of Raymond James Financial Services and Phases Financial Group. Investment advisory services are offered through Raymond James Financial Services Advisors, Inc.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Phases Financial Group and not necessarily those of Raymond James.

The information and opinions provided herein are provided as general market commentary only and are subject to change at any time without notice. This commentary may contain forward-looking statements that are subject to various risks and uncertainties. None of the events or outcomes mentioned here may come to pass, and actual results may differ materially from those expressed or implied in these statements. No mention of a particular security, index, or other instrument in this report constitutes a recommendation to buy, sell, or hold that or any other security, nor does it constitute an opinion on the suitability of any security or index. The report is strictly an informational publication and has been prepared without regard to the particular investments and circumstances of the recipient.

Past performance does not guarantee or indicate future results. Any index performance mentioned is for illustrative purposes only and does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Index performance does not represent the actual performance that would be achieved by investing in a fund. The S&P is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.