Productivity is Problematic

Insights from Cal Newport and the Pushback on Returning to the Office

In “Slow Productivity”, Cal Newport challenges the hyperactive, always-on culture of modern work. He advocates for a slower, more deliberate approach—one where fewer tasks are undertaken with greater depth and intention. Newport’s ideas resonate strongly with today’s workforce, particularly in a post-pandemic world where many employees are resisting the push to return to traditional office environments. Companies like Apple and JPMorgan Chase are finding it difficult to convince workers to give up the focus and flexibility of remote work, and this shift is reverberating through the commercial real estate market and the broader economy.

Key Concepts in “Slow Productivity”

Newport outlines three core pillars in his philosophy of slow productivity:

- Depth Over Speed: The key to sustainable productivity is depth. Rather than rushing through tasks, Newport suggests focusing on fewer, higher-value projects, completing them with deep concentration. This contrasts with the "busyness" mentality prevalent in many offices.

- Work-Life Integration: Rather than treating work as a separate entity that must dominate life, Newport calls for a seamless integration of work and life, allowing for personal fulfillment alongside professional achievements.

- Sustainability of Effort: Newport criticizes the burnout culture and overwork that has become normalized in many industries. Slow productivity encourages a consistent pace over time, avoiding the boom-and-bust cycles of productivity that lead to mental exhaustion.

These principles, especially the focus on deep work, have gained new relevance as workers push back against the traditional office environment post-pandemic.

The Post-Pandemic Office Debate: Resistance to Return

With the pandemic forcing employees to work remotely, many realized the benefits of focused work and better work-life balance. As companies now push for a return to the office (RTO), employees are pushing back, preferring the flexibility and deep work environments they’ve enjoyed at home.

Apple’s RTO Push: A Case Study

Apple, known for its cutting-edge headquarters and culture of in-person collaboration, has been one of the biggest advocates for returning to the office. The company initially set a return policy of three days a week in-office, citing that in-person work fosters creativity and innovation. However, many Apple employees resisted. In 2022, a group of employees penned an internal letter, arguing that remote work allowed them to focus more deeply and avoid long, stressful commutes.

This clash mirrors Newport’s point that typical office environments, with their constant interruptions, can hinder deep, meaningful work. Apple's employees found the home office better suited to tasks that require concentration, challenging the traditional belief that the office is the ultimate productivity space.

JPMorgan Chase: Balancing Hybrid Models

JPMorgan Chase has similarly pushed for employees to return, though it has embraced a hybrid approach. CEO Jamie Dimon has been vocal about the need for employees to return to the office, especially for collaboration, training, and maintaining company culture. Yet even within JPMorgan, about 10% of the workforce prefers to work remotely full-time, and the hybrid model remains popular.

The resistance from employees at Apple and JPMorgan underscores a key takeaway from Newport’s philosophy: employees value environments that allow for deep focus and balance, rather than the traditional office setting that often prioritizes presence over productivity.

Research and Changing Attitudes Toward Work

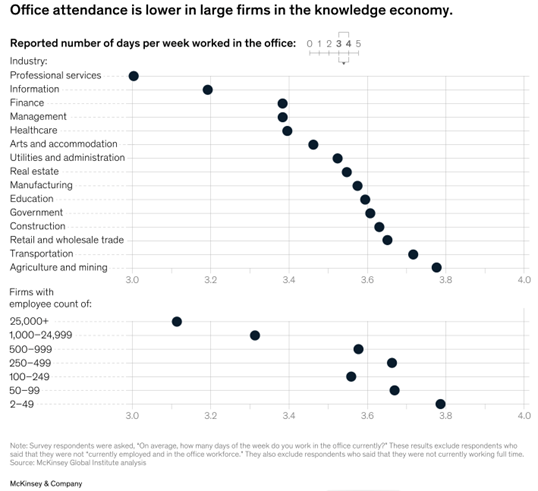

Studies by McKinsey and the CFA Institute have further validated the shift in work preferences. Employees are increasingly demanding flexibility and autonomy, which aligns with Newport's slow productivity principles.

- McKinsey's 2022 Survey revealed that 58% of workers in the U.S. have the option to work from home at least one day per week, and 35% can work remotely full-time. The research also found that hybrid work boosts job satisfaction, with employees reporting greater autonomy and work-life balance.

Source: https://www.mckinsey.com/mgi/our-research/empty-spaces-and-hybrid-places

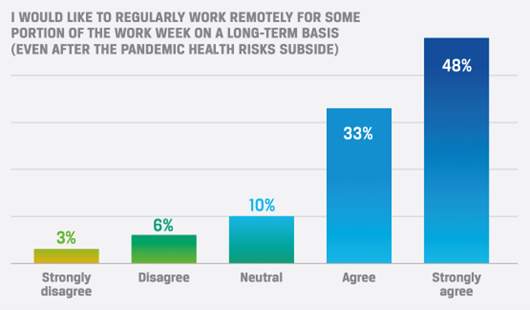

- CFA Institute’s Future of Work Report showed that workers experienced increased productivity and job satisfaction in remote settings, often citing the ability to engage in deeper, more focused work without the distractions of the office.

Source: https://rpc.cfainstitute.org/-/media/documents/survey/future-of-work-overview-11may21.pdf

This growing preference for remote work ties directly into Newport’s idea that traditional office environments can undermine productivity by encouraging shallow work and constant multitasking. Employees who experience the benefits of slow, deliberate work outside the office are less willing to return to old patterns.

Commercial Real Estate: The Fallout of Remote Work

The decline in office attendance has had a profound impact on commercial real estate. With many companies reducing their physical footprint, the demand for office space has plummeted, leading to higher vacancy rates and a rise in mortgage delinquencies. This is particularly evident in major cities like San Francisco and New York, where the shift to hybrid and remote models has left office buildings largely empty.

Rising Vacancy Rates

Data from real estate analytics firm Trepp shows a significant increase in office vacancy rates since 2019. Vacancy rates in major cities climbed from 12% in 2019 to 20% by 2023 as companies downsized or abandoned their office leases.

Quarterly office vacancy rates in the United States from 4th quarter 2017 to 4th quarter 2023:

Source: https://www.statista.com/statistics/194054/us-office-vacancy-rate-forecasts-from-2010/

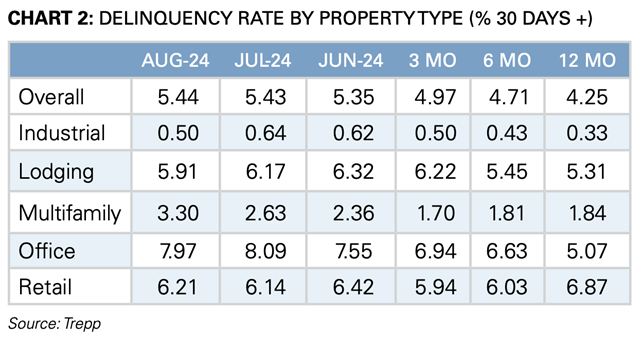

Commercial Mortgage Delinquencies

The shift toward remote work has also caused a spike in mortgage delinquencies on commercial office-backed securities. Trepp reports that the delinquency rate for office-backed commercial mortgage-backed securities (CMBS) rose to 4.5% in 2023, up from 2.5% in 2019, and in fact are still rising. As companies reduce their office space and office landlords struggle to fill vacancies, commercial real estate investors are facing significant financial pressures.

Source: https://www.trepp.com/hubfs/Trepp CMBS Delinquency Report August 2024.pdf

Interest Rates and Economic Pressures

The commercial real estate sector is also grappling with the broader economic impact of higher interest rates. The Federal Reserve's recent rate hikes in 2022 and 2023 have made borrowing more expensive, placing additional strain on commercial landlords. As interest rates have risen, the cost of refinancing and securing loans for office spaces increased, further complicating an already difficult situation for the sector.

These economic pressures are forcing companies to reconsider the value of maintaining large, expensive office spaces. Instead, many organizations are opting for hybrid models that support Newport’s call for deep, meaningful work environments.

Conclusion: A Future Rooted in Slow Productivity

Cal Newport’s “Slow Productivity” offers a compelling roadmap for rethinking work in a post-pandemic world. As companies like Apple and JPMorgan Chase grapple with the return-to-office debate, it’s clear that employees are demanding more flexibility and environments conducive to focused, meaningful work.

Research from McKinsey and the CFA Institute supports the idea that remote and hybrid models are here to stay, with many employees thriving outside traditional office settings. Meanwhile, the rising vacancy rates and mortgage delinquencies in commercial real estate illustrate the broader economic consequences of this shift.

As we move forward, embracing slow productivity—focusing on depth, sustainability, and work-life integration—may be the key to a more effective and fulfilling future of work. Companies that adapt to these new norms will not only support their employees’ well-being but also position themselves for long-term success in an evolving workplace landscape.

Explore Further:

- Cal Newport “Slow Productivity”

- McKinsey Survey: The Future of Work

- CFA Institute: Future of Work Survey

- Trepp Office Delinquency Report

Material was provided by Reem Rawashdeh, CFA, and in part from Cal Newport, McKinsey, CFA Institute and Trepp. Cal Newport, McKinsey, CFA Institute and Trepp are not affiliated with nor endorsed or sponsored by Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing materials are accurate or complete. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation.