October 21st, 2015: Now?

I was recently at the New York Stock Exchange attending an options forum sponsored by the OIC, the education arm of the Options Clearing Corporation.

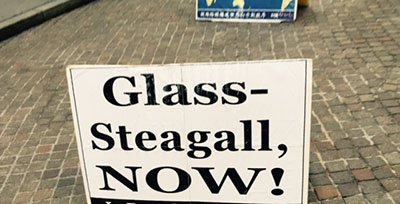

Outside on the cobbled street of dreams, in passive lobbying as it were, was this placard that was propped up espousing (demanding!) the return of the Glass-Steagall Act.

That thought has been known to resonate with me.

Oh to be a fly on the wall of the congressional offices of Senator Carter Glass (D-Virginia) and House Rep Henry Steagall (R-Alabama) when they were crafting the Banking Act of 1933, as it is also sometimes called. At its signing, one might think they all winked at each other and said, "There will never be another period of time as perilous as we have seen during these past four years, we fixed the future!"

When I am in recruiting conversations with financial advisors, I will point out the operational imbalance associated when the brokerage firm they are employed by is owned by a bank. Bankers manage spreads (THINK: CD rates to depositors = small, Credit Card rates to borrowers = large) and brokerage firms manage opportunity and risk in an entrepreneurial partnership with the customer.

Want to borrow money from a bank? You have to practically show them you don't need to borrow the money in the first place. A brokerage relationship? Let's see how many different ways we can make this work.

Could it be limiting and claustrophobic for brokerage financial advisors to work under a "spread-based" set of rules? And do they even know it?

They are two different cultures perhaps not to be combined because they ARE mutually exclusive. It does not result in a well eclipsed Venn diagram.

Forgive me, but can there be NO CONNECTION between Glass-Steagall being repealed in 1999 and the ensuing longest bear market in history (March 2000 - October 2012) and the now apoplectic, finance-numbing Great Recession?

I think I would alter the street placard this way, "Glass-Steagall, NOW?"

Views expressed in this newsletter are the current opinion of the author and are subject to change without notice. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed. Opinions expressed are not necessarily those of Raymond James & Associates.