Tech-related sectors resume market leadership

- 02.02.24

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

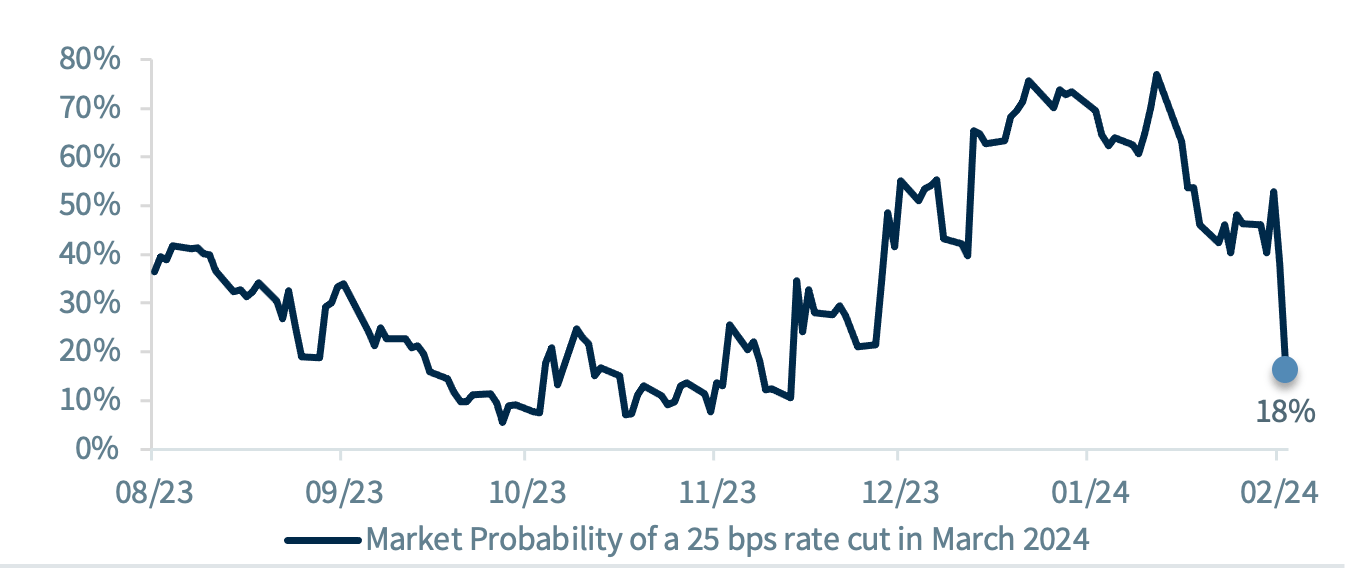

- The Fed is unlikely to cut rates in March

- Tech-related sectors can continue to outperform

- Early signs point to a Trump-Biden rematch

Happy Groundhog Day! Every year on February 2, people gather to see if Punxsutawney Phil sees his shadow. As the old folklore goes, if Punxsutawney Phil sees his shadow, we will have six more weeks of winter. If he doesn’t, we can celebrate the early arrival of spring. This year, Punxsutawney Phil did not see his shadow – so it looks like we’re going to have an early spring. And if you ever saw the movie “Groundhog Day”, you know that it refers to a situation or event that repeats over and over again. Well, it appears there have been some events in the financial markets and political spectrum that are shaping up to be their own version of Groundhog Day – from the Federal Reserve (Fed), to the economy, stock market and upcoming presidential election. Here’s what’s shaping up in the markets.

- The Fed and Chair Powell see their shadow | The Fed concluded its January policy meeting leaving interest rates unchanged, which was widely expected. However, Powell in his press conference suggested an interest rate cut in March was “not the most likely case.” As a result, it will be like Groundhog Day as the Fed goes back into its data-dependent mode for the next seven weeks (before its March 19-20 meeting) to assess the strength of the economy and path of inflation. The ongoing data continues to point to an economy that is slowing, but not contracting. The two dynamics to watch are the health of employment conditions and the amount of potential fiscal stimulus coming from Washington that could support the economy. While Powell acknowledged that progress has been made on the inflation front, policymakers are not yet ready to take a victory lap until inflation moves ‘toward’ 2%—particularly as they have been criticized for letting the inflation genie out of the bottle two years ago. And the last thing they want to do is dial back policy restraint too soon. That’s a key reason why our economist forecasts the Fed will wait until June before it starts cutting interest rates. The March meeting will also be the meeting the Fed starts to discuss its plans around tapering the pace of its balance sheet reduction.

- Tech-related sectors resume market leadership | Heading into 2024, consensus expectations were for market breadth to broaden (i.e., more stocks rising) beyond a narrow group of leaders. While it is still early, the S&P 500’s performance has been a repeat of what we saw throughout much of 2023, with the Tech-related sectors (i.e., MAGMAN – Microsoft, Apple, Google, Meta, Amazon, Nvidia) accounting for nearly all the market’s gains year-to-date. This has pushed the sector valuations to nearly a two-decade high, which begs the question: can Tech’s outperformance continue or are we in store for another dot-com bubble bursting? We think that Tech-related companies can continue to outperform for a few reasons. First, earnings within the Tech space (particularly within the mega-cap names) have been robust compared to the rest of the market. For example, the S&P 500 is expected to see 4Q23 EPS growth of only 1%, whereas Tech and Communication Services are on pace to climb 18% and 47%, respectively.** While the earnings bar was high for MAGMAN ahead of their earnings reports, these names, for the most part, outpaced already optimistic revenue and earnings expectations, with earnings that grew nearly 60% YoY! Moving forward, we continue to favor these Tech-related sectors as they are expected to generate the bulk of the S&P 500’s 2024 earning growth. Second, while S&P 500 margins in aggregate have contracted, Tech-related margins are double that of the S&P 500 and moving to record highs. Third, mega-cap Tech companies have diversified their revenue streams (e.g., MAGMAN receives ~60% of its revenues outside of Tech) which is a very different from the tech companies that dominated during the dot-com bubble. While we expect Tech to lead, we still reiterate our view that we will see a broadening of market participation.

- Early signs point to a Trump-Biden rematch | After the early state contests (i.e., Iowa and New Hampshire), former President Trump remains the overwhelming favorite to win the Republican nomination. While still early in the race, Trump’s sizeable lead over Nikki Haley suggests he will win the nomination providing his legal troubles do not get in the way. Despite concerns about the two candidates’ ages and unfavorable ratings, it does appear the 2024 presidential election is shaping up to be a Trump-Biden rematch. And while Trump is leading Biden in six of the seven battleground states, the winner of the presidential election remains a toss-up—particularly with nine months to go. While the election could prove to be a referendum on both candidates (this is the first election with the same two candidates back-to-back since 1956!), we do know that the economy has historically been the best barometer in ‘calling’ the election. That’s why the next few months are going to be crucial, particularly as the Fed attempts to steer the economy to a soft, non-recessionary landing. If they are successful, it tends to favor the incumbent (Biden).

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.