Earnings season takes center stage

- 01.27.23

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Earnings on pace to post first quarterly decline since 3Q20

- Cost cutting initiatives to keep margins elevated

- Weaker dollar to be a tailwind for U.S. multinationals in 2023

Earnings are front and center – and rightfully so. Over the last 20 years, more than 90% of the S&P 500’s price return has been explained by earnings. Therefore, an accurate reading on earnings is incredibly important to determining the direction of the market. Since the earnings results we are receiving are for the fourth quarter of last year, the reports are effectively 'old news.' However, the accompanying forward-looking commentary from CEOs is 'hot off the press' and provides us with valuable, real-time insights. At this juncture of the 4Q22 earnings season, ~35% of the S&P 500’s market capitalization has reported results. And currently, the Index is on pace for its first quarterly decline in earnings (-3.8%) since 3Q20. Below we summarize our five takeaways for what we’ve learned thus far and share what we hope to learn before the 4Q22 earnings season comes to a close.

What we have learned | As we enter the busiest week of earnings, there are several themes and patterns emerging that include:

- Slowing economic activity | Companies from a wide array of industries (e.g., 3M, Microsoft, Proctor & Gamble, Bank of America) have noted macroeconomic uncertainty and weakening consumer fundamentals (e.g., falling excess savings) as reasons why business and consumer spending has slowed. More important, they expect the slowdown to continue through 2023. Amid the release of this softer forward guidance, the Federal Reserve (Fed) should take note ahead of its FOMC meeting next week (Jan 31-Feb 1). This is the leading reason we expect a further slowing in its pace of rate hikes to 25 basis points (from 50 basis points).

- Dispersion beneath the surface | Looking beyond the headline figures, there have been winners and losers. Companies tied to the services industry (e.g., airlines, restaurants, payment processers) have highlighted an uptick in demand, while goods and interest rate sensitive companies (e.g., homebuilders) referenced a difficult environment.

- Cost cutting the cornerstone | As we have highlighted, 2022 was the year of companies passing on price increases. However, releases thus far have shown 2023 will be a year of cost cutting as businesses seek to maintain near record margins as price hikes are seeing push back from consumers. Some of this has occurred naturally, as transportation companies such as Union Pacific have highlighted falling energy costs and manufacturers have mentioned a decline in input costs. Others have been by choice, as companies are laying off workers to decrease labor costs. Next week’s Employment Cost Index (Tues.), ADP Jobs report (Wed.), and employment report (Fri.) should give us a macro view of the pace that job creation and wage growth are slowing.

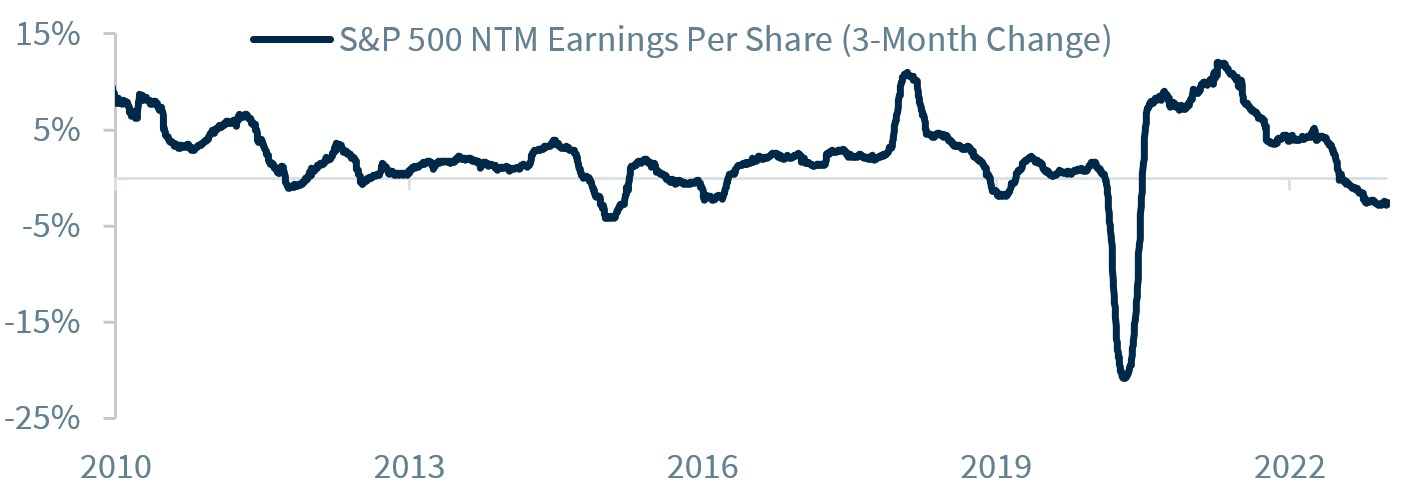

- Cautious guidance | As businesses point to macroeconomic uncertainty, they have grown more cautious with their guidance. This is in large part why forward 12-month earnings estimates have fallen ~3%, the largest three-month decrease (ex-COVID environment) since 2015. With our S&P 500 2023 earnings estimate of $215 below the consensus ($225), more earnings downgrades are expected.

- FX a headwind | On a year-over-year basis, the U.S. dollar rose 20% during the 4Q22, the fastest pace since 2015 and the second fastest since at least 1990. As the S&P 500 receives ~40% of revenues from overseas, some of the major multi-national companies such as McCormick and Abbott Labs highlighted that the stronger USD posed a headwind to earnings. Recent dollar weakness, however, should turn to a tailwind in 2023.

What we hope to learn | With over 65% of earnings yet to report, investors still have much to learn through the 4Q22 earnings season. Next week will be especially prescient, with ~115 S&P 500 companies (representing 33% of market cap) on the docket. With results across a wide swath of sectors and industries set to come, below are some of the key items that we will have our eye on:

- Tech in focus | This week, Microsoft highlighted that business are slowing digital spending amidst macroeconomic uncertainty. We will get a deeper look into the health of this sector next week, as some of the major tech-related companies (Apple, Alphabet, Amazon, Qualcomm) are set to report.

- Retailer health | Heading into 4Q, inventories at five of the major retailers rose 34% over the last two years. Guidance from these firms will confirm if inventories have peaked (and the level of further discounting) and give insights into consumer health.

- Energy momentum | This week, Chevron announced a $75 billion buyback program (>20% of its market cap) after benefiting from rising energy costs. With ~66% of energy firms yet to report, additional shareholder-friendly activity could boost the sector.

- Earnings in positive territory? | Earnings typically come in 3-4% better than estimates coming into the quarter. If they follow this trajectory, it is feasible that earnings growth for the fourth quarter narrows to flat or even flips into positive territory.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.