Navigating Required Minimum Distributions (RMDs) in 2025

As you approach retirement, ensuring a steady and tax-efficient income stream becomes paramount. One critical aspect of this is understanding Required Minimum Distributions (RMDs). These mandatory withdrawals from your retirement accounts can significantly impact your financial plan. But don't worry—navigating RMDs doesn't have to be daunting. With the right strategies and guidance from a knowledgeable financial advisor, you can manage your RMDs effectively and keep your retirement on track.

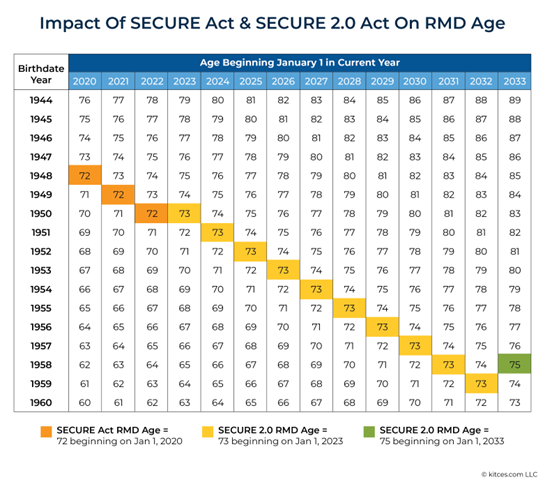

New RMD Age Thresholds: As of 2025, the age at which retirees must start taking RMDs has been adjusted to 73, thanks to the SECURE Act 2.0. This means that if you turn 73 in 2025, you must take your first RMD by April 1, 2026. Subsequent RMDs must be taken by December 31 of each year.

Penalties for Not Taking RMDs: Failing to take your RMD can result in significant penalties. The IRS imposes a 25% excise tax on the amount that should have been withdrawn but wasn't. This penalty can be reduced to 10% if the shortfall is corrected in a timely manner and the account owner can demonstrate that the shortfall was due to reasonable error. It's crucial to stay on top of these requirements to avoid unnecessary financial burdens.

Strategies a Financial Advisor Can Help With to Minimize Tax Impact and Ensure Compliance:

1. Consider Timing: A financial advisor can help you decide whether to delay your first RMD until April 1 of the year following the year you turn 73. They can analyze your overall financial situation to determine if taking two RMDs in one year might push you into a higher tax bracket and advise on the best timing strategy.

2. Qualified Charitable Distributions (QCDs): If you are charitably inclined, your financial advisor can guide you in directing up to $100,000 of your RMD to a qualified charity. This strategy can satisfy your RMD requirement without increasing your taxable income, and your advisor can help ensure all requirements are met.

3. Roth Conversions: Your financial advisor can assist in converting a portion of your traditional IRA to a Roth IRA before reaching RMD age. This can reduce the balance subject to RMDs, potentially lowering future RMD amounts and associated taxes. They can help you understand the tax implications and benefits of this strategy.

4. Aggregate Accounts: If you have multiple IRAs, a financial advisor can help you aggregate the RMD amounts and take the total from one or more accounts. This provides flexibility in managing withdrawals and ensures you meet the RMD requirements for all accounts.

Navigating RMDs can be complex, but with careful planning and the right strategies, you can minimize the tax impact and ensure compliance with IRS rules. It's always a good idea to consult with your financial advisor to tailor RMD strategies to your specific needs and circumstances. They can help you optimize your retirement income and maintain financial security throughout your retirement years.

Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. You should discuss any tax or legal matters with the appropriate professional. RMD's are generally subject to federal income tax and may be subject to state taxes. Consult your tax advisor to assess your situation.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of The Prosper Group Team and not necessarily those of Raymond James.