Managing earnings tax efficiently may be as important as the compensation package itself.

Every year, we hear about the highest paid executives with the biggest bonuses, salaries and raises. Perhaps another interesting question in addition to “how much?” is “how?” Executive compensation is complicated and requires a deft hand at negotiation, particularly when it comes to total compensation, and management. Unsurprisingly, the resulting tax burden can be complicated too.

Here’s a peek at various components that may be included in a total comp package, as well as some of the things to consider. For example, you may have to forfeit things like unvested restricted stock and options should you ever decide to leave the company. However, you may not realize that there is also time value associated with the options. Your advisor can run hypotheticals to analyze forfeiture values at several points in time, allowing you to leverage your total comp package to negotiate better terms if you move to another company.

Salary – Your base compensation. You have been negotiating this with every new job, right? Hopefully you also negotiate titles and paid time off.

Nonqualified deferred compensation – A nonqualified deferred compensation plan allows you to earn wages, bonuses or other compensation but receive them later. Deferring compensation until you’ve left the workforce may help reduce your income-tax burden during retirement, assuming you’ll be in a lower tax bracket at that point.

Equity positions – Many boards want executives to have some skin in the game, so part of their compensation comes in the form of meaningful positions in stock, usually with restrictions around buying and selling. The goal is to have your interests align with the company and its shareholders. That means a large part of your risk and reward is tied to the company and exposed to the vagaries of the stock market.

Restricted stock – Employees who receive restricted stock can pay compensation tax at the time of the grant instead of at the time of vesting by choosing something called an 83(b) election within 30 days of receiving the award. However, it’s important to carefully assess the value of electing 83(b). For instance, until the award vests, you may risk forfeiting the stock if you leave for whatever reason. In these cases, any taxes prepaid via an 83(b) election will not be refunded.

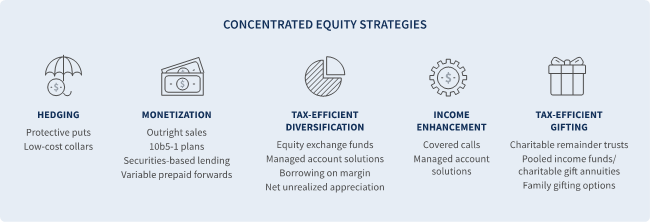

All of these components come with risk. Equity positions can lead to an overconcentration in your company’s stock over time. And you may be attached to it. After all, you should be proud of what you’ve accomplished. But there’s no sure thing in investing, so it makes sense to diversify your holdings to limit overexposure to just one investment, even one you helped build. Allow your financial advisor to help you right-size your portfolio. Together, you can work with your accountant to sell stock over time so you don’t trigger unnecessary tax consequences, violate any insider trading regulations, or infringe on any holding rules established by your company.

If you just can’t let go of some of those shares, talk to your advisor abut tax-efficient gifting to reduce concentrated equity risk while leaving a meaningful legacy to your heirs.

10b5-1 isn’t a new “Star Wars” droid, it’s a Securities and Exchange Commission regulation that allows executives to strategically sell an established number of company shares at regular intervals, even during blackout or restricted periods. Because executives often possess nonpublic information, they are not allowed to buy and sell based on that information. A 10b5-1 plan allows them to systematically divest to avoid perceptions of insider trading.

Retirement planning can be complicated as well, with so many moving parts. You want to make the most of your success, but you may need help finding a tax-efficient way to draw income once retired, including reviewing deferred compensation payout options that adhere to mandatory holding policies. You may be given the choice to take a lump-sum payout in the near term or push payments out five to 10 years, essentially creating a predictable income stream. You’ll likely be at your maximum earnings, and adding lump-sum payments from your nonqualified deferred compensation plan and accumulated stock awards could significantly boost your adjusted gross income as well as your tax obligations.

Keep in mind that these are general guidelines. Depending on your unique situation and the plans you’re making for the future, there may be specific actions you could take to minimize your tax consequences. Consult with your accountant and advisor to determine what will work best for you and your family.

Sources: The Wall Street Journal; Harvard Law School Forum on Corporate Governance and Financial Regulation; epi.org; mckinsey.com; fidelity.com; electrek.co; salary.com; harvardmagazine.com; bloomberg.com; rsmus.com; theatlantic.com; hbr.org