Cost Basis (n.): The original value of an asset used for tax purposes, adjusted for corporate actions, distributions, wash sale rule and income reallocation.

Seems straightforward, doesn’t it? But the simple number can make a big difference when it comes to taxes. The Internal Revenue Service uses your cost basis to calculate how much you’ve gained or lost by owning a particular asset, including tangible property and investments. You typically will owe short- or long-term capital gains taxes on the gains realized when you sell the asset, if the asset has appreciated between when you purchased it and when it’s sold. Your cost basis matters when it comes to estate planning, too. Here’s why.

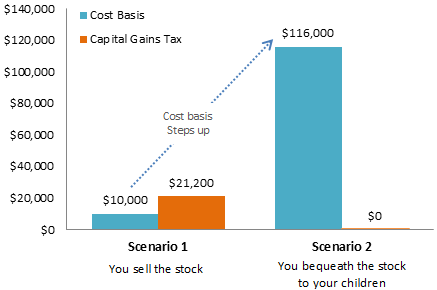

Step-ups in action. Say you purchased 1,000 shares of a tech company stock in 1980, when it was approximately $10 per share, and held on to it. Decades later, the stock is now valued at $116 per share.

Scenario 1 - You sell the stock yourself. You’ll reap $106,000 in gains but also owe Uncle Sam $21,000 in long-term capital gains taxes (assuming the 20% rate, which could be higher for those subject to the Medicare surtax).

Now consider this…

Scenario 2 - You bequeath your shares to your children.When your children inherit, they enjoy a “cost-basis step-up” to the stock’s fair market value (FMV) on the date of your passing ($116 per share). The stock also is automatically considered a long-term holding, regardless of whether you yourself held it for more than a year. The step-up narrows the amount of gain that would be subject to long-term capital gains taxes if the stock appreciates further. If your children immediately sell the inherited shares, they will owe $0 in capital gains taxes, even though the stock appreciated significantly during your ownership.

Tax Savings: That’s a potential savings of $21,000 with cost-basis step-ups as part of your estate and tax planning.

There are a couple of variations of cost-basis step-ups, including ones that take joint ownership of the original asset into account and one that uses an alternate valuation date. Some accounts qualify for an alternate valuation six months from the original date of death.

Because taxes are complicated, it’s wise to consult with your financial and tax professionals in order to stay within the guidelines.

*Above content provided by Raymond James’ Spring 2017 publication of Worthwhile Magazine.

Opinions expressed are not necessarily those of Raymond James & Associates. Information contained was received from sources believed to be reliable, but accuracy is not guaranteed. Investing always involves risk and you may incur a profit or loss. No investing strategy can guarantee success. Past performance may not be indicative of future results.