At first (perhaps second and third) glance, everything about Social Security seems complicated. There are myriad ways to determine when to file and how in order to maximize your household benefits. Then you have to calculate what you’ll owe in federal income tax. Help from your advisor and a knowledgeable accountant will help with the specifics, but here are some guidelines to help you better understand your tax obligations in retirement.

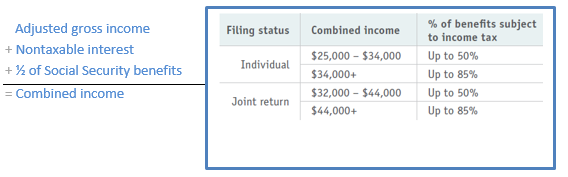

You’ll generally have to pay your regular federal income tax rate on your Social Security benefits if you have other sources of income (e.g., wages, self-employment, interest, dividends and other taxable income that is reported on your tax return). This includes income from retirement accounts, such as your 401(k) or pension, but doesn’t include Roth IRAs because you’ve already paid taxes on that money. If Social Security is your only source of income, then it’s quite likely you won’t have to pay taxes or even file a tax return. The rest of us, though, will have to pay Uncle Sam something. The good news is that no one pays federal income tax on more than 85% of his or her benefits. That means everyone gets at least 15% of their benefits free of federal income tax. And if you’re under the thresholds outlined below, your benefits won’t be taxed at all. The IRS uses something called combined income (sometimes called provisional income) to determine what amount is subject to taxation. Here’s the formula:

Here’s where it gets more complicated, and professional help comes in handy. You’ll note that the chart says “up to”, but what does that mean? If you’re in the 50% camp, the amount you include in your taxable income will be the lesser of either

1) half of your annual benefits or 2) half of the difference between your combined income and the IRS threshold. Things get more complex for those paying taxes on 85% of their benefits. The IRS offers both a worksheet in Publication 915 (irs.gov/pub/irs-pdf) and specialized software to help retirees calculate their Social Security tax liability.

Very few of us enjoy paying taxes, but when it comes to retirement, it’s a sign that you’re not entirely dependent on Social Security as your only source of income. Know, too, that if you owe, you can make estimated quarterly tax payments or choose to have federal taxes withheld using IRS Form W-4V. Talk to your advisor and accountant about how to pay your federal – and possibly state – income taxes without disrupting your financial plan.

*Sources: IRS.gov; AARP.com; ssa.gov

Opinions expressed are not necessarily those of Raymond James & Associates. Information contained was received from sources believed to be reliable, but accuracy is not guaranteed. Investing always involves risk and you may incur a profit or loss. No investing strategy can guarantee success. Past performance may not be indicative of future results.

*The referenced websites are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor the following websites or their respective sponsors. Raymond James is not responsible for the content of the websites or the collection or use of information regarding the website's users and/or members.