A quick guide on cryptocurrency application and risks.

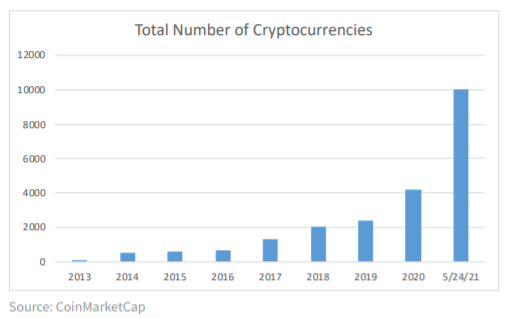

Cryptocurrencies represent digital units that are utilized to facilitate online transactions without the need for a central intermediary to process. The transactions are digitally recorded on a public ledger. As of May 2021, per CoinMarketCap, more than 10,000 cryptocurrencies, also known as coins, have been launched as there are minimal barriers to launching new coins. While almost all cryptocurrencies have no intrinsic value, the two most popular cryptocurrencies, Bitcoin and Ether, have a combined market value of over $1 trillion.*

Bitcoin, launched in 2009, is the most widely known cryptocurrency and its market capitalization surpasses that of all other cryptocurrencies. Additionally, Bitcoin’s invention coincided with that of the blockchain (described later), which was required to facilitate transactions. The supply of Bitcoin is finite (currently capped at 21 million coins) and designed to become increasingly constrained over time.

Ethereum is the most frequently used open source blockchain network (described later). The primary use case for Ethereum is the built-in functionality to create so-called “smart” contracts that can be executed without an intermediary. A simple example is a life insurance “smart” contract. When someone with a life insurance policy passes away, the notarized death certificate would be the input trigger for the contract to release the payment to the named beneficiaries. Ether, which is currently the second largest cryptocurrency by market capitalization, is the native cryptocurrency built into the Ethereum network. Ether is the cryptocurrency that is utilized to facilitate Ethereum smart contracts.

To read the rest of the Cryptocurrency Primer quick guide, please click here…

Opinions expressed are not necessarily those of Raymond James & Associates. Information contained was received from sources believed to be reliable, but accuracy is not guaranteed. Investing always involves risk and you may incur a profit or loss. No investing strategy can guarantee success. Past performance may not be indicative of future results.

Raymond James & Associates, Inc., member New York Stock Exchange / SIPC

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

© 2021 Raymond James & Associates, Inc., member New York Stock Exchange/SIPC. © 2021 Raymond James Financial Services, Inc., member FINRA/ SIPC. Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value. Raymond James® is a registered trademark of Raymond James Financial, Inc. 21-BDMKT-5050 KS 5/21

Prior to making an investment decision, please consult with your financial advisor about your individual situation. The prominent underlying risk of using Bitcoin as a medium of exchange is that it is not authorized or regulated by any central bank. Bitcoin issuers are not registered with the SEC, and the Bitcoin marketplace is currently unregulated. Bitcoin and other cryptocurrencies are very speculative investments and involve a high degree of risk. Investors must have the financial ability, sophistication/experience and willingness to bear the risks of an investment, and a potential total loss of their investment. Securities that have been classified as Bitcoin-related cannot be purchased or deposited in Raymond James client accounts

REGULATORY BACKGROUND | Financial Industry Regulatory Authority (“FINRA”) and the Securities and Exchange Commission (“SEC”) have issued multiple warnings to investors regarding the risks associated with Bitcoin and other cryptocurrency. New products and/or technology, such as Bitcoin and other cryptocurrency, are typically considered high-risk investment opportunities as they commonly are targeted by fraudsters who manipulate the market with artificial promotional scams. As of January 2021, the SEC is currently reviewing more than 10 applications and has rejected multiple applications from fund companies seeking to create and list a cryptocurrency Exchange Traded Product (“ETP”) due to the highly unregulated nature of the cryptocurrency marketplace. The biggest risk factors surrounding Bitcoin (and other cryptocurrency) issuers include that they are not registered with the SEC (or local country regulator) and can be exploited by criminals for money laundering/terrorist financing making the source of funds difficult to follow and verify.

RJF CRYPTOCURRENCY SECURITY DEFINITION | Approved cryptocurrency-related securities are defined as any security that is associated with a company and/ or issuer that is:

Prohibited cryptocurrency-related securities are defined as any security that is associated with a company and/or issuer that is affiliated with one or more of, but not limited to, the following non-U.S. federally regulated cryptocurrency business objectives: