First, we wish you and your family good health. As a business, we are considered ‘essential services’. Good business planning has put us in a position to work from home and practice ‘stay in place’ and social distancing. We have been doing this since Monday, March 16. We remain available to conduct your business as your financial advisor and to lend a line of communication as your neighbor and friend.

Crises are an evolution in development and a revolution in their awareness to the masses. This statement piggybacks off the title of our last communication, ‘There is a Change in the Nature of Change’. We last wrote that change is coming faster and with more breadth than ever in the history of man. The last two weeks centered in the Coronavirus COVID-19 are the antithesis of this phenomenon.

In two weeks the Coronavirus COVID-19 has gone from a news story to ‘the news’. In a short period of time, the virus is threatening our nation’s health, our medical system, our financial markets and our economy. The first case was discovered in the US in mid-January 2020; just over 60 days ago. As we write on March 23, there are approximately 44,000 confirmed cases (and presumably many more) in the US. (John Hopkins, Corona Resource Center).

Policy Response

The response to the outbreak has been unprecedented in its scope and speed. The following has happened in the last two weeks:

- US monetary policy has reduced rates to 0%

- The US Treasury has implemented wide-sweeping intervention in the credit markets

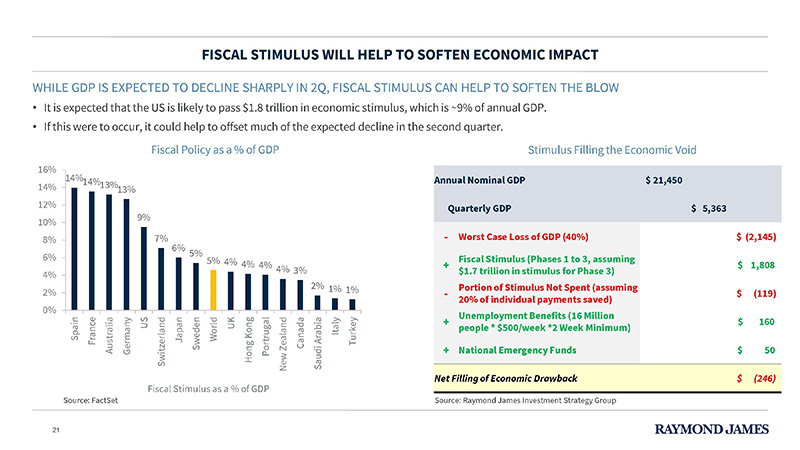

- US fiscal policy has implemented $800 billion of health therapy and diagnostic funding and $100 billion of unemployment and sick leave benefits

- Additional fiscal funding is being debated including business loans and payroll support estimated at $2 trillion

- States including California, New York, Washington, Illinois, Michigan, Ohio and Massachusetts, among others, have implemented ‘Stay in Place’ mandates. Many cities have joined and additional states will follow

- Social distancing is the new norm and first weapon against the pandemic

- The Stafford Act calling for the National Guard and the Defense Production Act repurposing production to fight the virus have been implemented widely

- The US has closed borders to Mexico and Canada and limited international travel

All of this and more in the US and similar measures are being enacted daily across the globe. The speed and breadth of governmental policy has been unprecedented.

The Market Response

Speed and breadth have described the effects on the financial markets as well. In just the past two weeks:

- The daily volatility is unprecedented; averaging 7% daily price moves over an 8 day period

- The VIX (volatility index), which measures market risk and investor’s sentiments, reached historically high record levels

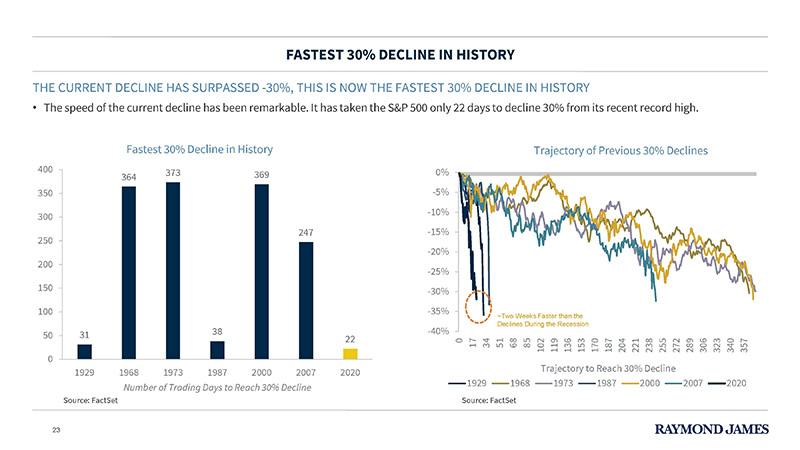

- The US stock market took only 22 days to decline 30% from its all-time high. By comparison, it took the Tech market decline in 2000 369 days and the Financial Crisis market decline 247 days to correct the same amount

- Yield spreads (the difference in rates paid between quality bonds and higher risk bonds) widened from a historically narrow range of 4-6% to 12+% during the week of March 16’s massive market volatility

The Economic Response

In two weeks, economic growth deterioration has been dramatic. In the last two weeks:

- ‘Stay in Place’ and closure of non-essential businesses have effectively shutting down restaurant and leisure activities

- The airline, restaurant and tourism industries are running at a fraction of capacity

- The largest post WWII decline for quarterly GDP is -10%. We are likely to be experiencing a drop of this amount or more this quarter

- Unemployment claims are beginning and may rise at their fastest rate in history

AB&E Response

Our daily intake of information and conversations revolve around COVID-19, government policy response, the financial markets and the global economy. Positive changes will need to be seen from each of these areas, in the order described above, to know we are through to the other side of this crisis.

Listening to our own Raymond James healthcare and policy experts, as well others, leads us to believe we have not seen the worst of the virus to date. But response is ramping up and attention to flattening the virus contagion curve is acute.

The focus of policy response has been to provide working credit markets and a fiscal focus on saving businesses, jobs and future income. It has been significant and swift.

The markets are a forward looking mechanism and will react before you and I are comfortable or the economy shows signs of a recovery. Bear markets typically find their bottoms several months before recessions end. It is likely markets will find further lows before a sustainable market recovery is possible.

The economy will be the last of these items to show recovery. Job creation and increased confidence to spend and invest in businesses comes slower than policy response and market reactions.

We have been in daily conversations, reading and listening to conference calls with our own internal analysts and strategists and external thought leaders. There has been significant evaluations of the fluid events, but we have not seen significant shifts in strategy.

We had prepared portfolios for a risk-off scenario the last several years. Our anticipation was a modest recession and a modest bear market. In our opinion, the crisis has amplified both of these events.

As investors digest economic fallout from the Coronavirus measures, it is likely that the current market lows will experience a retracement, or if Stay in Place (SIP) measures are extended, lower lows are a possibility. Market lows tend to base on lesser volatility as investors become disenchanted with equities as an asset class. Pessimism is in its depths and hope is scarce. Market lows are a process, more than a specific point in time. History will provide the exact market low, but it is never known to the trader or investor for months or years hence.

With that said, the goal of a market downturn is to position one’s portfolio for better future expected returns. This entails adding risk to the portfolios by either buying risk assets with cash or reallocating assets from more conservative assets with lower expected returns to risk assets with higher expected returns. Following is a simplistic example of the opportunity to rebalance.

|

Target before crisis |

Today (03/24/2020) |

Opportunity to rebalance |

|

|

Stocks |

50% |

35% |

+15% |

|

Bonds |

50% |

65% |

-15% |

*The investment profile is hypothetical, and the asset allocations are presented only as an example and are not intended as investment advice.

Please consult with your financial advisor if you have questions about these examples and how they relate to your own financial situation.

Most models or portfolios are more broadly diversified than the example above. However, the idea and theory is to buy lower and sell higher. The last 3-5 years offered an opportunity to rebalance from equities to bonds as equities went higher. Today’s trade may be the opposite with the stock market lower and bond allocations a higher percentage of portfolio allocations.

When history is recorded of this time period, it will be signified with a theme of significance and speed. To date, it has been the pain and loss that is exemplified in this regard. We are hopeful, and it is possible, that the widespread corrective measures currently being taken and their corresponding results may result in significant and quick results.

We are not naive enough to believe that this will end placing us back to where we started in the same time it unfolded. But market recoveries can begin abruptly and significantly. Being active investors during the bottom process and the recovery following is key to long-term investing success.

*Views expressed are the current opinions of the author, but not necessarily those of Raymond James & Associates or your Financial Advisor. The author’s opinions and forward looking statements expressed are subject to change without notice.

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk including the possible loss of capital. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.

*The CBOE Volatility Index® (VIX® Index®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index options prices.

*Rebalancing a non-retirement account could be a taxable event that may increase your tax liability.

Insights & Discovery