A comprehensive Approach

Nobody plans to fail...they just fail to plan! When it comes to finances and planning for the future, there are so many concepts and rules of thumb to balance with the different parts of your life. The team at Foundation Wealth Strategies utilizes the depth of resources at Raymond James and helps to categorize and make clear the path towards reaching your goals. Similar to planning a voyage, we provide advice and advocacy toward understanding how to properly align segments of your journey that ultimately allow for a smooth odyssey.

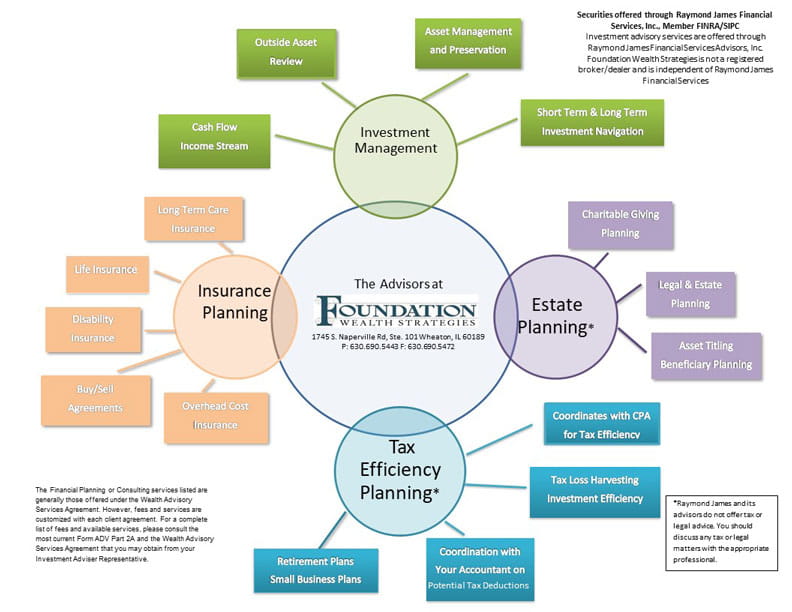

We help you arrange four areas of your finances in an easy-to-understand method of organization that takes into account the best possible schedule of when to commence the different parts.

The four areas in which we focus are:

-

We spend our days deep in the details of investing to provide crafted solutions. Asset Management Services, available exclusively through Raymond James advisors, provides fee-based accounts that unlock access to specialized money managers and strategies, as well as more traditional managed portfolios. They also provide a gateway to a variety of wealth management solutions at Raymond James – solutions to help your money work for you. Our goal is to help provide solutions for the complexities, leaving you more time for your passions. Our team uses an established, proactive due diligence process to help ensure the managers who are invited to our platform have maintained their standards of excellence over time. We partner with seasoned research teams that cover individual securities, fixed income, mutual funds, futures and options strategies and cash management solutions.

-

Understanding risk can be a complex concept and balancing the amount of risk with the right types of insurance can be stressful and very expensive. We provide decades of expertise on how to balance risk with insurance by partnering with a large number of top firms across the nation that use both seasoned, proven solutions as well as new, state-of-the-art products that can function as multiple coverages for catastrophic events in your life. As your experienced guide, we audit your risk, educate you on the types of risk that your financial plan carries, and help by managing your existing insurance portfolio or by suggesting new ways of reducing costs. This is all accomplished with a priority placed on educating you and simplifying the process of auditing your risks on a regular basis. We also specialize in helping executives, business owners, and professionals with more complex solutions such as buy/sell arrangements, key person insurance and deferred compensation programs.

-

Understanding how investments are taxed is a key planning technique we utilize to provide a more efficient plan for the long term. We pay close attention to tax rules today and apply this knowledge toward building a more efficient portfolio. By working closely with a network of CPAs and accountants, or by partnering with your long-time tax professional in a collaborative manner, we are able to keep more money in your pocket by reducing taxes, expenses and time spent on updates to your plan. Whether your plan is more sophisticated in its approach or simple in character, we pay close attention to building a portfolio that keeps tax efficiency at the top of the priority list.

-

Protecting your hard-earned portfolio doesn’t just stop with a robust estate plan. It requires ongoing monitoring of HOW you own your assets and partnership with top-rated legal firms that balance immediate protection with long-term planning for the future. We prefer to work closely with your legal team or can introduce you to trusted colleagues that we’ve worked with for years – all in an effort to balance planning for the future with keeping costs low and simplifying your plan. We monitor your overall portfolio and financial plan by regularly checking beneficiary designations, changes in federal and state estate planning laws, and suggesting updates to your documents. As a Chartered Financial Consultant ® and Certified Financial Planner ®, we have experience with inheriting assets, planning for generational wealth transfer, and how to efficiently protect assets from creditors or governmental agencies like Medicaid through collaboration with legal experts and partners. Whether you need to protect your business from creditors or specific property from liabilities, having the right team in place can ensure documentation and planning is manifested in a robust team approach.

Advisory Fees are in addition to the internal expenses charged by mutual funds and other investment company securities. To the extent that clients intend to hold these securities, the internal expenses should be included when evaluating the costs of a fee-based account. Clients should periodically re-evaluate whether the use of an asset-based fee continues to be appropriate in servicing their needs. A list of additional considerations, as well as the fee schedule, is available in the firm’s Form ADV Part II as well as the client agreement. Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC Investment advisory services are offered through Raymond James Financial Services Advisors, Inc. Foundation Wealth Strategies is not a registered broker/dealer and is independent of Raymond James Financial Services

Our Client Onboarding Process

Our personalized client onboarding process provides a strong foundation for establishing our long-term professional relationship. We invest the time to help ensure all bases are covered, all details are addressed and all parties are on the same page.

We are committed to delivering you the exemplary service you deserve. Learn more about what it means to be one of our valued clients.

-

Beginning of our relationship

Sign new account paperwork and forms; refine the match between your specific goals and concerns versus your current accounts.Service commitment meeting

Manage your expectations including online access and cash management tools; set up statement and communication preferences and further analysis of other financial concerns.Goal Planning & Monitoring meeting

Review your personalized, comprehensive financial plan; reassess and reprioritize your goals if necessary. -

Review current life and healthcare insurance policies and other products such as annuities.

Legal and estate planning

Evaluate existing documents, like wills and trusts, and family succession plans, or discuss the need for establishing a plan.Strategy and planning meetings

Ongoing regular review and adjustment of your investments and financial plan.Year-end and tax season planning

Timely planning to help mitigate your tax burden. -

Events

Quarterly market update webinars

Annual educational topic workshops and family appreciation event

Case study

revamping a savings strategy

Sarah, a 50-year-old physician, needed help getting her retirement savings back on track. The past few years, she struggled with lifestyle inflation as she tried to keep up with colleagues’ lavish spending and now had concerns about outliving her savings, as she had seen family members experience. We helped her clarify her priorities and get a handle on her cash flow, showing her how long her money might last under different scenarios. We also helped her work out an income strategy that aligned with her vision of how she wants to spend her time in retirement.

This hypothetical example is for illustrative purposes and is not representative of any actual experience. Individual results will vary.

See the retirement readiness checklist

Experience to lead the way

Our combined years in the financial services industry provide you with a seasoned team and a level of knowledge necessary to help you pursue your financial goals and objectives.