March Letter

Health Is Your True Wealth

Please, please, please take care of yourself and your loved ones. It appears as if the reality of this global pandemic is starting to set in. With this reality, comes high levels of fear. A lot of this fear is driven by uncertainty. People are concerned that they will lose some income, they won’t have someone to watch their kids, and they shouldn’t visit their elderly parents. Our hearts go out to everyone who is struggling with challenges related to this virus.

The Formula for a Bear Market

- A terrible thing happens that comes as a surprise.

- That surprise causes companies to lose revenue, and consumers to lose confidence.

- Those events cause the economy to slow down.

- The market reacts by falling and falling and falling.

- The terrible thing gets on track to being resolved.

- The market starts to turn around, returns to where it started, and continues to grow

This is the formula that has repeated itself over the decades. Here are examples of things in the past that has created a bear market: New technology trading at much higher than its value, banks issuing a ton of bad loans, planes hitting the Twin Towers, and the list goes on. The length and the depth of these cycles change, but the pattern is always the same.

In this current cycle, we have sped through the first 4 steps and are working on step 5. That is our big unknown. We need to understand how to handle this virus and Congress needs to figure out how to provide protection to people and companies that are being financially damaged. The good news is that a lot of people are working very hard to solve both of these issues.

Once the market feels that solutions have been found - not necessarily implemented, but heading in the right direction - they will calm down and start to turn around.

Well-Prepared and Here for You

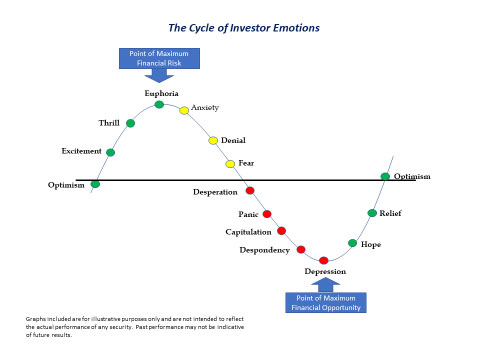

I’ve been using this investor emotions chart since I’ve been in business. I believe it was first created during the Dutch tulip crisis in 1637. At the peak of the mania, some single bulbs sold for 10 times the annual income of a skilled worker. Very little has changed. We haven’t created any new emotions since that time.

If you can figure out where we are on this chart, then you’ll start to know when we are at the bottom. So, when is it going to end? Honestly, I have no idea, but I do know it will end. We must stop the economy to fix the health crisis. I’ve read four possible scenarios. They are basically driven by how fast we get ahead of the virus in order to slow the progression. This means how quickly and aggressively our government requires us to quarantine. Once this peaks, things will start to simmer down. We are now seeing this in China and Korea, which is a very good sign. Things don’t have to be great for the market to improve. The market moves on direction. The market is asking itself, are things getting better or worse? Once we turn a corner, the market will too.

Stopping and starting the world’s largest economy is a daunting task. But it will restart. Even when you’re at home, you continue to spend money: order packages from Amazon, use technology needed to work from home, and buy grocery staples like Kellogg’s cereal, Crest toothpaste, Clorox, soap and let’s not forget toilet paper!

The economic impact will hurt, there’s no doubt about that. The good news is that our government is working on measures to help ease the impact. Someone sent me a great quote: “The calvary is coming, but they’re slow and arguing over which horse to ride”. It does appear that they are going to do whatever it takes – that’s very good news.

We have planned for this because we prepare for bear markets and recessions. We didn’t know when, what, or why, but we knew something was coming, because the pattern repeats itself. We have always asked you about any spending you might have in the next two years, and have insisted you keep that in cash. We also keep two more years in something conservative, just in case. Your goal plan has this stock market scenario built into it. This event will not negatively impact your financial plan.

I don’t mean to minimize how frightening this is right now, but this WILL end. A vaccine will be created, we’ll figure out how to test, screen and treat this. Schools and businesses will be back to normal. And so will the market. The US economy will continue to grow as it has since 1776.

Please take care of yourself and your loved ones during this health crisis. We’ll take care of things here. Please reach out to us if you have any questions and concerns. This may last for a while, and we will be here for you each step of the way. This too shall pass.

Any opinions are those of the author and not necessarily those of Raymond James. There is no assurance any of the trends mentioned will continue or forecasts will occur. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance does not guarantee future results.

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC. © 2020 Raymond James Financial Services, Inc., member FINRA/SIPC. Evans Wealth Strategies is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment advisory services offered through Raymond James Financial Services Advisors, Inc.