New Tariffs

We are seeing a pickup in volatility that is linked to the some of the decisions regarding tariffs with some of our biggest trading partners.

What we don’t know is whether these tariffs are part of a short-term negotiating tactic or are here for a long time. The fact that U.S., Canada and Mexico have become one big trading bloc, which assumed that we had a long-lasting agreement (the USMCA) upon which many integral supply chains have been built.

The potential deconstruction of these integrated supply chains is causing confusion for many companies and their investors as they try to understand exactly how they will work. Their hesitancy to start reengineering these complex arrangements, not knowing whether these tariffs will last a few months or for years, has created a great deal of uncertainty.

Tariffs are a tax. As Warren Buffet said this weekend, the tooth fairy doesn’t pay these taxes. They are paid by the U.S. companies as they receive these imports. The cost of the tariffs will be paid by some combination of higher prices for consumers, lower profits for our companies or lower prices for the countries that export to us.

Higher costs on imports do not cause overall inflation, but they can increase the costs of imported items that had tariffs put on them. Which means we have less money to spend on other items. Only an increase in the money supply that is greater than the growth of our economy causes “widespread inflation”.

The market is reacting to this uncertainty with lowered expectations of economic growth. This may be a result of a potential slowing growth of our workforce as immigration enforcement changes are implemented. As you can see on the chart below, the U.S. stock market is down about 2% for this calendar year, but down about 6% in the last month.

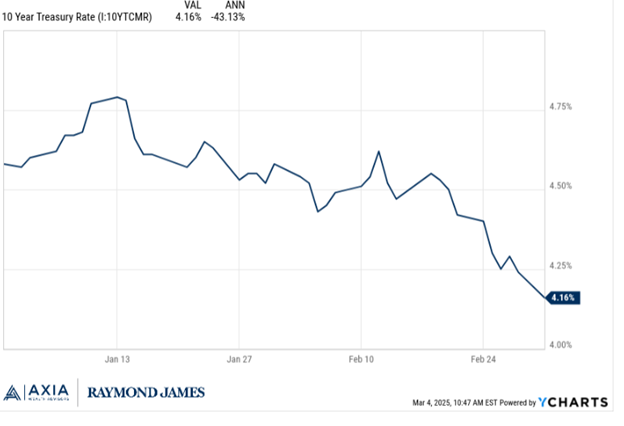

A smaller government deficit, which is needed, can also slow the economy as less money is spent in various manners. This is also showing up in lower bond yields and increased expectations of interest rate cuts by the Federal Reserve (Fed). How the markets will adjust to this and any new news coming from tax, regulatory changes etc. is unknown. The graph below shows the drop in yield of the benchmark 10-year treasury this year.

As you can see, the interest rate on this important bond is down over ½ of 1% since the middle of January, without any interest rate changes from the Fed. Again, this move reflects market participants weighing slowing economic growth and potentially less supply of new bonds as DOGE and Congress try to reduce the deficit.

One thing has become certain and that is “stay tuned” regarding a heavy dose of new policies and arrangements in our trading position with other countries.

How all this will eventually shake out will only become evident in time. Hopefully this will work for the benefit of our economy and citizens. But expect the markets to adjust abruptly to the latest statements from the new administration, whether perceived positively or negatively.

We seem to be in for a period of higher-than-normal volatility- but remember volatility can be up or down movements. And these movements have proven time and again to be impossible to foresee or time.

In the interim, we know that every company is looking at how best to increase their revenue and profits given any new scenario they encounter. And companies innovating to provide new solutions and products to grow their businesses and meet customer expectations will continue to be the case.

As long-term investors, we know that owning these companies via the stock market has rewarded us over the long term. But to benefit from that growth, we also have to endure trying periods which happen more frequently than we prefer.

As always, please don’t hesitate to contact us with any questions, thoughts or concerns or something new in your life that we need to take into consideration.

And thank you very much for your trust and confidence in us.

Beach

Disclosure

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of John Foster and not necessarily those of Raymond James. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.