The Market Often Tests Us

The last couple of weeks there has been no shortage of headlines about the financial markets and news which have created fear among many investors.

Each time something like this happens, it seems like this may last forever. And while it is not fun to see our account values decline, it is not a reason to abandon a sound, long-term strategy that is designed to meet your goals over many years.

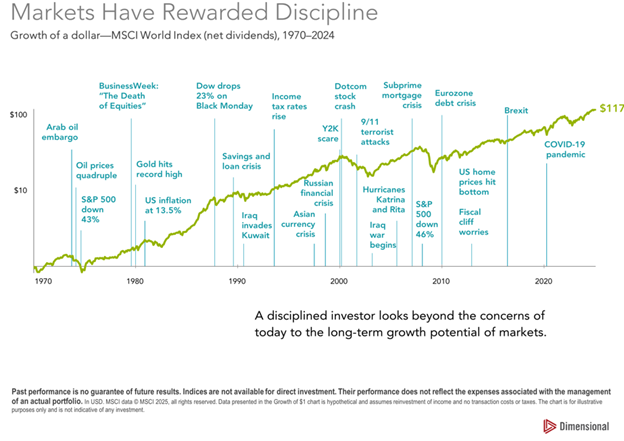

We tend to forget, but we have these types of setbacks regularly, and there are always scary headlines that accompany those market pullbacks. The chart below reminds us of what we have been through the last 50 plus years, some of the headlines that accompanied those pullbacks, and more importantly what $1 dollar grew to become for someone who endured all of these drawdowns.

The question of how long and to what extent this current drawdown will be is unknowable. But the chart above does remind us that those who stayed invested through all these types of challenges were rewarded.

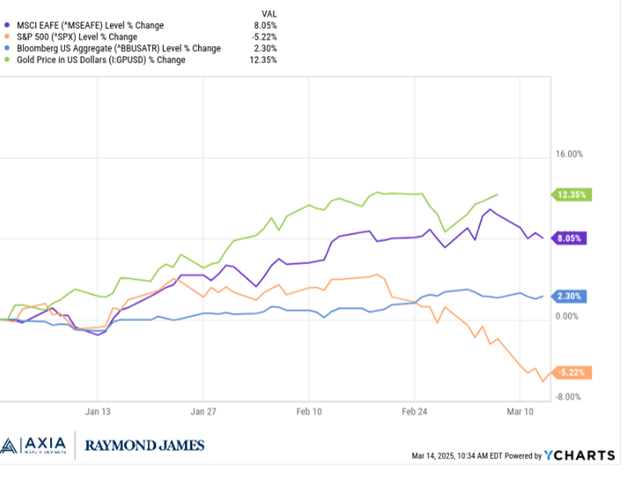

This is also a time to appreciate the value of diversification. Much of the financial news is focused on the performance of the big tech companies in the U.S. While most of these companies have seen a big drawdown in their prices this year, being diversified into different asset classes has mitigated this downturn for clients who are truly diversified.

The chart below shows the benefit of that diversification so far this year.

Hopefully this can help put the current turbulence in the markets in a different perspective than how the just reading the headlines would lead us to think.

Not knowing the future is always unsettling. But holding truly diversified portfolios can help investors stick with their strategy in both good times and those inevitable periods of stress.

As we go through periods like this, don’t hesitate to get in touch with us if you any thoughts or concerns.

As always, thank you for your trust and confidence in us.

Beach

Disclosure: The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of John Foster and not necessarily those of Raymond James. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Prior to making an investment decision, please consult with your financial advisor about your individual situation. If you no longer wish to receive these emails, please reply “unsubscribe.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity performance of developed markets. As of January 2023, the MSCI World Index consisted of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States.