Challenges in the Bond Market

As you know by now, we don’t make any forecasts. Warren Buffett’s two well-known quotes about forecasters are: “The only value of stock forecasters is to make fortune-tellers look good.” His other often repeated quote is “Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”

For many good reasons we are not foolish enough to make a forecast, but we do make observations. And we are seeing some significant moves in government bond yields around the world, not just in the U.S.

A lot is being said in the financial media about the state of the bond market, and particularly about the recent downgrade of U.S. government debt by Moody’s, the bond rating firm.

We have, as of May 27,2025, seen the 30-year Treasury bond yield climb to around 5%. The chart below shows the yield for the last five years on this bond which is issued by the Treasury to help fund our government’s deficits.

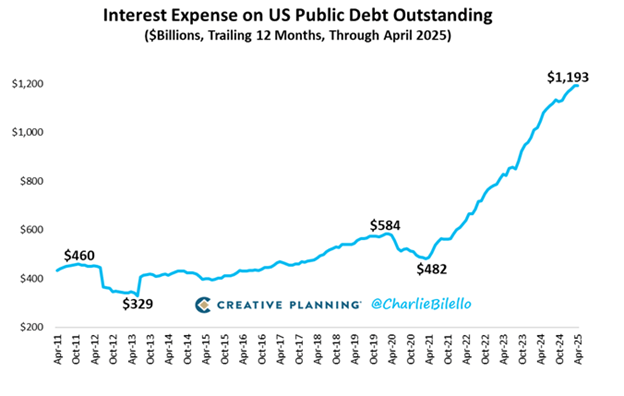

One of the biggest concerns that bond market investors have is the increase in interest that the government is having to pay, due to a much larger debt load and higher interest rates. The chart below illustrates the increase in the amount of interest cost for the U.S. over the last five years.

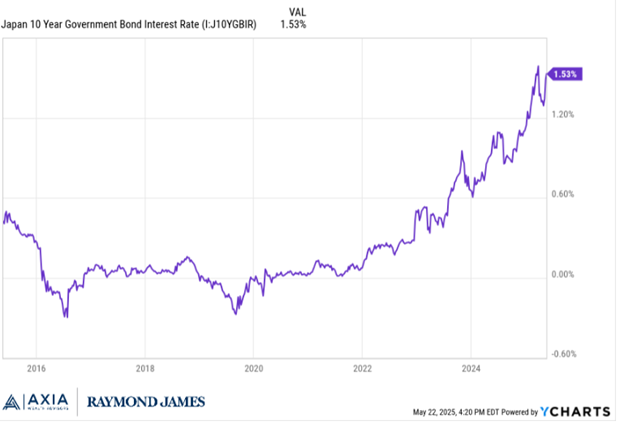

As I mentioned, it is not just the U.S. bond market that is seeing an increase in the cost to borrow money. Below is a chart of the 10-year Japanese Government bond yield.

Similar moves are also present in many other global government bond markets.

The reasons you normally see yields increase on bonds are:

Inflation expectations have increased; thus, bond investors are demanding a higher yield to compensate them for potential loss of purchasing power

Growth expectations have increased, thereby increasing the demand for borrowing

The perceived credit worthiness of the bond issuer has decreased, which increases the risk of not being repaid the expected interest and principal on time

Which one of these or combination of these is responsible for the recent increase in government bond yields recently? Unfortunately, only time will tell. But there is a definite increase of concerns about the trajectory of government debt and the ability to service that debt.

Our job is to manage the bond portion of our clients’ portfolios in a way that does not expose them to any unnecessary risk. We do that using diversified funds that primarily invest in very high-quality bonds of short to intermediate length. This helps provides a hedge against the downside that long term bonds can experience if long term yields go up significantly, while also diminishing the risk that short-term rates are reduced by the Federal Reserve to stimulate the economy.

There is no perfect strategy without the benefit of knowing the future. But there are ways to keep you in the middle of the road, with room on either side should unexpected events occur. And that is our goal for our clients.

As always, thank you for your trust and confidence in us. And please do not hesitate to reach out if you have any thoughts, questions or if something is new in your life that we need to know.

Thanks,

Beach

Disclosure: The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Beach Foster and not necessarily those of Raymond James. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Prior to making an investment decision, please consult with your financial advisor about your individual situation. If you no longer wish to receive these emails, please reply “unsubscribe".

There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.